- Analytics

- News and Tools

- Market News

- US Dollar bulls holding at key support, Fed sentiment is cautious

US Dollar bulls holding at key support, Fed sentiment is cautious

- All eyes looking to the Fed meeting in May.

- US Dollar bulls need to get above 101.90.

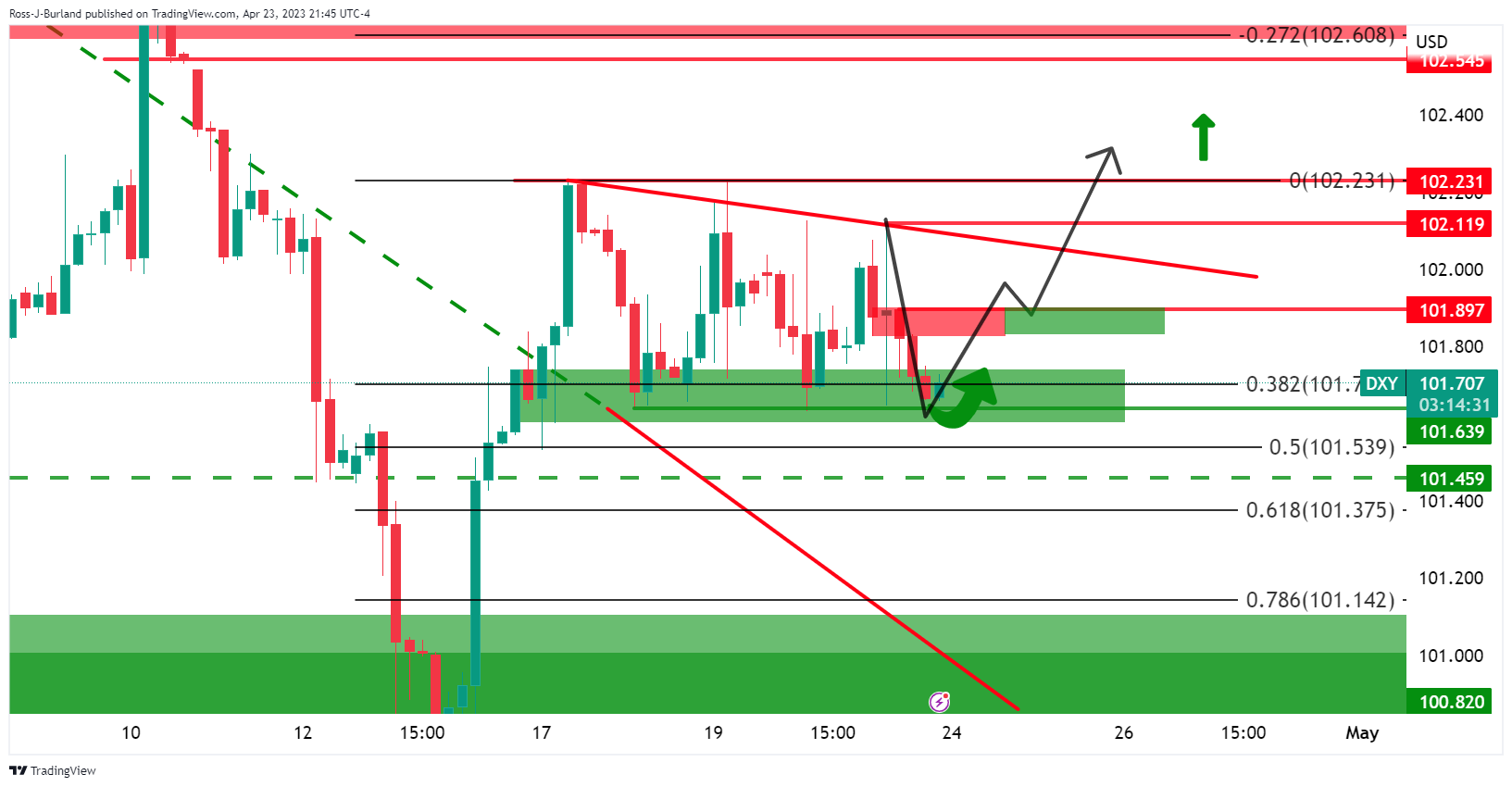

The US Dollar is a touch softer against most major currencies in early Asia trade. DXY, which measures the US Dollar vs. a basket of currencies is trading flat near 101.67 but the recent break above 102.036 sets up a test of the April 10 high near 102.807, as illustrated below.

The greenback is heading into the final week of the month on the back foot as investors get prepared for the central bank meetings in May. With a focus on the Federal Reserve, Fed officials have been sounding a bit more cautious.

For instance, Cleveland Federal Reserve President Loretta Mester said “I anticipate that monetary policy will need to move somewhat further into restrictive territory this year, with the fed funds rate moving above 5% and the real fed funds rate staying in positive territory for some time. Precisely how much higher the federal funds rate will need to go from here and for how long policy will need to remain restrictive will depend on economic and financial developments.”

Mester added, “even before the stresses in the banking industry in March, banks were already beginning to tighten their credit standards. The question now going forward is, Will stresses in the banking industry, those stresses in March, lead banks to move faster to tighten their credit standards?”

Fed´s Lorie Logan said “As you surely know, inflation has been much too high. The Fed has raised interest rates by 4.5 percentage points over the past year to bring the economy into better balance.”

Fed´s Patrick Harker said “I think we’re close to where we need to be. We need to be a little cautious here to not just respond to the current level of inflation, but where we think it’s going,” adding that due to monetary policy lags, “So this is where I am not in the camp where just keep increasing rates and rates and rates. I think we need to slow it down.”

Fed´s Raphael Bostic said that he favors one more hike and noted “our policy works with the lag. We’ll have moved firmly into a restrictive space. And then I think it’s time for us to let the restrictive action work its way through. And that will take some time.”

The media blackout goes into effect and there will be no Fed speakers until Chair Powell’s press conference on May 3 whereby Federal Reserve policymakers are widely expected to raise rates by another 25 basis points though the focus will be on the guidance for the future rate path.

Analysts at Brown Brother Harriman pointed out that ´´between the May 2-3 and June 13-14 meetings, the Fed will have digested two more job reports, two CPI/PPI reports, and one retail sales report. ´´

´´At this point,´´ they said, ´´a pause in June might just be the most likely outcome but it really will depend on how all that data come in. After all that, one cut is still priced in by year-end vs. two at the start of last week. In that regard, Powell has said that Fed officials “just don’t see” any rate cuts this year. We concur.´´

DXY technical analysis

As illustrated from the daily charts in the 4-hour charts, the 101.90s is where the bulls need to get above and stay above for prospects of a move test the 102.80s. A break below 101.45 opens risk of a move back into the bearish trend.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.