- Analytics

- News and Tools

- Market News

- USD/CAD bears moving in, significant correction eyed

USD/CAD bears moving in, significant correction eyed

- USD/CAD is starting to recede, correction-eyed.

- BoC and Fed themes are in focus, driving the price.

USD/CAD is flat on the day after moving between a low of 1.3448 and 1.3489 so far, currently trading at 1.3460 and in retreat in midday New York trade. The Canadian Dollar was initially offered on Thursday ahead of a parliamentary appearance by Bank of Canada Governor Tiff Macklem. Additionally, the price of oil has continued to deteriorate, one of Canada's major exports.

Fed hawks back in town

The hawkish theme surrounding the Federal Reserve has come back to the fore, supporting US yields, and the US Dollar, and weighing on the oil price. West Texas Intermediate crude is down 2% on Thursday.

As for the Federal Reserve, the futures pricing has shown an 85.7% chance the Fed will hike rates 25 basis points when policymakers conclude a two-day meeting on May 3, according to CME's FedWatch Tool. The hawkish sentiment was kicked off by Federal Reserve´s Governor Christopher Waller last Friday said that despite a year of aggressive rate increases, the Fed "hasn't made much progress" in returning inflation to their 2% target and argued that rates still need to go up. As such, the likelihood of a rate cut by December has narrowed considerably this week.

The latest guidance is very much in line with market pricing and Atlanta Fed President Bostic said that he favors one more 25bp rate hike and then a pause. Bostic explained that tightening credit conditions could do some of the Fed’s work. ´´The Atlanta Fed has historically been seen, rightly or wrongly, as a barometer of consensus on the FOMC,´´ analysts at ANZ Bank said.

Fed Bank of New York President John Williams also said on Wednesday inflation was still at problematic levels, and the US central bank would act to lower it. Looking ahead, the Federal Open Market Committee will enter a blackout this weekend ahead of the 2/3 May meeting.

US Dollar softer on data

Nevertheless, the US Dollar, as measured by the DXY index, fell on Thursday as weak data reinforced expectations the world's largest economy is likely headed toward a recession. DXY, which tracks the greenback's value against a basket of major currencies, eased 101.632 after sliding on Friday to its lowest level since early February as investors bet that the Federal Reserve could pause in June after another expected rate hike next month.

In the data. Thursday's data showed US Initial Claims climbed modestly to 245,000 while the week before was revised to show 1,000 more claims than previously reported. The Philadelphia Fed showed that factory activity in the mid-Atlantic region plunged to the lowest level in nearly three years in April while, elsewhere, Existing Home Sales also fell after an increase in February for the first time in a year.

US rate futures are now pricing a roughly 69% probability of a pause in June.

Eyes on BoC

Meanwhile, the focus is on the Bank of Canada´s governor Tiffany Macklem. On Tuesday, Macklem said in testimony in the House of Commons that inflation is coming down quickly but that continued strong demand and the tight labour market are putting upward pressure on many service prices, and those are expected to decline only gradually.

On Thursday, Macklem said the there has been a steady improvement in inflation and modest economic growth. He has stated that it is not a major concern' if the Fed raises rates more than BoC, ‘we have an independent monetary policy’.

Meanwhile, money markets expect the BoC to leave its policy rate on hold at 4.50%, a 15-year high, through the end of the year.

USD/CAD technical analysis

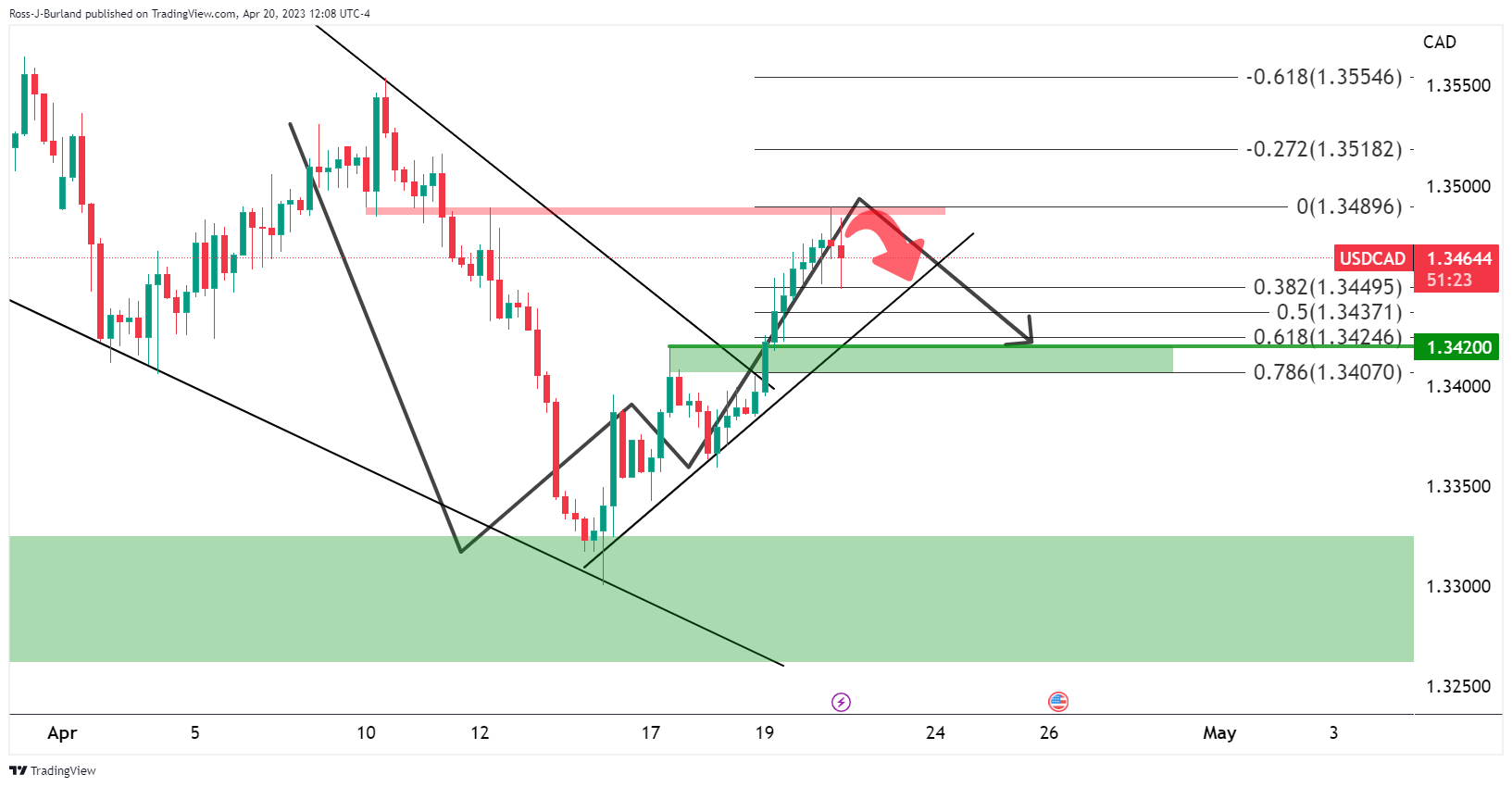

The overall bias is bullish as per the bullish pennant on the daily chart above. We also have a W-formation in the pattern that points to a meanwhile correction:

The price is being faded and the Fibonacci scale can be drawn on the prior bullish impulse:

We have the neckline meeting the 61.8% ratio near 1.3420 as a target. That is to say, if the 38.2% ratio does not hold as support near 1.3450.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.