- Analytics

- News and Tools

- Market News

- When is the UK inflation data and how could it affect GBP/USD?

When is the UK inflation data and how could it affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for March month is due early on Wednesday at 06:00 GMT.

Given the recently released upbeat UK employment data, coupled with the firmer economic activity numbers and the doubts about the Bank of England’s (BOE) next moves, today’s British inflation numbers will be the key for the GBP/USD traders. Also increasing the importance of the UK CPI is the looming banking crisis and the policymakers’ push for measures that could help the market ward off the risks.

That said, the headline CPI inflation is expected to decline further from the 41-year high marked in late 2022 while easing to 9.8% YoY in March, versus 10.4% prior. Further, the Core CPI, which excludes volatile food and energy items, is likely to drop to 6.0% from 6.2% in previous readings. Talking about the monthly figures, the CPI could ease to 0.5% versus 1.1% prior.

Also important to watch is the Retail Price Index (RPI) figures for March, expected to mark a reduction to 0.6% MoM and 13.3% YoY versus 1.2% and 13.8% priors in that order.

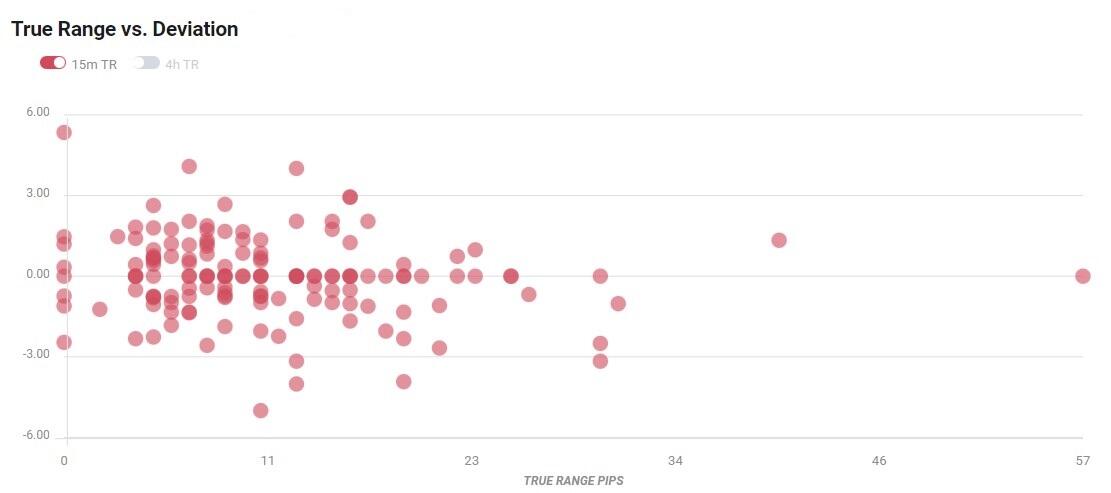

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed, the reaction is likely to remain confined around 20-pips in deviations up to + or -3, although in some cases, if notable enough, a deviation can fuel movements over 50-60 pips.

How could it affect GBP/USD?

GBP/USD stays defensive above 1.2400 as it lacks follow-through amid the cautious mood in the market and the US Dollar’s corrective bounce. Also challenging the Cable pair buyers are the latest doubts on the UK banking sector’s health, as well as the geopolitical pressure on UK PM Rishi Sunak. However, upbeat UK employment numbers and the Bank of England (BoE) policymakers’ push for higher rates keep the Cable buyers hopeful ahead of the key British inflation data.

That said, considering the recent improvement in the British data and expectations of overcoming the labor problems, the softer UK inflation data may help the GBP/USD bears to retake control. It’s worth noting that a positive surprise from the UK CPI or Core CPI should be traded with a pinch of salt amid hawkish Fed bets.

Technically, the Cable pair recently bounced off the bottom line of the stated rising wedge, which in turn joins the steady RSI (14) to suggest further recovery of the quote. However, the 21-SMA surrounding 1.2435 restricts the immediate upside of the GBP/USD price.

Key notes

GBP/USD traders sit tight ahead of UK CPI

GBP/USD Price Analysis: Retreats towards 1.2400 within rising wedge, UK inflation eyed

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of the GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.