- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls take on resistance, eye $2,050

Gold Price Forecast: XAU/USD bulls take on resistance, eye $2,050

- Gold price bulls stay in the market on a weaker US Dollar.

- Federal Reserve bets are driving the Gold price with US CPI and FOMC minutes digested.

Gold price has been drawing its strength on Wednesday from a slide in the US Dollar and benchmark US yields as signs of cooling inflation bolstered bets that a pause in US rate increases was imminent. Gold price has traveled from a low of $2,001.22 to a high of $2,028.40 following both the latest US Consumer Price Index data and the minutes from the Federal Open Market Committee´s March 21-22 meeting whereby the rate hike was widely viewed as dovish.

Firstly, the Consumer Price Index (CPI) climbed 0.1% in March after advancing 0.4% in February, compared with a forecast of 0.2% gain in a Reuters poll. But in the 12 months through March, the core CPI gained 5.6%, after rising 5.5% on the same basis in February. That core measure strips out volatile food and energy prices and was posting a month-on-month gain of 0.4%.

Nevertheless, despite a hot core reading, Fed funds futures traders are pricing in 69% probability that the Fed will raise rates by an additional 25 basis points at its May 2-3 meeting, down from around 76% before the data. This is sending the US Dollar lower on the day and into technical support and has benefitted the Gold price as higher rates to tame rising price pressures have otherwise weighed on the non-yielding asset's appeal. Traders have positioned for one more hike in May followed by 2-to-1 bets of a pause in June.

´´While the miss on this morning's CPI report is giving the yellow metal a lift higher, the strong labour market trends and sticky core services inflation suggest a 25bp hike at the May FOMC meeting is still in the cards,´´ analysts at TD Securities have argued.

´´However, if the market increasingly feels the May hike could be the last of the cycle, with cut timing also top of mind, it could be the catalyst needed to see gold challenge the highs yet again. With that said, CTAs could add fuel to the fire with the next upside trigger sitting at $2,064,´´ the analysts added.

As for the Federal Reserve Open Market Committee minutes, they showed that the staff at the Committee are forecasting a mild recession later in 2023.

Key quotes from the FOMC minutes:

"Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years."

"In assessing the economic outlook, participants noted that since they met in February, data on inflation, employment, and economic activity generally came in stronger than expected. They also noted, however, that the developments in the banking sector that had occurred late in the intermeeting period affected their views of the economic and policy outlook and the uncertainty surrounding that outlook."

"Participants agreed that the labor market remained very tight."

"Some participants noted that given persistently high inflation and the strength of the recent economic data, they would have considered a 50 basis point increase in the target range to have been appropriate at this meeting in the absence of the recent developments in the banking sector. However, due to the potential for banking-sector developments to tighten financial conditions and to weigh on economic activity and inflation, they judged it prudent to increase the target range by a smaller increment at this meeting."

"Members concurred that the U.S. banking system is sound and resilient. They also agreed that recent developments were likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation, but that the extent of these effects was uncertain. Members also concurred that they remained highly attentive to inflation risks."

Gold price technical analysis

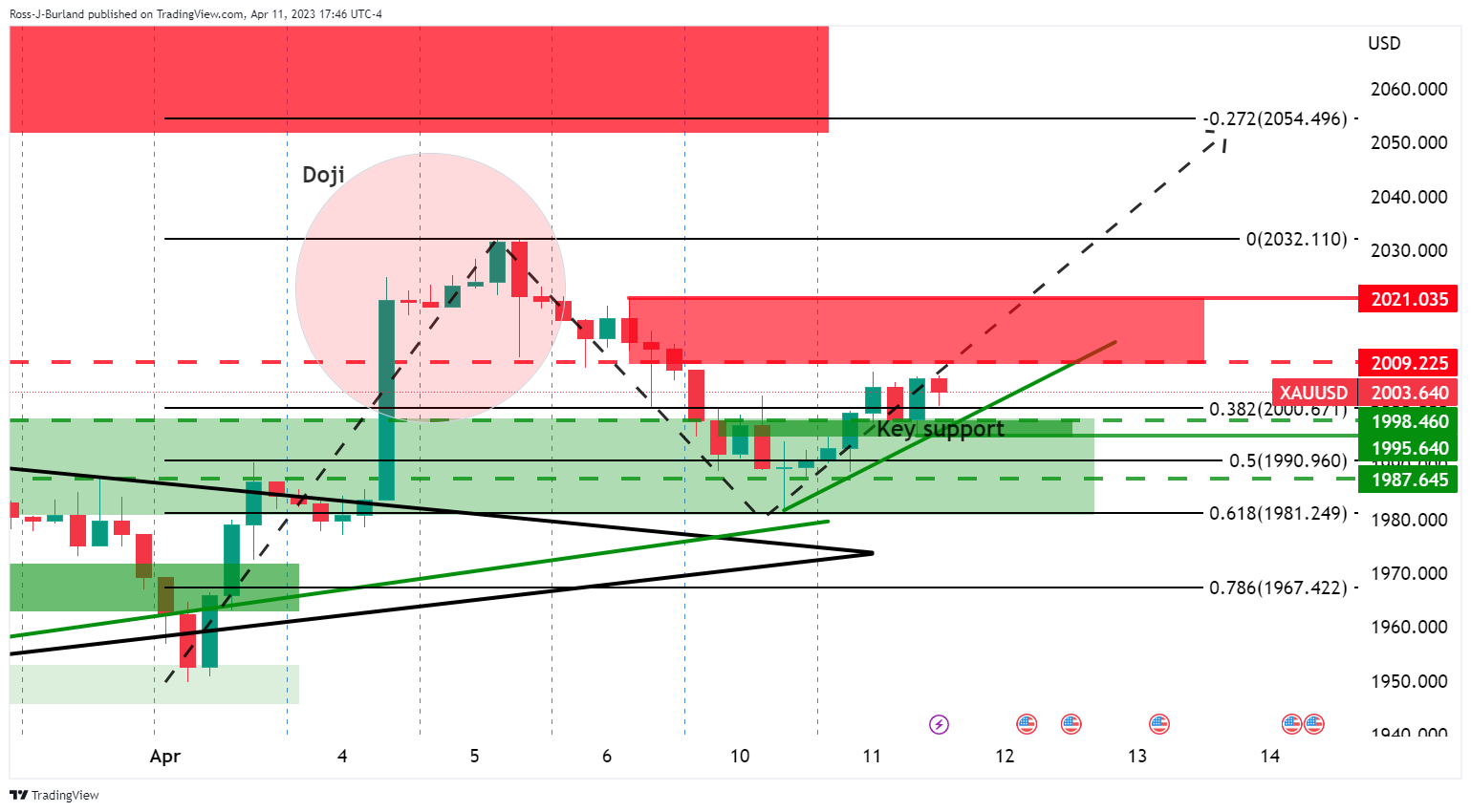

Gold price H4 chart

In the prior Gold price analysis, it was stated that ´´the Gold price four-hour chart shows that the bulls are holding the fort at key support with $2,010/20 now eyed as the next major Gold price resistance area guarding $2,050. ´´

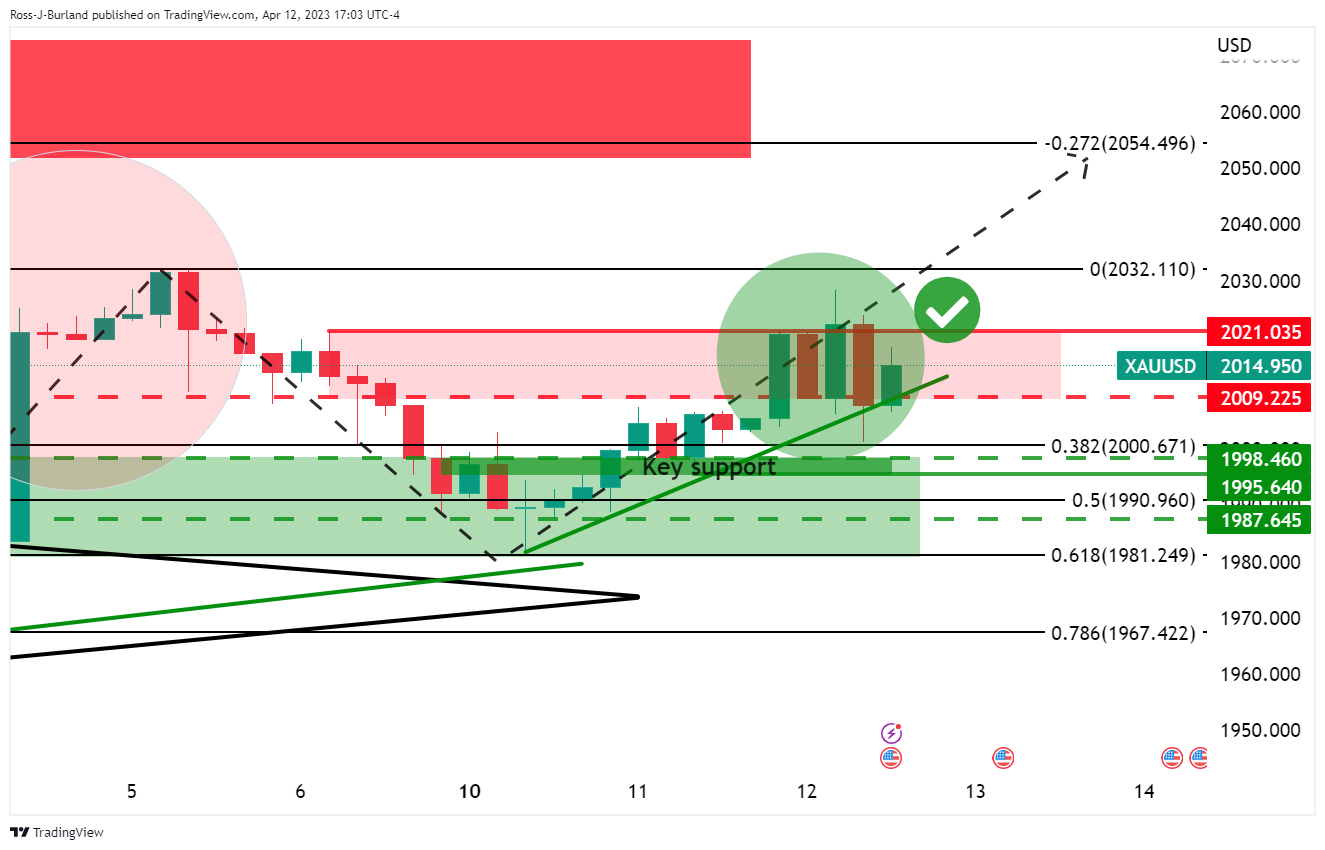

Gold price update

As illustrated, the price is making headway, but it is some way off still and is yet to crack the $2,020s resistance.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.