- Analytics

- News and Tools

- Market News

- USD/CAD Price Analysis: Bears are in the market and eye test of 1.3400

USD/CAD Price Analysis: Bears are in the market and eye test of 1.3400

- USD/CAD bears lurking below a 38.2% Fibonacci retracement area.

- Bears look to the target area of the 1.3400s.

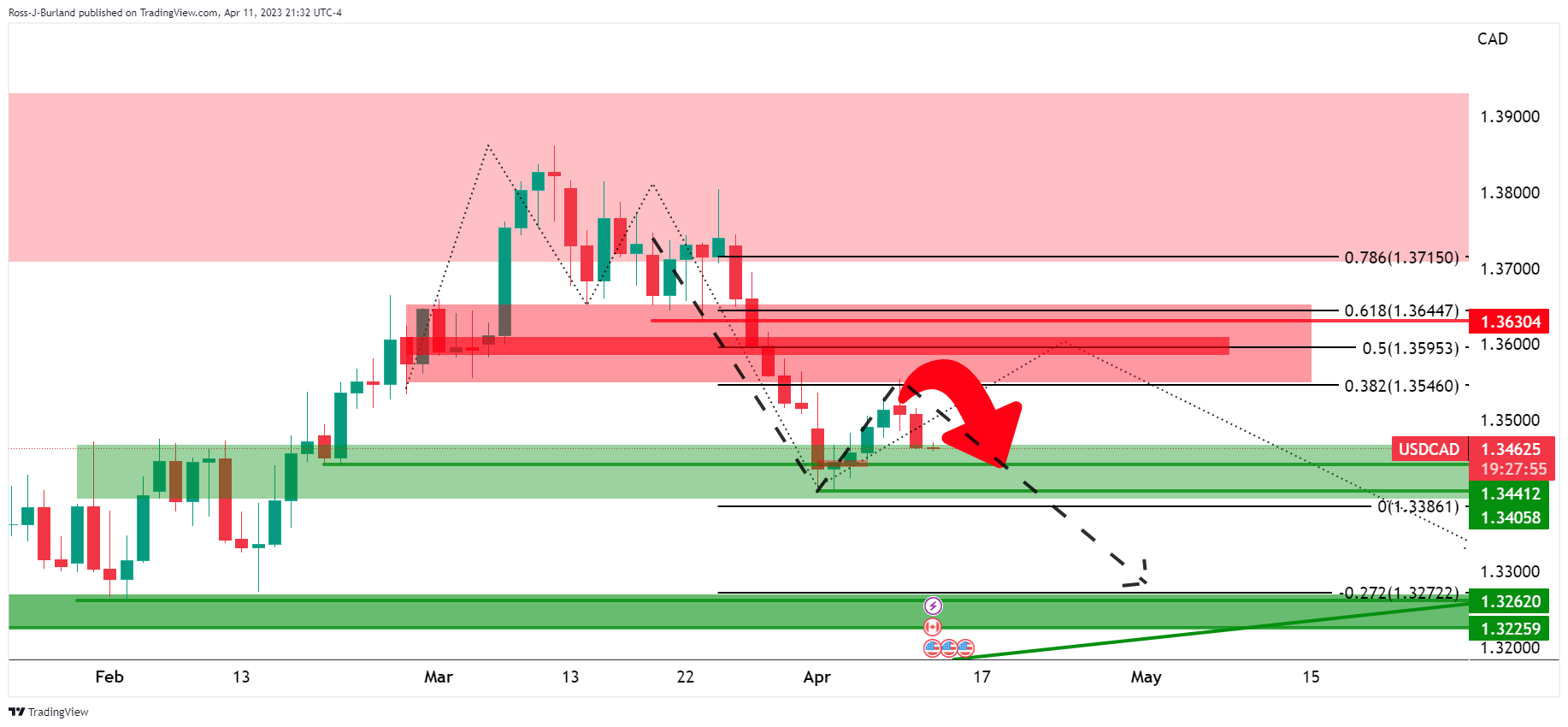

As per the prior USD/CAD analysis, USD/CAD Price Analysis: Bears are in control and target a break of daily lows, the price dropped accordingly and the bears are in the clear for a run to test 1.3400.

USD/CAD prior analysis

It was argued that ´´the bears will stay the course and break below the recent lows for a bearish extension.´´

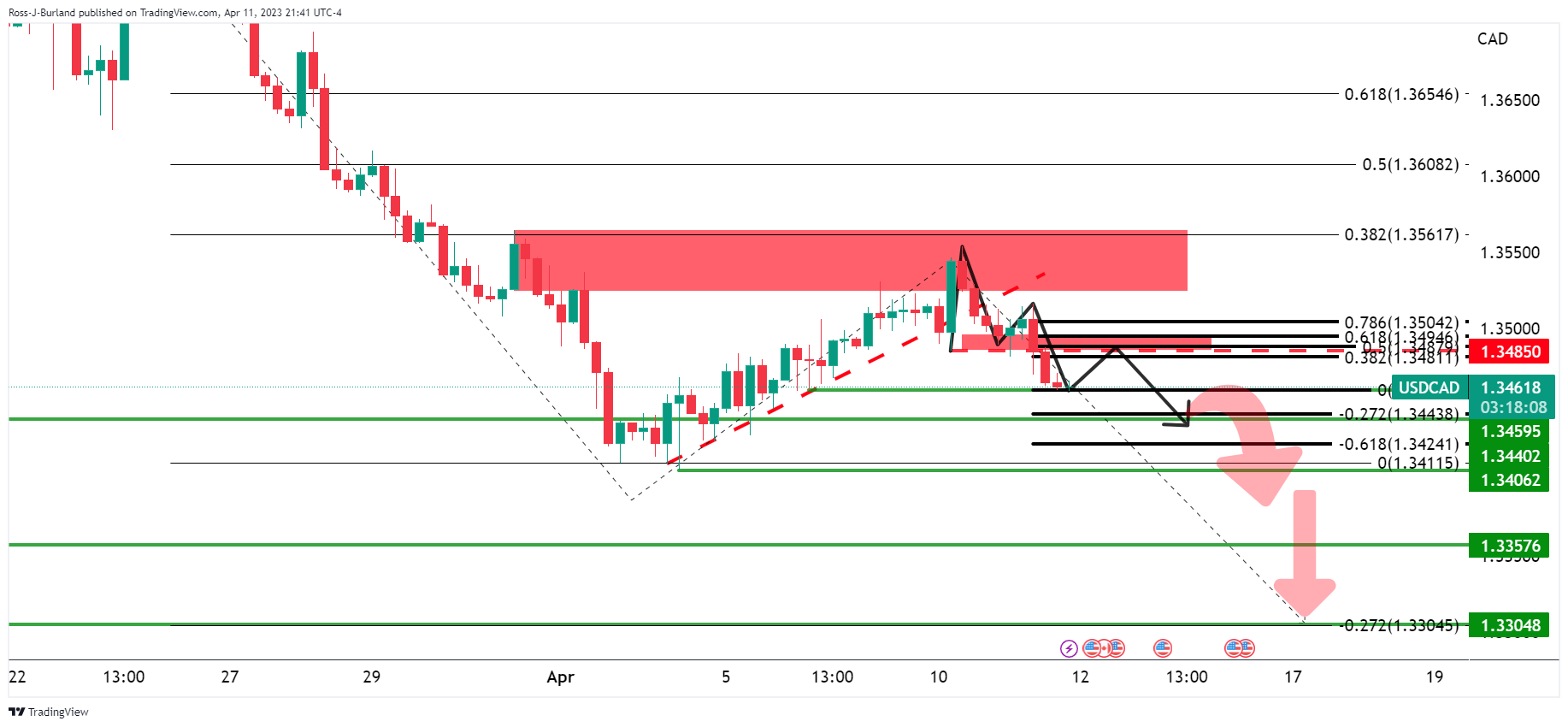

When moving down to the 4-hour chart, it was stated that ´´the price was meeting resistance very close to the daily 38.2% Fibonacci ... breaking 4-hour structure to the downside, as illustrated below:

The price is on the back side of the prior 4-hour bullish trend/correction, and the M-formation can be regarded as a topping pattern. The neckline of the pattern might act as resistance on a pullback and lead to a subsequent lower low to target the 1.3440-50s.´´

It was also argued that a break below 1.3440 opened the risk to test 1.3400 prior lows and bearish extensions as per the weekly chart, as illustrated at the beginning of the prior top-down analysis.

USD/CAD update, live charts

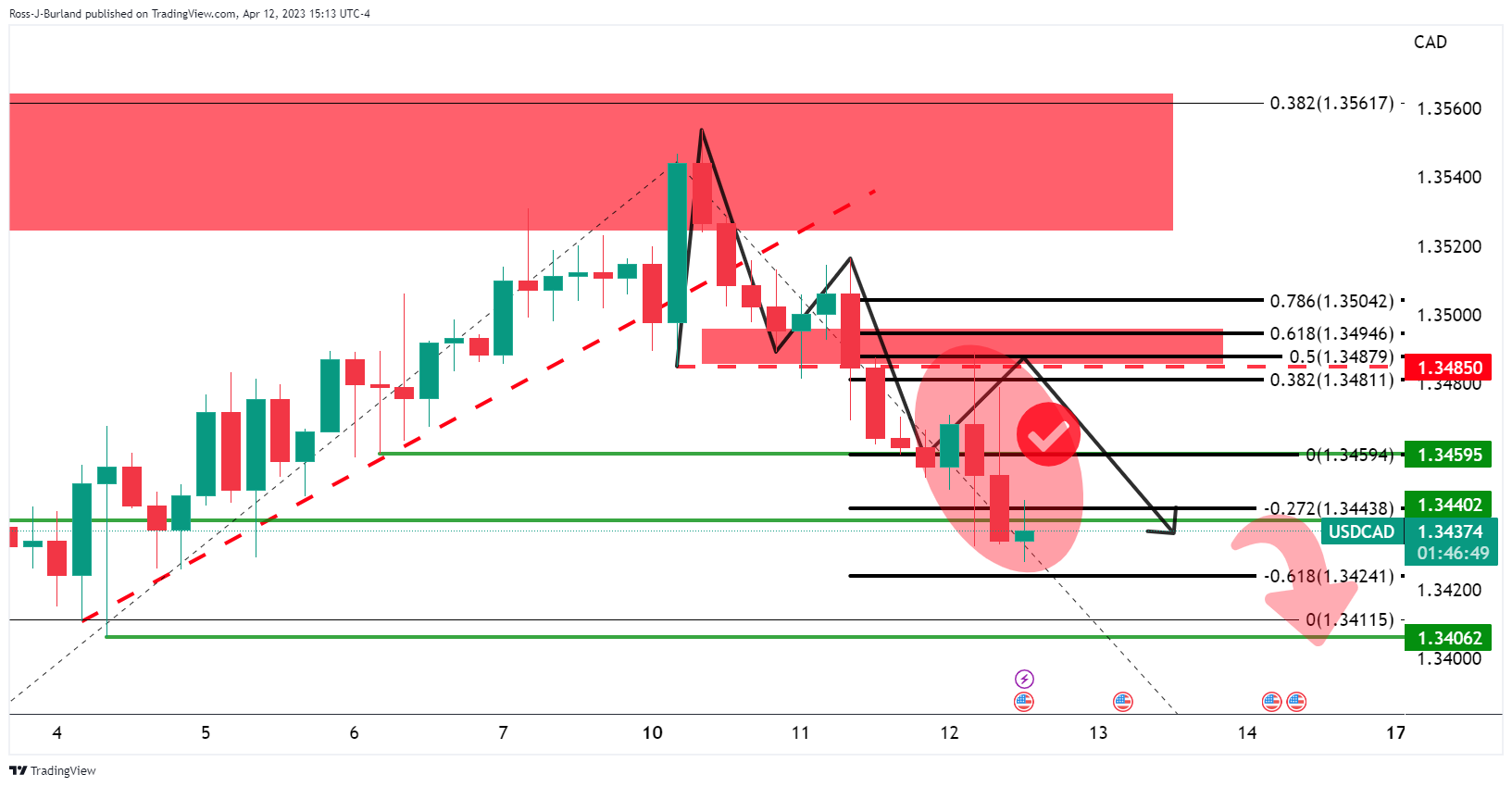

The price has come in a stone's throw´s distance from 1.3400, reaching a low of 1.3428 so far on the day. We are likely to see consolidation at this juncture, however.

USD/CAD H1 chart

On the hourly chart, we can see that the price is being rejected at old support again. A 38.2% Fibonacci retracement aligns with prior support that would be expected to act as resistance on a restest while the bears commit to the front side of the bearish trend. This in turn could lead to an additional push lower and into the target area of the 1.3400s.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.