- Analytics

- News and Tools

- Market News

- GBP/USD bulls hope US prices have cooled, eye break of 1.2520

GBP/USD bulls hope US prices have cooled, eye break of 1.2520

- GBP/USD bulls are stepping in at a key structure area on the charts.

- All eyes will be on the US inflation data on Wednesday in the main.

GBP/USD has traveled within a range of 1.2379 and 1.2456 on the day and is up around 0.3% currently at 1.2420.

The British pound has found solid ground in a key support area amidst improved risk sentiment, helping to keep sterling towards the 10-month high it reached last week as traders bet that interest rates would soon peak and come down later this year.

Domestically, the Bank of England Governor Andrew Bailey is scheduled to speak on Wednesday and could give clues on the future path for monetary policy, but attention is on the US Consumer Price Index also. Analysts at TD Securities argued that core prices likely cooled off modestly in March, which could result in an even softer US dollar leading to higher Cable.

Meanwhile, the following illustrates the technical landscape leading into tomorrow´s events:

GBP/USD technical analysis

GBP/USD is trading within the right-hand shoulder of a massive inverse head and shoulders pattern, testing the neckline.

GBP/USD bullish/bearish scenario

The price had dropped for four consecutive days and retraced over 70% of the prior bullish impùlse. Bulls are moving in following a close above the 61.8% Fibonacci retracement measure which is bullish. A higher high could be on the cards for this bull cycle. However, the price is on the backside of the bull trendline which means the bull cycle has been decelerating. If bears commit heavily to the next bullish thrust, a period of distribution could unfold. 1.2270s will be key in this regard ahead of 1.2190. However, the above thesis is meanwhile bullish:

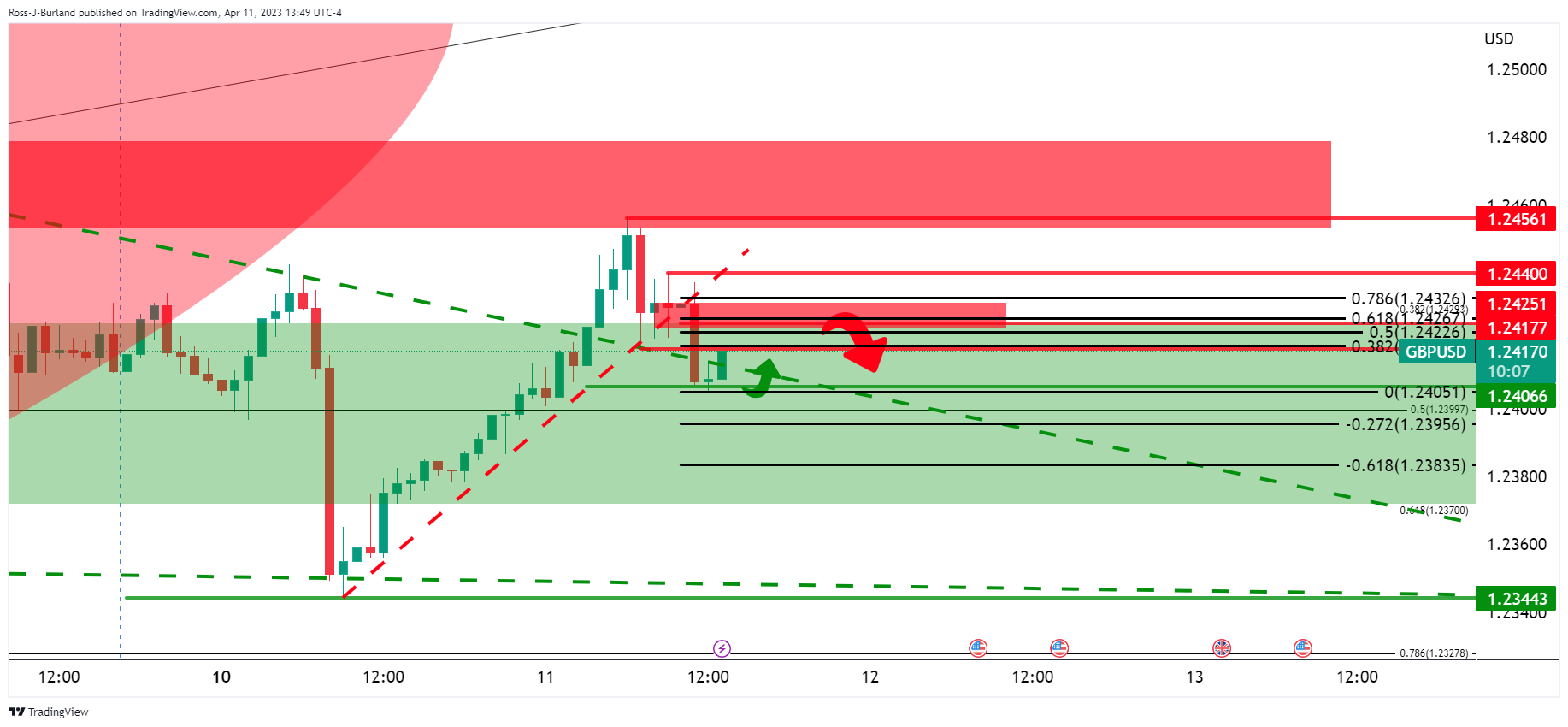

GBP/USD H1 chart

On the lower time frames, such as this hourly chart, we can see the price is testing 1.2400 structure but so long as this holds, given the break of the trendline to the upside, a break of 1.2450 will likely leave the bulls in control for a run to test the 1.2520s.

If on the other hand, considering the break of the prior bullish trendline, if bears commit below 1.2450, then a bearish thesis will be in play to break below 1.2400:

GBP/USD bullish scenario

However, the bullish thesis will be in play while above support and 1.2350 as per the above daily chart. All will depend on the US consumer Price Index outcome for the US session and beyond ahead.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.