- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD dips for the second day as US labor market data sparks recession fears

Gold Price Forecast: XAU/USD dips for the second day as US labor market data sparks recession fears

- Gold price takes a hit on disappointing US unemployment claims as the labor market eases.

- US Treasury US bond yields drop, but XAU/USD traders booking profits ahead of US NFP spurred the ongoing dip.

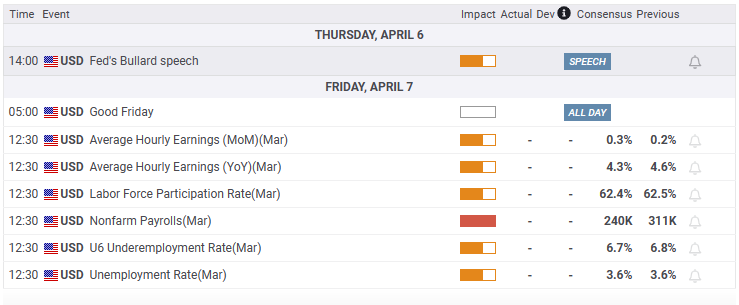

- St. Louis Fed President Bullard warns of sticky inflation, says Fed needs to stay vigilant to reach 2% target

Gold price slides for the second consecutive day, though it’s bracing for the March 20 high at around $2,009.75. Worse than expected, US labor market data accumulated during the week triggered investors worried about a possible recession in the United States (US). Therefore, traders scaled back their bullish bets in the yellow metal. At the time of writing, the XAU/USD is trading at $2,011.28.

XAU/USD retreats from YTD highs, ahead of US Nonfarm Payrolls report

Global equities are trading mixed, with most European (EU) bourses trading with gains. Wall Street is extending its losses to four straight days. Gold price headed down spurred by a jump in US Initial Jobless Claims for the week ending on April 1, which increased by 228K above forecasts of 200K. Additionally, data from the week before April 1 was upward revised from 198K to 246K, painting a dismal scenario for the US labor market.

Latest data like the ADP report missing estimates and job vacancies heading south exacerbated an investor’s flight to safety, initially sending XAU/USD rallying towards its YTD high of $2,032.13. Nevertheless, bad US jobs data underpin the greenback despite US Treasury bond yields continuing to drop.

US Treasury bond yields, particularly the most sensitive to interest rates, the 2-year, dropped to 3.674% before reversing their course and is up at 3.783%.

Even though the US 2-year Treasury bond yield has gained traction, money market futures estimate that the Federal Reserve (Fed) would hold rates unchanged, as shown by the CME Fed WatchTool. The odds of keeping rates at 4.75%-5.00% are 56.1%. In addition, some investors speculate that the Fed could cut rates as soon as July.

Lately, the St. Louis Federal Reserve President James Bullard said that Q1’s incoming data is stronger than expected, adding that financial conditions are less tighter than the 2007-2009 crisis. Bullard said inflation would be “sticky going forward” and that the Fed “needs to stay at it” to get inflation back to its 2% target.

ING estimates XAU/USD can hit the all-time-high

ING Analysts commented that flows toward XAU were due to the banking crisis. Analysts noted, “US data showed the job market is loosening, fuelling expectations that the Fed is nearing the end of its monetary tightening cycle.”

“Markets will be keeping a close eye on the US jobs report later this week and whether this takes the gold market to striking distance of its all-time high of US$2,075.47/oz made in August 2020,” according to ING.

XAU/USD Technical Analysis

The uptrend in XAU/USD remains intact, though the current dip could be due to Gold traders’ banking profits ahead of the US Nonfarm Payrolls report. Nevertheless, buyers must keep XAU/USD price above $2,000 if they want to challenge the ATH at $2,075.47. On the flip side, a fall below the former, and sellers could drag XAU/USD to test the 20-day EMA at $1,960.42. Once cleared, the March 17 low at $1,918.38 would be exposed, ahead of the 50-day EMA at $1,912.95.

What to watch?

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.