- Analytics

- News and Tools

- Market News

- USD/CAD Price Analysis: Bulls need acceptance from 1.3520 hurdle and Canada Employment data

USD/CAD Price Analysis: Bulls need acceptance from 1.3520 hurdle and Canada Employment data

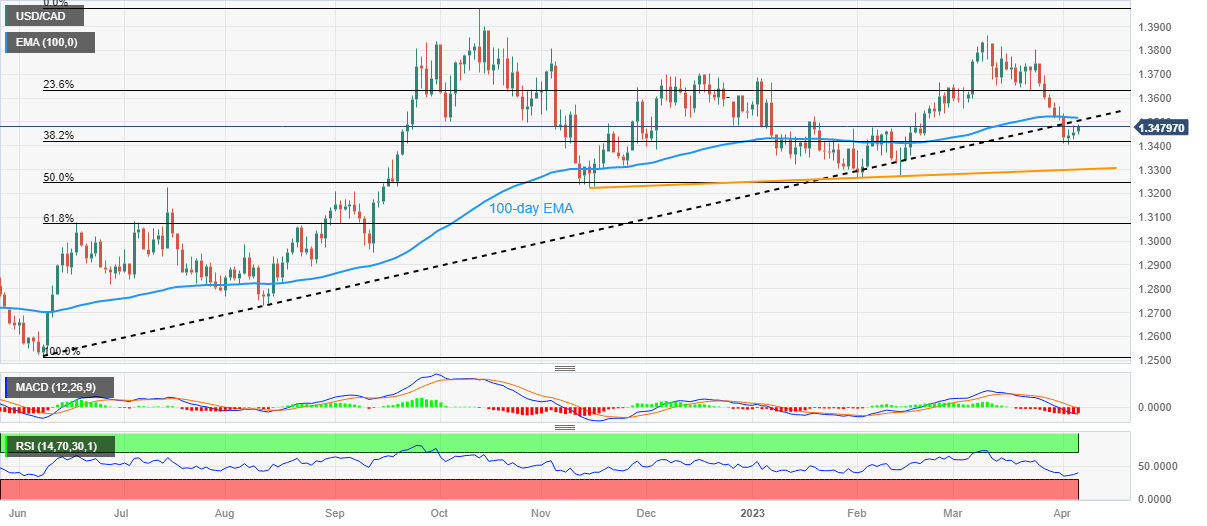

- USD/CAD extends recovery from seven-week low, grinds higher of late.

- Convergence of previous support line from June 2022, 100-day EMA challenges Loonie pair’s recovery.

- 38.2% Fibonacci retracement level, five-month-old ascending trend line lures sellers.

- Canada’s monthly employment data for March bears downbeat forecasts and can weigh on prices.

USD/CAD refreshes intraday high near 1.3485 as it pares the weekly gains during a three-day uptrend on early Thursday. The pair’s latest run-up could be linked to a pre-data consolidation amid broad US Dollar strength ahead of the employment data from Canada and the US.

Also read: USD/CAD bulls eye 1.3500 on softer Oil price, firmer US Dollar, focus on Canada employment data

In doing so, the Loonie pair extends Tuesday’s U-turn from the 38.2% Fibonacci retracement of its upside from June-October 2022. The quote’s recovery also takes clues from the latest rebound in the RSI (14) from below 50 levels.

However, a convergence of the 100-day Exponential Moving Average (EMA) and a 10-month-old support-turned-resistance line, around 1.3520 at the latest, appears a tough nut to crack for the Loonie pair buyers.

In a case where the USD/CAD price remains firmer past 1.3520, it can rise towards the 23.6% Fibonacci retracement level of 1.3635 and then to the December 2022 peak of 1.3700.

On the flip side, a downside break of the stated 38.2% Fibonacci retracement level of 1.3425 can restrict the short-term USD/CAD downside.

If the USD/CAD breaks 1.3425 support, an upward-sloping support line from mid-November 2022, around 1.3300 by the press time, can act as the last defense of the USD/CAD buyers.

Overall, USD/CAD is likely to witness a pullback unless bulls manage to cross the 1.3520 hurdle and see welcome data from Statistics Canada.

USD/CAD: Daily chart

Trend: Limited recovery expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.