- Analytics

- News and Tools

- Market News

- USD/CHF Price Analysis: Retreats beneath 0.9200 on the confluence of technical factors

USD/CHF Price Analysis: Retreats beneath 0.9200 on the confluence of technical factors

- USD/CHF dropped after facing the 20-day EMA and a resistance trendline, extending its losses for two straight days

- USD/CHF Price Analysis: Short term, a triple bottom could cap the pair’s fall and open the door to test 0.9300.

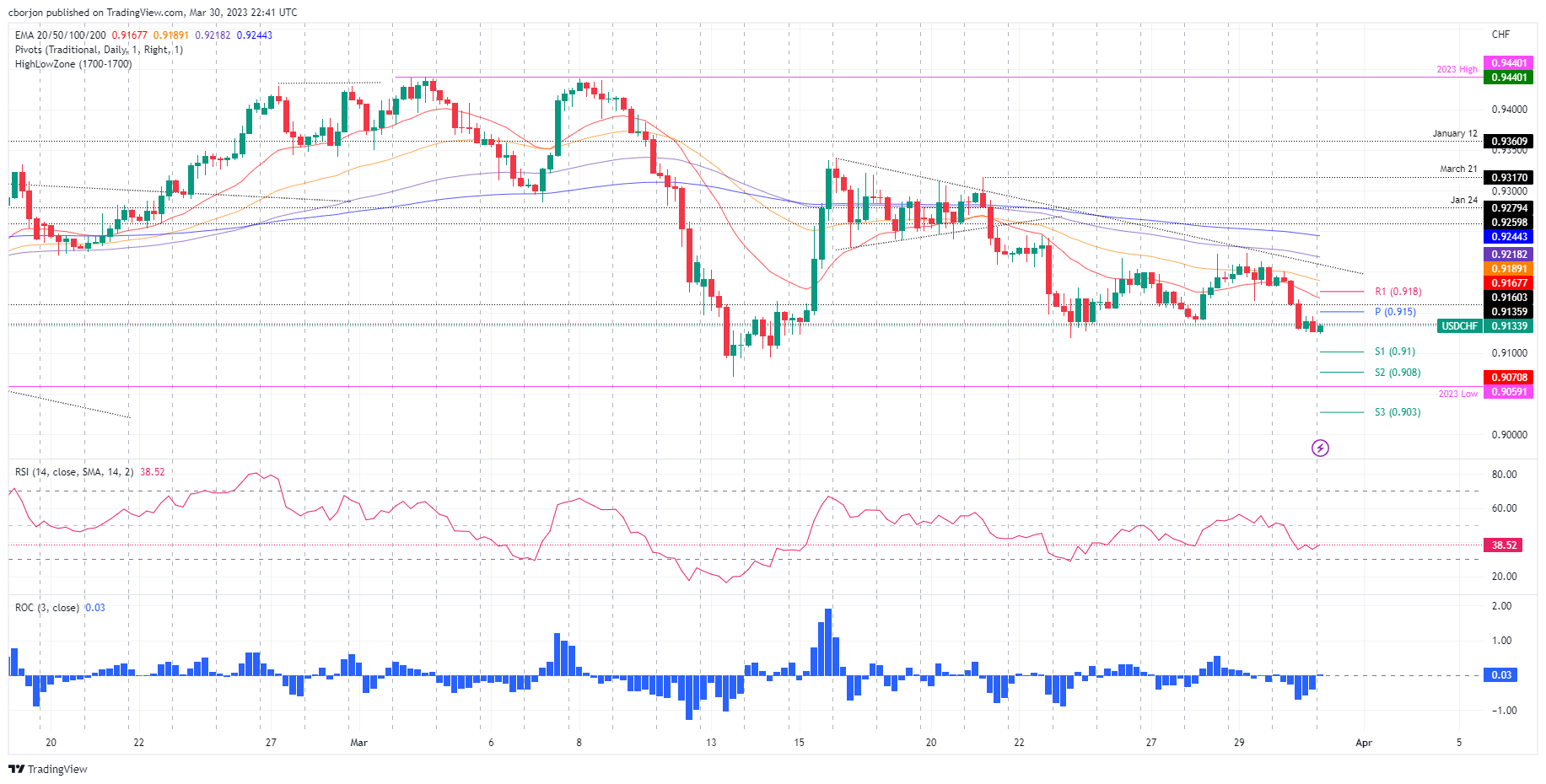

After facing a resistance trendline, which intersects with the 20-day Exponential Moving Average (EMA), the USD/CHF dropped and extended its losses for two straight days. At the time of writing, the USD/CHF is trading at 0.9133, up 0.08%, as Friday’s Asian session begins.

USD/CHF Price action

The USD/CHF slid from the 0.9200 mark as the US Dollar (USD) weakened across the FX board. Furthermore, the USD/CHF pair is downward biased, though to further cement its bearish case, the major needs to break below the March 13 swing low at 0.9070. Once cleared, the USD/CHF pair would test the YTD lows at 0.9059, which, once cleared, could open the door towards 0.9000. On the flip side, buyers reclaim the 20-day EMA at 0.9215, and the major could test 0.9300.

Short term, the USD/CHF4-hour chart portrays a triple bottom forming, though it is at the brisk of being invalidated if the spot price tumbles and extends below 0.9118. If buyers keep the price above the latter, the chart pattern will remain in play. If the USD/CHF breaks above the daily pivot at 0.9150, the next resistance would be 0.9180, followed by March 30 high at 0.9200. Once cleared, the next reistace would be the 100-EMA at 0.9218, ahead of the 200-EMA at 0.9244.

In an alternate scenario, if the USD/CHF pair dwindles below 0.9118, that would pave the way to test the YTD low at 0.9059.

USD/CHF 4-Hour chart

USD/CHF Technical levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.