- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD collapses below $1950 as US bond yields aim higher

Gold Price Forecast: XAU/USD collapses below $1950 as US bond yields aim higher

- Gold price drops on risk-appetite improvement, and US Treasury bond yields rising.

- US Treasury bond yields rise, with 10-year TIPS, a proxy for real yields advancing above 1.30%.

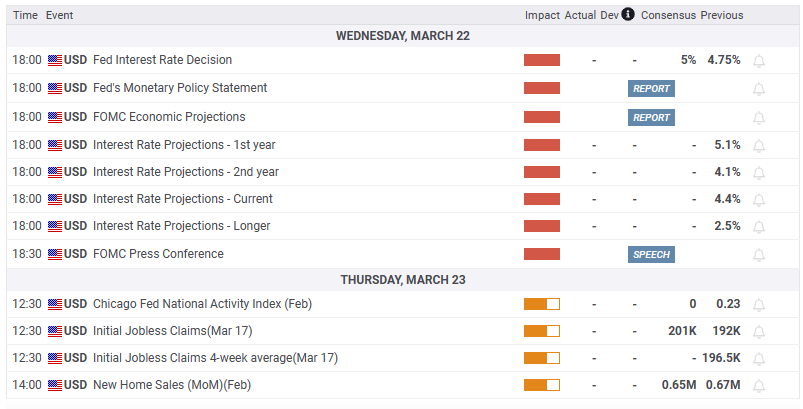

- The Federal Reserve will commence its two-day monetary policy meeting, expected to deliver a 25 bps rate increase.

Gold price is tumbling across the board, down more than $30.00 or 1.59%, as US Treasury bond yields rise, while risk appetite improvement dented Gold’s demand. Hence, US equities climb moderately as the Federal Reserve’s Open Market Committee (FOMC) meeting begins soon. At the time of writing, XAU/USD is trading at $1947.26 after hitting a daily high of $1985.08

Gold price tumbles on high US Real Yields, and traders booking profits

Traders’ fears calmed in the last 48 hours after the UBS takeover of Credit Suisse, and US banks continued to try to stabilize First Republic Bank. The Federal Reserve (Fed) would begin its March monetary policy meeting, with traders expecting the Fed to raise rates by 25 bps as Powell and Co. continued their efforts to curb stubbornly high inflation.

The XAU/USD retreated most of its gains after reaching a YTD high on Monday at $2009.75. Since then, the yellow metal plunged 3.09%, as traders apparently booked profits ahead of the FOMC’s meeting.

Money market futures anticipate an 83.4% chance for a quarter percent increase in the Federal Funds Rate (FFR), according to CME FedWatch Tool. However, there is still uncertainty around the potential outcome of Fed Chair Jerome Powell’s press conference, which could cause instability in financial markets.

Another reason for XAU/USD’s fall is that US Treasury bond yields are climbing. The US 10-year Treasury bond yield is 3.58%, up nine bps. The 10-year Treasury Inflation-Protected Securities (TIPS), a proxy for US Real Yields, stands at 1.351% after tumbling as low as 1.142% on March 16.

In the meantime, the US Dollar Index, a gauge of the buck’s value against six peers, is trimming some of its earlier losses after hitting a low of 103.00, down 0.03%, at 103.274.

Gold technical analysis

XAU/USD’s daily chart portrays a bullish bias in the yellow metal. However, price action in the last three days could form an evening star candlestick chart pattern. This means that Gold can drop in the near term. The first support would be the March 15 daily high turned support at $1937.31, followed by the $1900 barrier. Once cleared, the 20-day Exponential Moving Average (EMA) at $1892.89 is next, followed by the 50-day EMA at $1867.89.

What to watch?

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.