- Analytics

- News and Tools

- Market News

- AUD/USD oscillates at around the 20-day EMA on risk-on mood, RBA minutes eyed

AUD/USD oscillates at around the 20-day EMA on risk-on mood, RBA minutes eyed

- AUD/USD maintains a positive tone on a soft US Dollar.

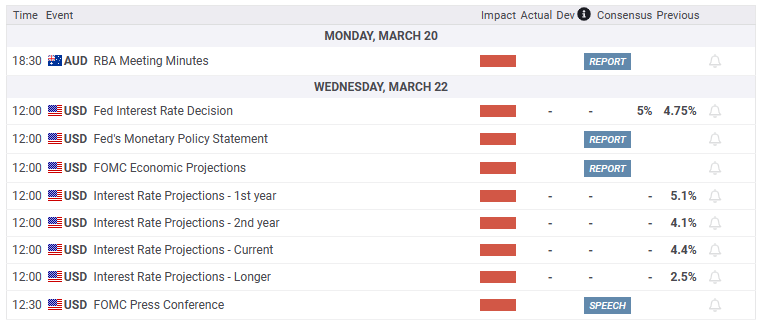

- Money markets expect a 25 bps rate hike by the Fed on Wednesday.

- AUD/USD Price Analysis: Daily close above 0.6714 would add upward pressure; otherwise, it could fall to 0.6600.

AUD/USD prints a leg-up above the 0.6700 figure, helped by an improvement in market sentiment. Investors shrugged off banking crisis contagion woes after UBS decided to buy Credit Suisse, perceived by traders as an excuse to buy riskier assets. That, alongside speculations for less aggressive monetary policies amongst central banks, weighed on the US Dollar. At the time of writing, the AUD/USD exchanges hands at 0.6715.

AUD/USD to hover around 0.6700 ahead of the FOMC’s meeting

The financial markets’ mood remains upbeat after the banking crisis saga and appears to be calm. However, in the United States (US), First Republic Bank stock plunged after another credit downgrade. The US Federal Reserve (Fed) would begin its two-day monetary policy meeting on Tuesday, with money markets estimating a 70% chance of a 25 basis point rate hike by the Fed. That would lift the Federal Funds Rate (FFR) to the 4.75% - 5.00% threshold. After the Fed’s decision, Chair Powell will hit the stand.

The latest round of US economic data witnessed Industrial Production shrinking and the University of Michigan (UoM) Consumer Sentiment deteriorating. However, Americans expected inflation to fall, with 1-year expectations estimated to finish at 3.8% from 4.1%, while for 5-yeard, it dropped to 2.8% from 2.9%.

The US Dollar Index, a gauge of the bucks’ value against a basket of peers, continues to extend its losses, down 0.51%, at 103.343, a tailwind for the AUD/USD.

On the Australian front, the lack of data left traders adrift to risk appetite. Even though China’s reopening should bolster the Australian Dollar (AUD), the latest rate hike by the Reserve Bank of Australia (RBA), was perceived as a dovish one, which would exert downward pressure on the AUD/USD.

AUD/USD Technical analysis

After dropping below the 0.6600 figure, the AUD/USD reclaimed the 0.6700 figure. Nevertheless, the 20-day Exponential Moving Average (EMA) at 0.6713 is difficult to surpass, as the AUD/USD is forming a dragonfly doji. If the AUD/USD registers a daily close above the 20-day EMA, that will set the pair to test the intersection of the 50/100-day EMAs, each at 0.6779-85, respectively. Once cleared, the 0.6800 could be tested. Otherwise, the AUD/USD could extend its losses below 0.6700 toward the 0.6600 figure.

What to watch?

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.