- Analytics

- News and Tools

- Market News

- USD/CAD trims weekly losses, rises to 1.3770

USD/CAD trims weekly losses, rises to 1.3770

- USD/CAD still down for the week and pointing to the upside.

- US Dollar mixed on Friday between lower US yields and risk aversion.

- Key events for next week: Canada CPI (Tuesday) and FOMC meeting (Wednesday).

The USD/CAD printed a fresh daily high on Friday at 1.3772, amid a weaker Loonie and a mixed Greenback. After moving away from the bottom, the pair is about to post a small weekly loss.

The bad and the ugly

Data released on Friday showed the Canadian Industrial Product Price Index dropped 0.8%, a surprise considering market expectations of a 1.6% increase. The Raw Material Price Index fell 0.4%, below the estimate 0%. The economic figures did not help the Loonie, that is among the worst performers on Friday.

Next week, the key report from the Canadian economy will be February’s Consumer Price Index (CPI) on Tuesday. It is expected to show an increase of 0.4% MoM, and the annual rate slowing from 5.9% in January to 5.5%.

The US Dollar is mixed on Friday, attempting a recovery as stocks in Wall Street deepen losses. US yields are down by 4% on average, with the 10-year at 3.41%, slightly above March lows.

Markets remain anxious with the banking turmoil and next week is the FOMC meeting. The consensus is still for a 25bps rate hike but the end of the tightening cycle is seen sooner than previously thought. The change in expectations weighed on the Greenback.

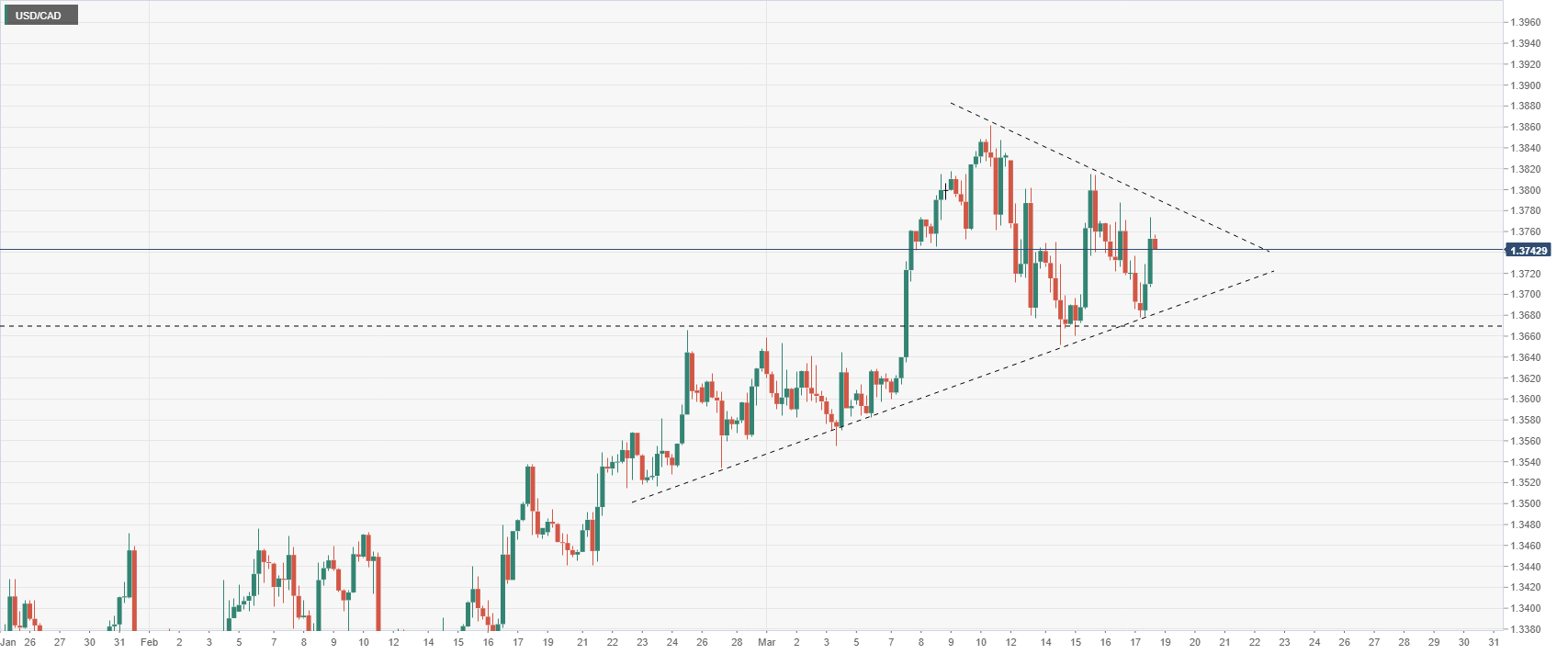

Higher lows, lower highs

The USD/CAD has been making higher lows and lower highs during the last sessions. On Friday, it reversed from a two-day low at 1.3676 and jumped to 1.3763. The short-term direction is not clear.

The pair remains above the 20-day Simple Moving Average (1.3655) and also above the 1.3660/70 key support area. While above that two supports, the outlook looks constructive for the USD/CAD.

USD/CAD 4-hour chart

Technical levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.