- Analytics

- News and Tools

- Market News

- EUR/USD refreshes day high above 1.0640 as hawkish Fed bets diminish, USD corrects further

EUR/USD refreshes day high above 1.0640 as hawkish Fed bets diminish, USD corrects further

- EUR/USD has extended its recovery above 1.0640 as the USD Index is losing steam further.

- Federal Reserve might remain steady on interest rates after discounting lower inflation in February and fresh banking instability.

- European Central Bank went for a third consecutive 50 bps interest rate hike to tame rampant inflation despite Credit Suisse’s debacle.

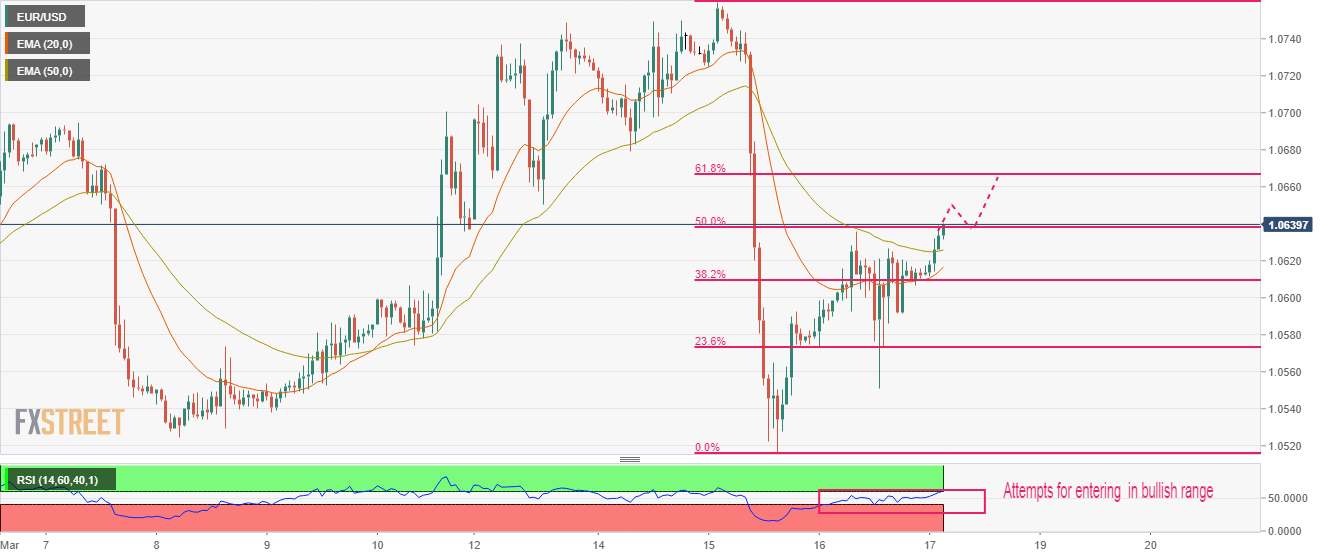

- EUR/USD has scaled above the 50% Fibonacci retracement, which cements a bullish reversal.

EUR/USD has printed a fresh day's high at 1.0642 in the Asian session as the US Dollar Index (DXY) has extended its correction further. The major currency pair has extended its recovery move above 1.0636 gradually and is expected to deliver more gains. The USD Index has refreshed its two-day low at 104.17 and is expected to slip further as uncertainty for the interest rate decision by the Federal Reserve (Fed) is escalating dramatically.

The Euro remained in action on Thursday as the European Central Bank (ECB) went for a third consecutive 50 basis points (bps) interest rate hike to tame rampant inflation in Eurozone. European Central Bank President Christine Lagarde ignored volatility linked to the deepening global banking crisis and remained stuck to its plan of hiking interest rates by 50 bps.

S&P500 futures are showing marginal correction after a stellar recovery on Thursday as investors ignored the likely global banking turmoil and cheered rising odds of a less-hawkish monetary policy stance by the Federal Reserve. The USD Index is facing the heat amid a recovery in the risk appetite of the market participants. A minor demand has been observed for US government bonds, which has trimmed 10-year US Treasury Yields to 3.56%.

Banking turmoil cements consideration for a steady Fed policy

Investors were worried after scrutiny of January economic indicators that the Federal Reserve will dial back the 50 bps rate hike spell to strengthen its competitiveness against United States' stubborn inflation. However, weak monthly inflation growth, higher jobless rate, lower Producer Price Index (PPI) figures, and contracting Retail demand conveyed that January’s data was a one-time show and Fed chair Jerome Powell would continue the 25 bps rate hike spell.

Meanwhile, fresh fears of a global banking meltdown have joined the declining inflation scenario, which has stemmed the odds of an unchanged monetary policy announcement by Federal Reserve chair Jerome Powell. After the collapse of Silicon Valley Bank (SVB), Signature Bank, and the debacle of Credit Suisse, financial instability issues have stretched to First Republic Bank. Similar to the new lifeline inculcation in Credit Suisse by the Swiss National Bank (SNB), First Republic Bank has also got tremendous liquidity support from various financial institutions including JP Morgan Chase & Co and Morgan Stanley. However, the fears of further global banking turmoil are still solid.

ECB went for a bigger rate hike despite Credit Suisse's fiasco

Inflation in the Eurozone economy is extremely persistent and only a restrictive monetary policy could contain rampant price index. For that, a 50 bps rate hike was already announced by European Central Bank Lagarde a few weeks back. However, investors thought that the European Central Bank won’t go big this time as fresh banking sector debacle fears could ruin the economic stability. In spite of the Credit Suisse fiasco, European Central Bank continued its 50 bps streak and pushed interest rates to 3.50%.

Reuters reported on Thursday that European Central Bank policymakers agreed to go ahead with a 50 bps increase in key rates after the Swiss National Bank (SNB) "threw a lifeline" to Credit Suisse. Also, European Central Bank's policy debate was between a 50 basis points hike and leaving rates unchanged. There was no discussion of a 25 bps hike.

For further action, the street is expecting more rates from the European Central Bank as current inflation levels are well-above the targeted range, and European Central Bank Lagarde has cleared that wage pressures are extremely solid.

Analysts at Rabobank see two more hikes of 25bp. Persistent unrest in financial markets is the main downside risk, but if this fades, inflation persistence could still require higher rates.”

EUR/USD technical outlook

EUR/USD has challenged the 50% Fibonacci retracement (plotted from March 15 high at 1.0760 to March 15 low at 1.0516. The shared currency pair has scaled above the 20-and 50-period Exponential Moving Averages (EMAs) at 1.0617 and 1.0626 respectively, which indicates that the short-term trend is bullish.

Meanwhile, the Relative Strength Index (RSI) (14) is attempting to shift into the bullish range of 60.00-80.00. An occurrence of the same will trigger the upside momentum.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.