- Analytics

- News and Tools

- Market News

- WTI bulls waiting in the flanks at major support

WTI bulls waiting in the flanks at major support

- WTI bears are in control and eye a test of $72.00.

- However, the M-formation could see a correction in the forthcoming hours from major support.

Oil prices are weaker in mid-day trade on Wall Street after the United States reported inflation last month rose at an annualized 6% pace, matching expectations and down from 6.4% in January.

However, inflation is still way above the Federal Reserve's targets which imply prospects of a recession, especially amid the banking sector concerns that continue to challenge growth and demand-dependent commodities such as oil.

West Texas Intermediate crude oil is down by over 3% on the day now and printing fresh session lows in New York at the time of writing.

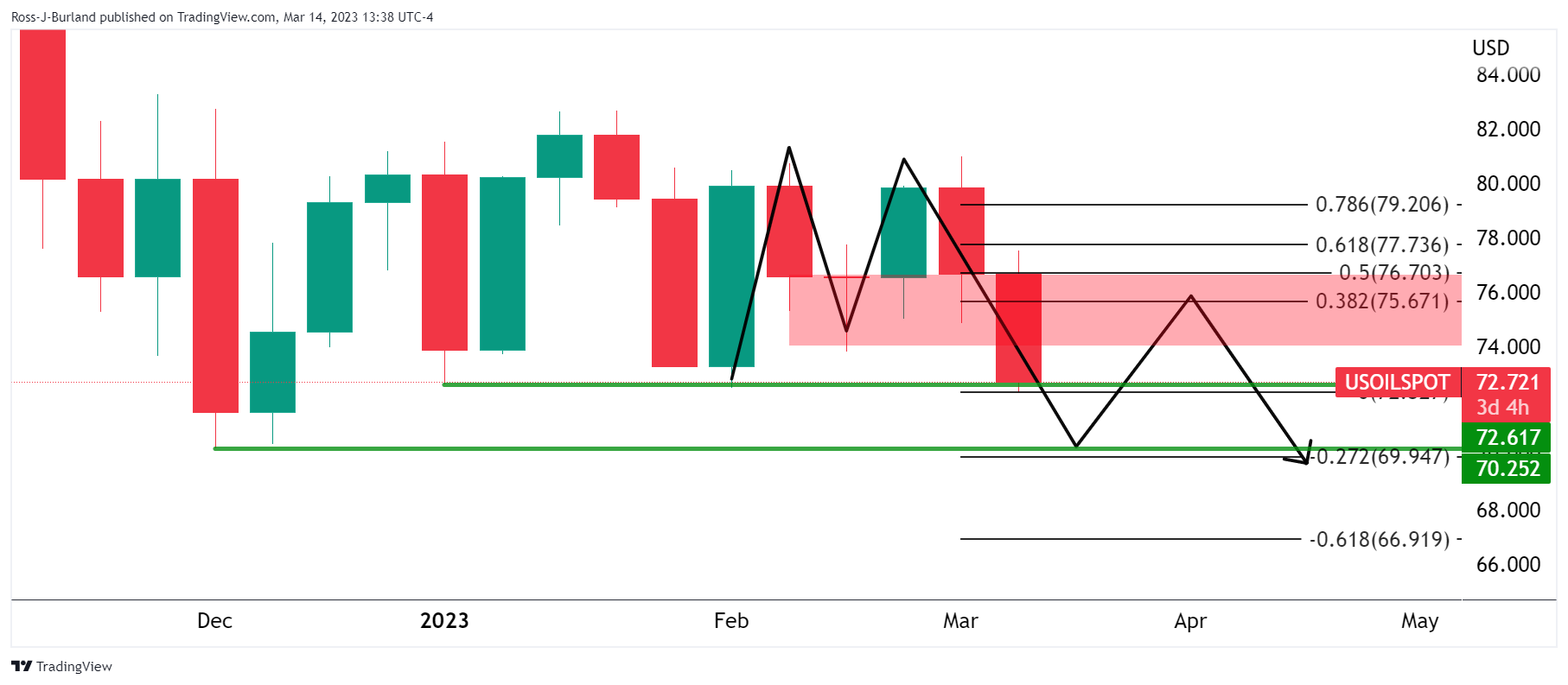

Looking to the charts, we can apply a multi-time frame analysis to determine prospects of a correction in the meanwhile but ultimately, a bearish bias prevails as follows:

WTI daily charts

In a series of lower highs, the daily charts show the price moving sideways within a broad range of between $70.10 and $83.32. There is a price imbalance, greyed area, above $77.50, but the momentum is with the bears while below $74.80, and liquidity below $70.10 is calling. However, while being on the backside of the bearish trend, (broken bear trendline), this could be a phase of accumulation and a clear out of stale stops below $70.10 could result in a surge of demand further down the line. nonetheless, the bears are in control for the time being

WTI weekly charts

The weekly charts show that the price broke the bullish trend and is now backside and moving sideways but still biased lower while on the front side of the micro bear trendline below $74.82 as illustrated above.

However, the M-formation could hamstring the bears between $70.25 and the neckline near a 50% mean reversion of $76.70.

WTI H1 charts

Moving down to the hourly chart, we see that the price is indeed on the front side of the bear trendline but meeting support. The M-formation, zooming in, is a reversion pattern that could see a correction in the forthcoming hours from support before a downside continuation to test $72 the figure.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.