- Analytics

- News and Tools

- Market News

- XAG/USD trades below the three-week high level of $22.00

XAG/USD trades below the three-week high level of $22.00

- Silver slides after reaching a March high, following a significant increase not seen since early November 2022.

- XAG/USD starts the day with a lower open price of $20.54 before climbing to an intraday price of $21.70.

- The price movements are relatively narrow, with the highest and lowest intraday prices being $21.92 and $21.62, respectively.

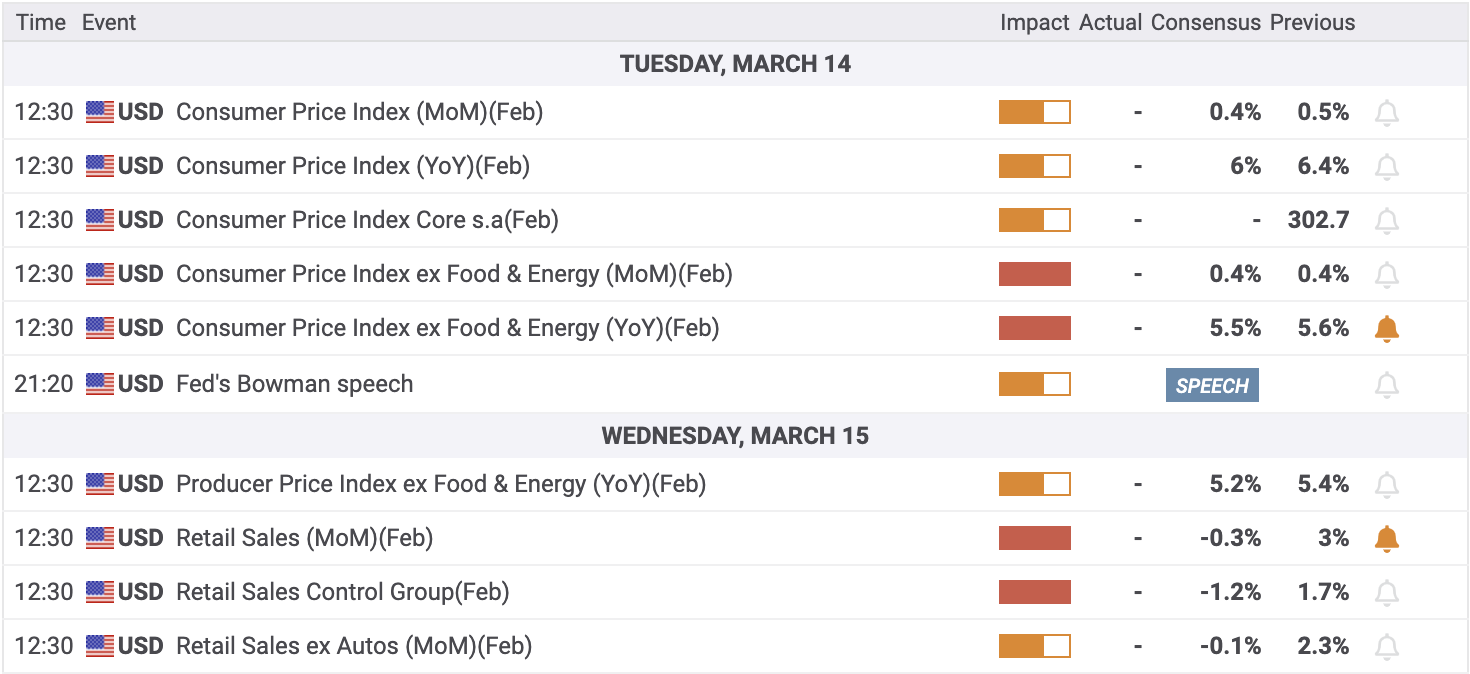

- Traders cautiously watch Tuesday’s US CPI and Wednesday’s US Retail Sales data.

Daily price movements:

Silver (XAG/USD) starts the day on a slightly bearish note, with a lower open price of $20.54 compared to the close price of the previous day. However, the XAG/USD currency pair climbs back up and trades at $21.70, still 0.47% down from its previous close of $21.81 at the press time, with a narrow intraday price range of $21.92 to $21.62. The market sentiment remains mixed ahead of Tuesday’s US inflation data.

After Silicon Valley Bank's (SVB) collapse, the banking sector's condition has raised concerns, leading to a decrease in expectations for a rate hike by the Federal Reserve (Fed). Investors are watching how this crisis and US Inflation data – to be announced on Tuesday at 15:30 GMT – could impact.

Key economic events:

US February Consumer Price Index (CPI) (Feb) on Tuesday at 12:30 GMT and US February Retail Sales on Wednesday at 12:30 GMT are crucial for monetary expectations and are closely watched. However, the unfortunate SVB collapse has resulted in markets anticipating a more lenient stance by the Federal Reserve (Fed).

Technical view:

The daily chart shows XAG/USD trades above its 20-SMA of $21.05, indicating a short-term bullish trend. However, it is still below its daily 50-SMA of $22.36, suggesting a longer-term bearish bias. RSI(14) is at 59.43 at the time of press, indicating a buying stance.

The daily pivot point is $21.43, with daily resistance levels at $22.32, $22.82, and $23.71, and daily support levels at $20.93, $20.04, and $19.54.

Traders are advised to carefully monitor price movements ahead of the US inflation data and use appropriate risk management strategies.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.