- Analytics

- News and Tools

- Market News

- USD/CAD clings above 1.3600 after upbeat US jobs data

USD/CAD clings above 1.3600 after upbeat US jobs data

- Upbeat labor market data boosted the US Dollar.

- The Federal Reserve pressured to deliver after solid US data warrants further tightening.

- USD/CAD headed upwards due to interest rate differentials between the Fed and the BoC.

The USD/CAD stages a comeback after losing 0.41% on Wednesday and rises above 1.3600 courtesy of broad US Dollar (USD) strength, sponsored by higher UST bond yields. Data from the United States (US) reinforced the economy is solid, particularly the labor market. Therefore, the USD/CAD advances 0.24% and trades at around 1.3600s after hitting a low of 1.3582.

USD/CAD pierces 1.3600 as US jobless claims edge down

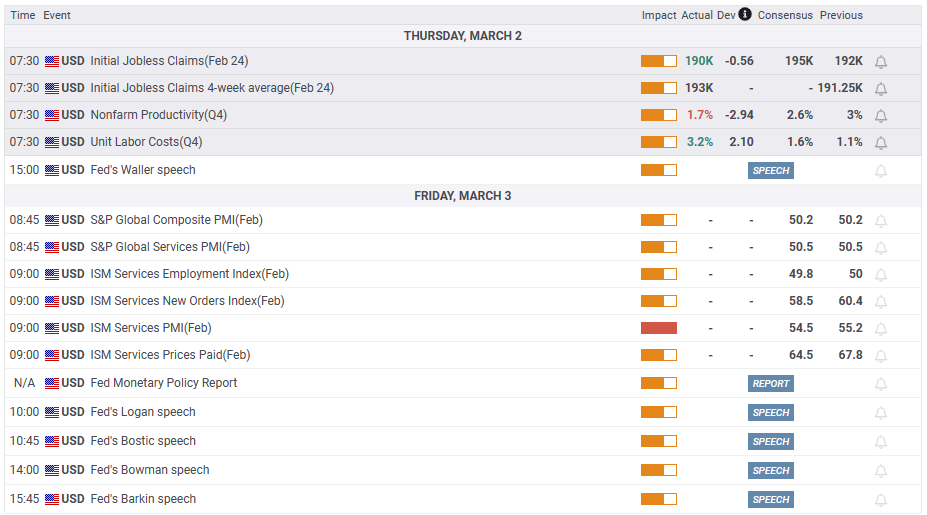

On Thursday, the US Department of Labor (DoL) revealed that Initial Jobless Claims for the week ending February 25 came at 190K below the 195K foreseen by analysts. The 4-week moving average, which smooths volatile movement from week to week, stood at 193K and climbed from last week’s 191K. The USD/CAD rose and printed a daily high of 1.3641 before settling at current levels.

Since then, the US !0-year Treasury bond yield skyrocketed above the 4% threshold, at the time of writing, stands at 4.056%, gains six basis points, and underpins the greenback. The US Dollar Index (DXY), a gauge of the buck’s value vs. a basket of six currencies, gains 0.55% at 104.944.

On Wednesday, Federal Reserve officials continued their hawkish rhetoric after last week’s data disappointed investors hopeful of witnessing lower inflation readings. Minnesota Fed President Neil Kashkari commented that he is inclined “to push up my policy path” and foresees the Federal Fund Rate (FFR) to peak at around 5.4%. Echoing some of his comments was Atlanta’s Fed President Raphael Bostic though he was moderate, projects the FFR to peak at 5.0% - 5.25% but emphasized that it will stay there “well into 2024.”

On the Canadian front, traders should be aware that the Bank of Canada (BoC) lifted rates 25 bps to 4.50% on January 25 and commented that it would pause hiking rates. Therefore, that would keep the Loone (CAD) pressured as interest rate differentials between the Fed and the BoC would increase flows to the US Dollar. Given the backdrop, the USD/CAD path of least resistance is upwards.

The USD/CAD rally was capped by high oil prices, as WTI extended its rally to three days, with investors assessing China’s oil demand once it completes its reopening.

USD/CAD Technical analysis

Technically speaking, the USD/CAD is still upward biased, but it has consolidated during the week. If the USD/CAD pair stays around 13600.1.3660, that could lead to desperate bulls, which need to reclaim the YTD high of 1.3685, on its way to 1.3700 and beyond. On the other hand, a break below 1.3600 could exacerbate a correction toward the 20-day Exponential Moving Average (EMA) at 1.3507.

What to watch?

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.