- Analytics

- News and Tools

- Market News

- NZD/USD rises to 0.6250 on soft USD, with traders eyeing NZ data

NZD/USD rises to 0.6250 on soft USD, with traders eyeing NZ data

- NZD/USD was the strongest peer in the FX space and rallied more than 1%.

- US manufacturing activity stabilized, but input prices rose, sparking inflation concerns.

- NZD/USD Price Analysis: Will test solid resistance around 0.6280-0.6300, with daily Mas hoovering around the area.

Despite sentiment shifting sour, the NZD/USD rallies and stays firm above the 0.6250 area, bolstered by a softer greenback, albeit UST bond yields are rising sharply. US equities are pointing toward registering losses, which could weigh on risk-sensitive currencies at the beginning of the Asian session. At the time of writing, the NZD/USD is gaining 1.16% or 71 pips.

NZD/USD continued its uptrend on a soft US Dollar

Wall Street is set for a lower close. The Institute for Supply Management (ISM) reported that the February US Manufacturing Purchasing Managers’ Index (PMI) was 47.7, lower than the estimated value of 48. Although it seems to have stabilized compared to the previous month’s reading of 47.4., the prices subcomponent increased significantly, causing concerns about inflation among investors.

That augmented speculations that the Federal Reserve would continue tightening monetary conditions as traders pushed back rate cuts, as the CME FedWatch Tool reported.

The NZD/USD trimmed some of its earlier gains on the ISM release and dipped toward 0.6222, before resuming the uptrend, despite hawkish comments by Federal Reserve officials.

Neil Kashkari of the Minnesota Fed commented that he’s open to raising rates by 25 or 50 bps at the upcoming meeting, while he foresees rates peaking around 5.4%. Of late, Atlanta’s Fed President Raphael Bostic commented that rates need to go as high as 5% - 5.25% and stood there “well into 2024.”

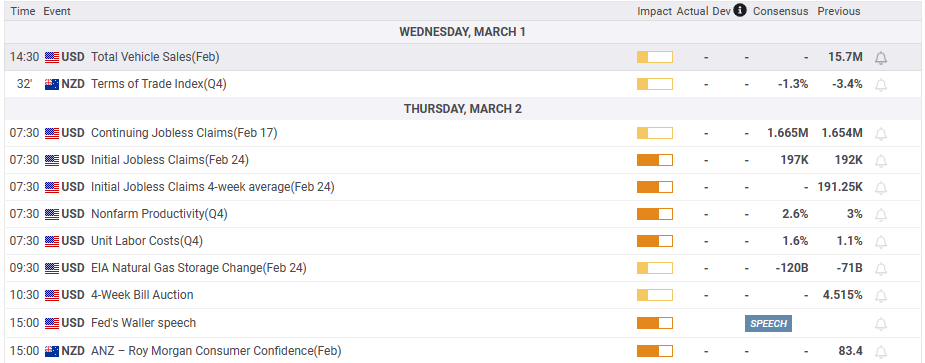

On the New Zealand (NZ) docket, the lack of data kept investors leaning on US Dollar dynamics and expectations that the Reserve Bank of New Zealand (RBNZ) is expected to raise rates in April, with odds for a 50 bps standing at 51%, per money market futures.

NZD/USD Technical analysis

The NZD/USD is neutral to upward biased, even though it sits below the daily Exponential Moving Averages (EMAs). However, at the time of typing, it faces solid resistance with the 50 and 200-day EMAs, at 0.6293 and 0.6282, respectively. If the NZD/USD cracks the 200-day EMA, that will exacerbate a rally above the 0.6300 mark. Otherwise, failure to do it would pave the way for further downside.

Trend: Neutral upwards.

What to watch?

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.