- Analytics

- News and Tools

- Market News

- Silver Price Forecast: XAG/USD holds the fort at $21.00 despite UST yields continuing to rise

Silver Price Forecast: XAG/USD holds the fort at $21.00 despite UST yields continuing to rise

- Silver price holds to its earlier gains but remains at risk, of closing the session below $21.00 a troy ounce.

- US ISM Manufacturing PMI missed estimates, though it showed some improvement.

- Federal Reserve officials emphasized the need to raise rates to the 5.25% - 5.50% area.

Silver price advances in the North American session after finding resistance above the $21.00 area, though it clings to gains of 0.33%. Bolstered by a softer US Dollar (USD) after United States (US) data missed estimates, the white metal is extending its gains for two straight days. At the time of writing, the XAG/USD trades at around $20.90s.

US manufacturing activity improved, but higher input prices overshadowed the data

Sentiment shifted sour on US manufacturing data. The ISM revealed February’s Manufacturing PMI came at 47.7, below estimates of 48, though it appeared to stabilize, with the prior’s month reading at 47.4. However, the prices subcomponent jumped, reigniting inflation worries amongst investors, as witnessed by US money market futures, with traders expecting rates to climb as high as 5.50%, with no rate cuts in 2023.

A knee-jerk reaction tumbled the XAG/USD from $21.11 to $20.89 a troy ounce. However, Silver’s fall was capped by the US Dollar, which continued to weaken through the US session.

Earlier, Federal Reserve officials crossed newswires and continued their hawkish rhetoric. Minnesota’s Fed President Neil Kashkari (voter) said interest rates should reach 5.4% in December and stay at that level. He also mentioned that he would consider increasing rates by either 25 or 50 basis points during the upcoming Fed meeting.

Later, Atlanta’s Fed President Raphael Bostic commented that rates need to go as high as 5% - 5.25% and stood there “well into 2024.”

The Fed’s hawkish rhetoric did not help the greenback, which, by the US Dollar Index, is down 0.46% at 104.471. Contrarily, the US 10-year Treasury bond yield is advancing seven basis points, eyeing a break above the 4% threshold, a headwind for precious metals prices.

XAG/USD Technical analysis

Silver’s daily chart portrays XAG/USD as downward biased. The bearish case is further cemented by crossing the 20-day EMA below the 200-day EMA, which could exacerbate a test of the YTD low at around $20.43. XAG/USD’s recovery in the last couple of days is sponsored by a technical signal, with the Relative Strength Index (RSI) exiting from oversold conditions, which triggered a buy signal. Failure to extend its gains above $21.00 could pave the way for further downside.

The XAG/USD first support would be the February 27 daily low of $20.56, which, once cleared, it could pave the way to the YTD low at $20.43. On the other hand, if Silver stays afloat above $21.00, the XAG/USD could test the February 24 high at $21.39.

What to watch?

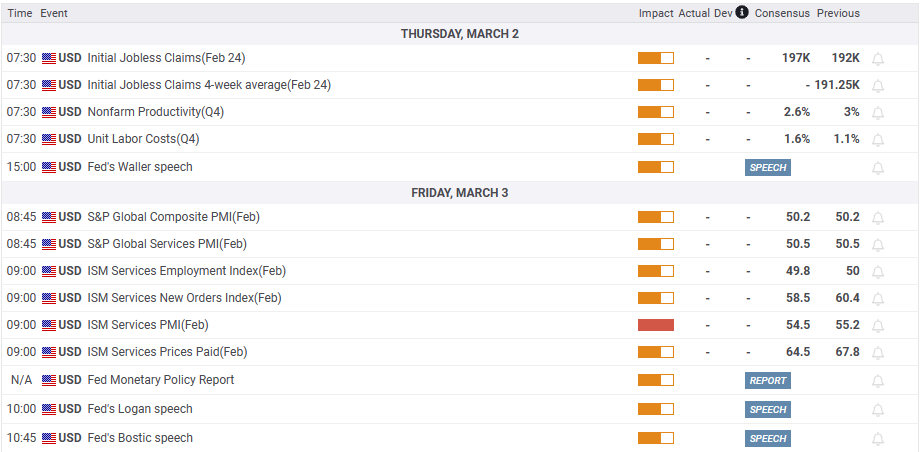

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.