- Analytics

- News and Tools

- Market News

- China NBS Manufacturing / Non-manufacturing PMIs beats are a welcome suprise for AUD bulls

China NBS Manufacturing / Non-manufacturing PMIs beats are a welcome suprise for AUD bulls

China's Manufacturing Purchasing Managers Index (PMI) and the official Non-manufacturing PMIs have been released as follows:

- China Manufacturing PMI Feb: 52.6 (est 50.6, prev 50.1).

- China Non-Manufacturing PMI Feb: 56.3 (est 54.9, prev 54.4).

AUD/USD update

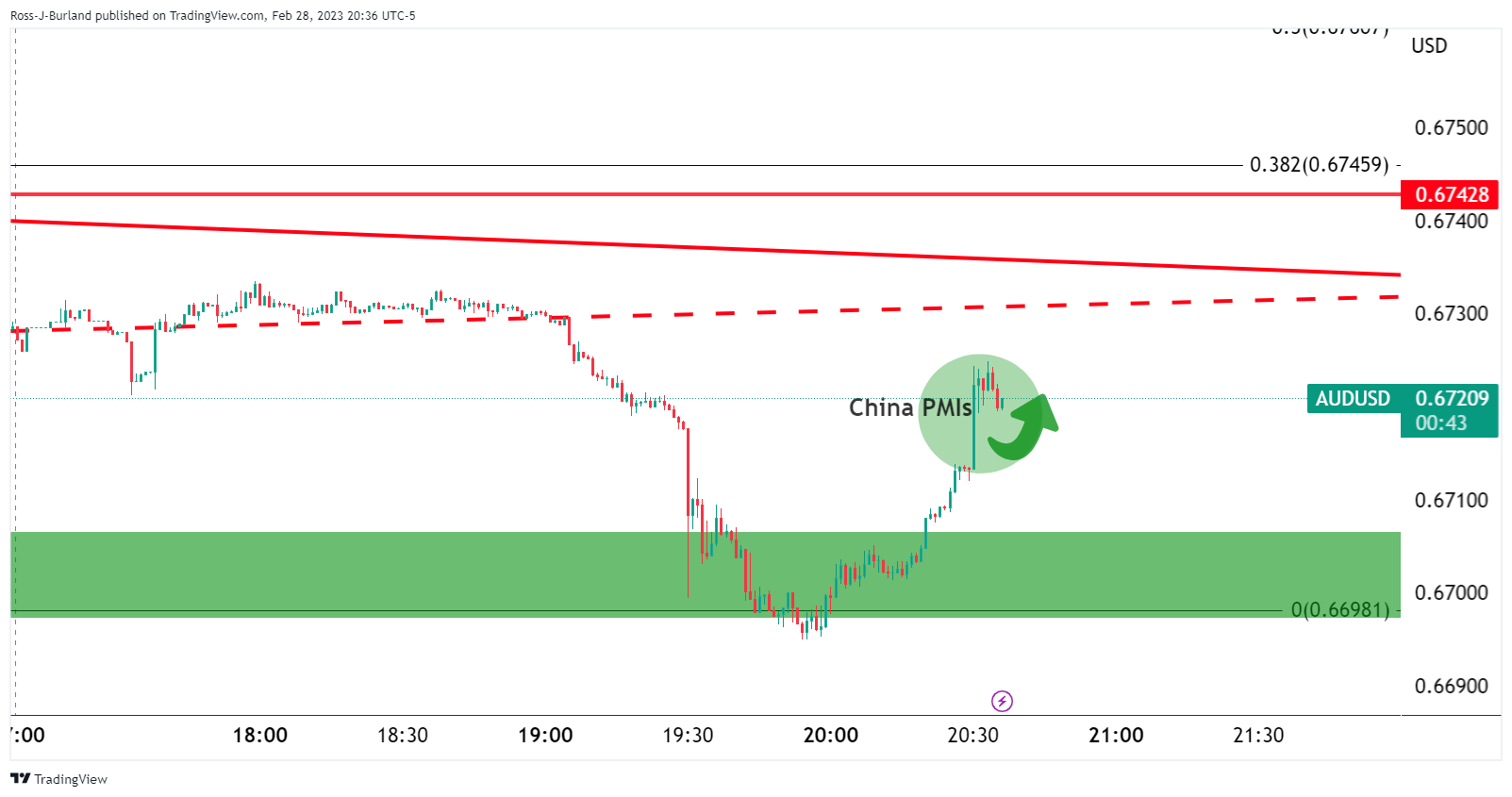

AUD/USD has been trying to correct but the data has done little to help dig the bulls out of a hole despite sizeable beats so far. However, it is early days since the release and the bulls could find a lifeline there.

Earlier, Australia's data dump, including Gross Domestic Product and the monthly Consumer Price Index weighed on the Aussie as follows:

Consequently, AUD/USD has now broken a trendline support and was resisted by the 50% mean reversion of the prior bearish impulse on Tuesday:

Despite the positive upturn in data from China PMIs, the combination of today's Chinese and Australian data would be expected to continue to weigh on the Aussie as aggressive Australian monetary tightening is likely cooling the Australian economy. This could cast a more dovish sentiment over the Reserve Bank of Australia.

About the China PMIs

The Manufacturing Purchasing Managers Index (PMI) released by the China Federation of Logistics and Purchasing (CFLP) studies business conditions in the Chinese manufacturing sector. Any reading above 50 signals expansion, while a reading under 50 shows contraction. As the Chinese economy has influence on the global economy, this economic indicator would have an impact on the Forex market.

The official non-manufacturing PMI, released by China Federation of Logistics and Purchasing (CFLP), is based on a survey of about 1,200 companies covering 27 industries including construction, transport and telecommunications. It's the level of a diffusion index based on surveyed purchasing managers in the services industry and if it's above 50.0 indicates industry expansion, below indicates contraction.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.