- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls wait patiently for a buy low opportunity

Gold Price Forecast: XAU/USD bulls wait patiently for a buy low opportunity

- US Dollar slides during a risk-on start to the US day on the back of US data bucking the trend.

- Gold price double bottom near the $1,800 psychological level is offering a compelling bullish case.

The Gold price is breaking the structure to the upside which could be paving the way for a buy-low opportunity for patient bulls for the sessions ahead. XAU/USD has come up from the Friday session lows of near $1,806 and has broken $1,814 structure, squeezing shorts with prospects of a prolonged squeeze for the week ahead with the January lows at $1,824 eyed.

Gold price bulls back in control

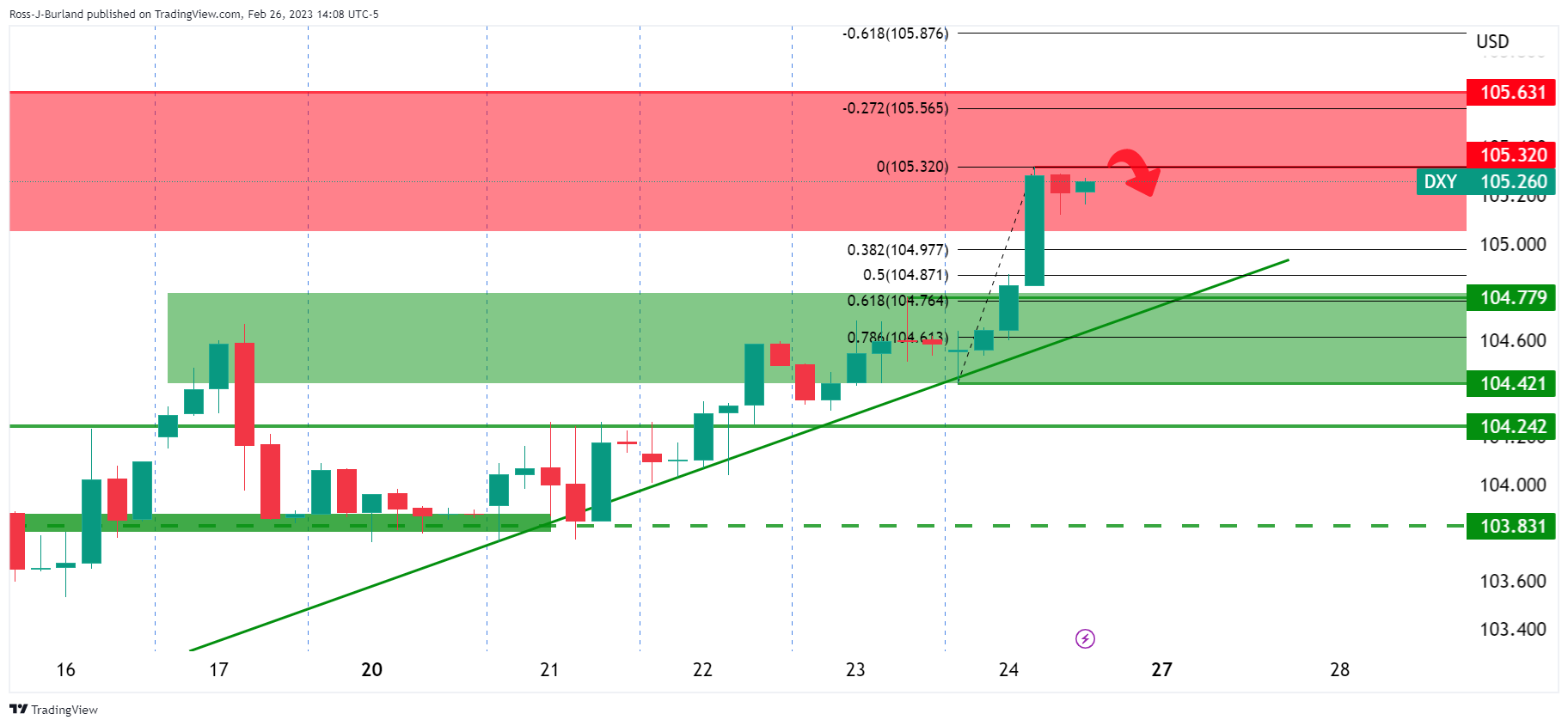

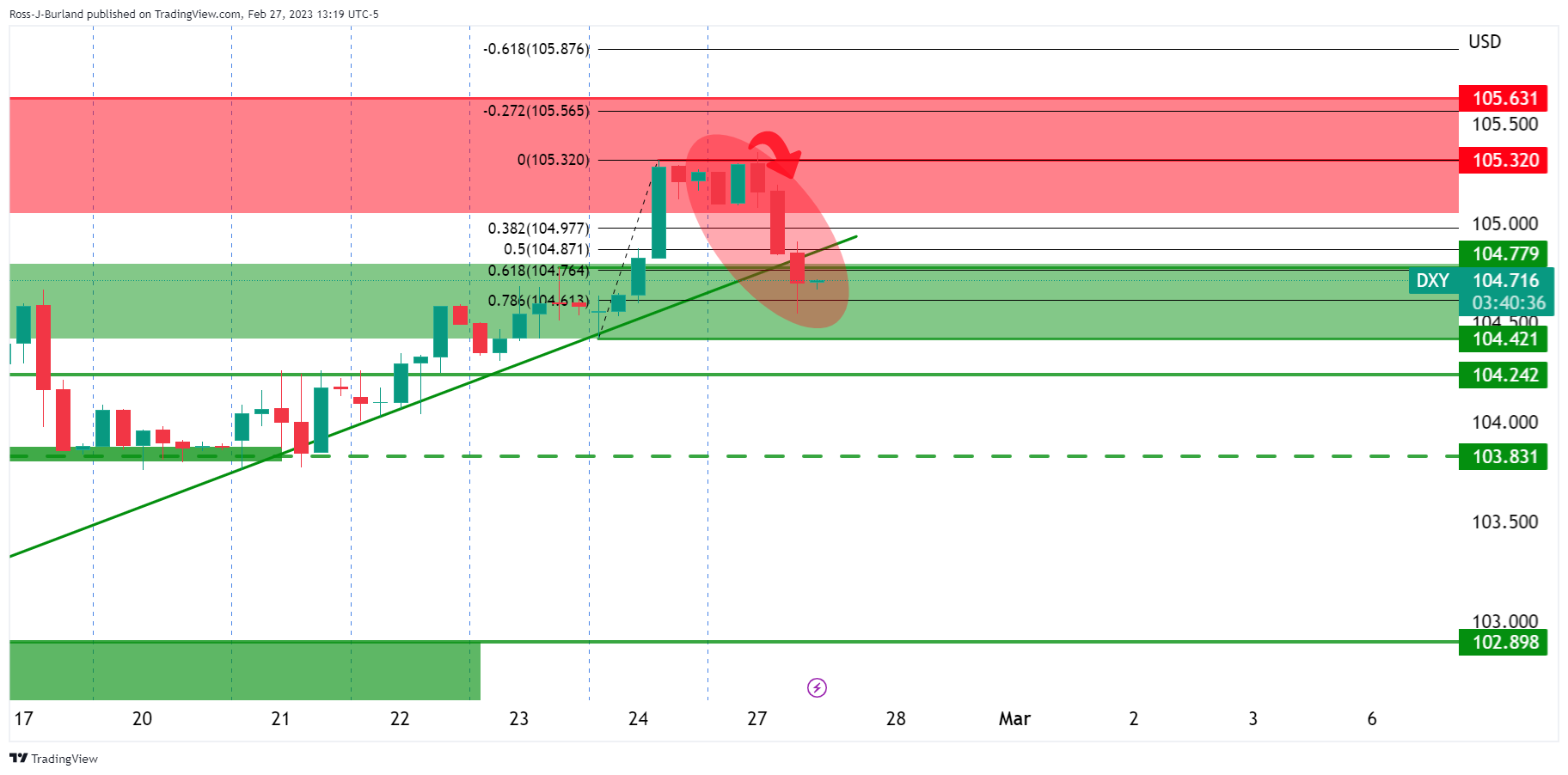

The Gold price pushed higher on Monday as the US Dollar was sold off in a risk-on environment as US data missed expectations, snapping a series of troublesome inflationary data from the US of late. The US Dollar index, DXY,

dropped to a low of 104.546 on the day after hitting a seven-week peak, making gold less expensive for overseas buyers. The DXY recovered some of the losses later in the morning but remains under pressure, sliding from recovery session highs at 104.83 and moving back into test 104.70 bullish commitments.

Federal Reserve expectations driving Gold price

Meanwhile, after hitting its highest since April 2022 this month, the Gold price has dropped by more than 7% after US data pointed to a resilient economy and Federal Reserve expectations flipped back to hawkish again.

''To state the obvious, the recent US data have come around to support our more hawkish view on the Fed, which in turn supports our call for a stronger dollar,'' the analysts at Brown Brothers Harriman said in a note. ''Market sentiment is finally swinging back in the US Dollar’s favor and we remain hopeful that the data continue to encourage this shift.''

For instance, the US data on Friday showed US consumer spending increased by the most in nearly two years in January, while inflation accelerated, adding to market fears the Fed could continue raising interest rates. However, today's Commerce Department's Durable Goods report, which covers everything from air fryers to helicopters, showed a whopping 54.6% plunge in commercial aircraft/parts. This led to the US-made merchandise numbers falling by 4.5% in January, steeper than the 4.0% decline analysts expected and a reversal from December's downwardly revised 5.1% increase and the greenback dropped heavily.

Nevertheless, worries about further interest rate hikes from the US Federal Reserve have kept bullion near a two-month low and WIRP suggests 25 bp hikes in March, May, and June are priced in that takes Fed Funds to 5.25-5.50%, the analysts at BBh warned.

''Right now, odds are running around 30% of a fourth hike in July but this should rise if the data continue to run hot. Strangely enough, an easing cycle is still expected to begin in Q4, albeit at much lower odds,'' the analysts added. ''Eventually, it should be totally priced out into 2024 in the next stage of Fed repricing. There are plenty of Fed speakers this week and we expect them to tilt heavily hawkish.''

-

Fed's Jefferson: Lower inflation without unecessary amount of disruption in job market possible

Speaking of which, Federal Reserve Governor Philip Jefferson said on Monday that it is possible for inflation to decline without an unnecessary amount of disruption in the job market, as reported by Reuters. However, he added that "inflation is too high and that is hard for people across the demographic spectrum."

All in all, this leaves the outlook data dependent and markets will need to wait for the Nonfarm Payrolls report a little longer than this week as it falls on the 2nd Friday of this month.

In the meanwhile, traders will instead be looking to the ISM surveys. Data already released point to a rebound for the ISM mfg index in Feb following five months of consecutive declines that saw the series drop to a post-Covid low of 47.4 in Jan, analysts at TD Securities said. ''Separately, we look for the ISM services index to stabilize around its current level after the notable Dec-Jan zigzag in the series. We might revise our projection as more data is released next week.''

Gold price technical analysis

As per the start of the week's analysis, it was stated that the US Dollar was up high and a correction would be anticipated for the initial balance to start the week:

We have since seen that sell-off in DXY:

This has left a bullish outlook on the Gold price as follows:

The double bottom near the $1,800 psychological Gold price level is offering a compelling case for a move towards the $1,830s, a touch above the January opening lows. However, a retest of the W-formation's neckline could be on the cards first.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.