- Analytics

- News and Tools

- Market News

- EUR/USD finds some respite near 1.0530, looks at data

EUR/USD finds some respite near 1.0530, looks at data

- EUR/USD bounces off lows near the 1.0530 level.

- The dollar appears somewhat offered despite higher yields.

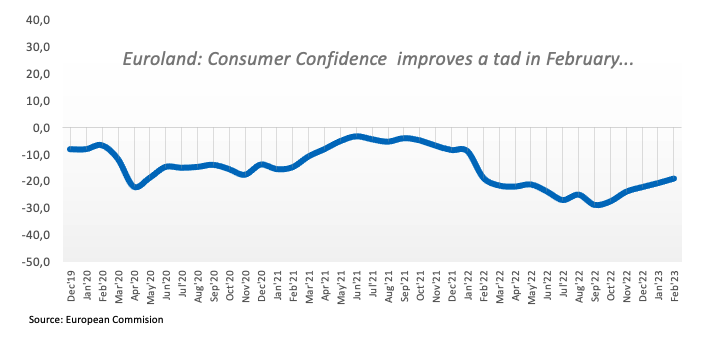

- EMU Final Consumer Confidence came at -19 in February.

Following an initial drop to the 1.0530 region, or 8-week lows, EUR/USD manages to regain some buying interest and advances to the 1.0560 area at the beginning of the week.

EUR/USD focuses on USD, data

EUR/USD so far advances modestly and leaves behind five consecutive sessions with losses on the back of some tepid selling pressure around the greenback on Monday.

Indeed, investors appear to be cashing up some gains in light of the recent strong upside momentum in the dollar, forcing the USD Index (DXY) to give away some ground and return to the vicinity of the 105.00 support.

In the domestic calendar, in the meantime, final figures saw the Consumer Confidence in the broader Euroland tracked by the European Commission unchanged at -19 for the current month, while the Economic Sentiment worsened to 99.7 also in February (from 99.9).

In the US, Durable Goods Orders and Pending Home Sales will be in the limelight seconded by the speech by FOMC P.Jefferson (permanent voter, centrist).

What to look for around EUR

Price action around EUR/USD remains depressed so far, although the pair seems to have met some motivation after bottoming out in the 1.0535/30 band earlier on Monday.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the bank has already anticipated another 50 bps rate raise at the March event.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: EMU Consumer Confidence, Economic Sentiment (Monday) – France Flash Inflation Rate (Tuesday) – Germany/EMU Final Manufacturing PMI, Germany Unemployment Change, Flash Inflation Rate (Wednesday) – EMU Flash Inflation Rate, Unemployment Rate, ECB Accounts (Thursday) – Germany Balance of Trade, Final Services PMI, EMU Final Services PMI (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.06% at 1.0551 and a breakout of 1.0714 (55-day SMA) would target 1.0804 (weekly high February 14) en route to 1.1032 (2023 high February 2). On the flip side, the next support aligns at 1.0532 (monthly low February 27) seconded by 1.0481 (2023 low January 6) and finally 1.0328 (200-day SMA).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.