- Analytics

- News and Tools

- Market News

- GBP/USD Price Analysis: Stays defensive above 1.2000 as bears fear bumpy road ahead

GBP/USD Price Analysis: Stays defensive above 1.2000 as bears fear bumpy road ahead

- GBP/USD struggles for clear directions after two-day downtrend.

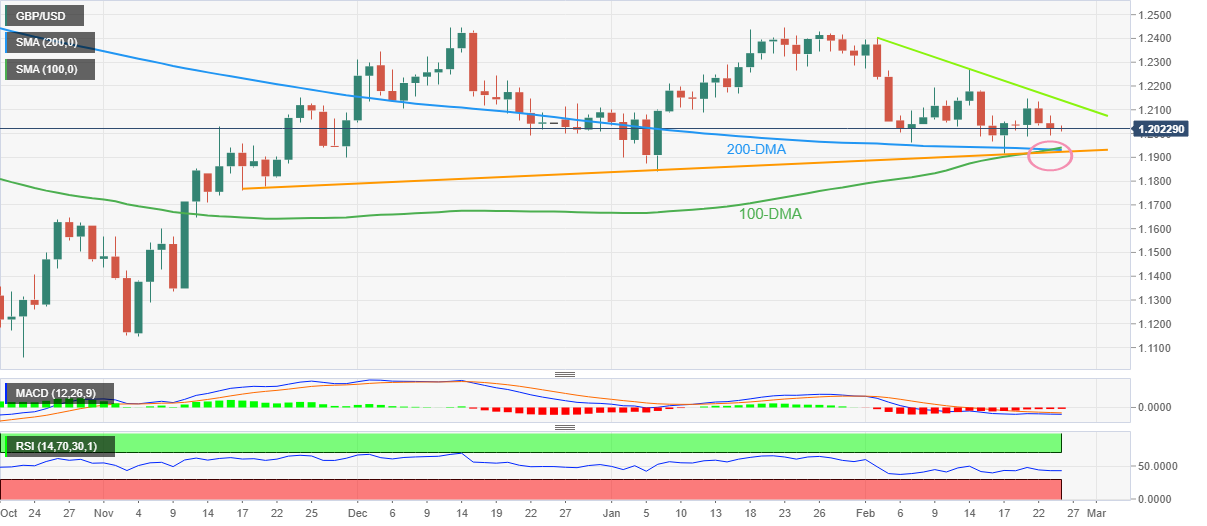

- Convergence of 200-DMA, 100-DMA and three-month-old ascending trend line offers strong support.

- Bearish MACD signals, steady RSI suggests more downside.

- Recovery remains elusive below three-week-long descending resistance line.

GBP/USD picks up bids to reverse the early Asia losses, despite failing to gain traction above 1.2000. That said, the Cable pair seesaws around 1.2020-25 during Friday morning, following a two-day downtrend.

The quote’s latest weakness could be linked to the bear’s fears of strong support ahead as the 200-DMA and 100-DMA join an upward-sloping support line from late November 2022 to challenge the pair’s further downside near the 1.1940-20 area.

It’s worth noting, however, that the bearish MACD signals and the steady RSI (14) keep the GBP/USD sellers hopeful.

As a result, the quote’s further downside appears to have limited room unless breaking 1.1920 key support. In that case, a slump to the previous monthly low of 1.1840 becomes imminent before highlighting the mid-November 2022 swing low near 1.1760.

Should the GBP/USD bears keep the reins past 1.1760, the last October’s high of 1.1645 may return to the chart.

On the contrary, a three-week-old descending resistance line restricts immediate Cable moves near 1.2140, a break of which could quickly propel the pair towards the mid-February swing high of near 1.2270.

Following that, multiple tops marked around 1.2450 will be crucial to watch for the GBP/USD buyers.

GBP/USD: Daily chart

Trend: Limited downside expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.