- Analytics

- News and Tools

- Market News

- USD/CAD bears are movimg in ahead of key US data

USD/CAD bears are movimg in ahead of key US data

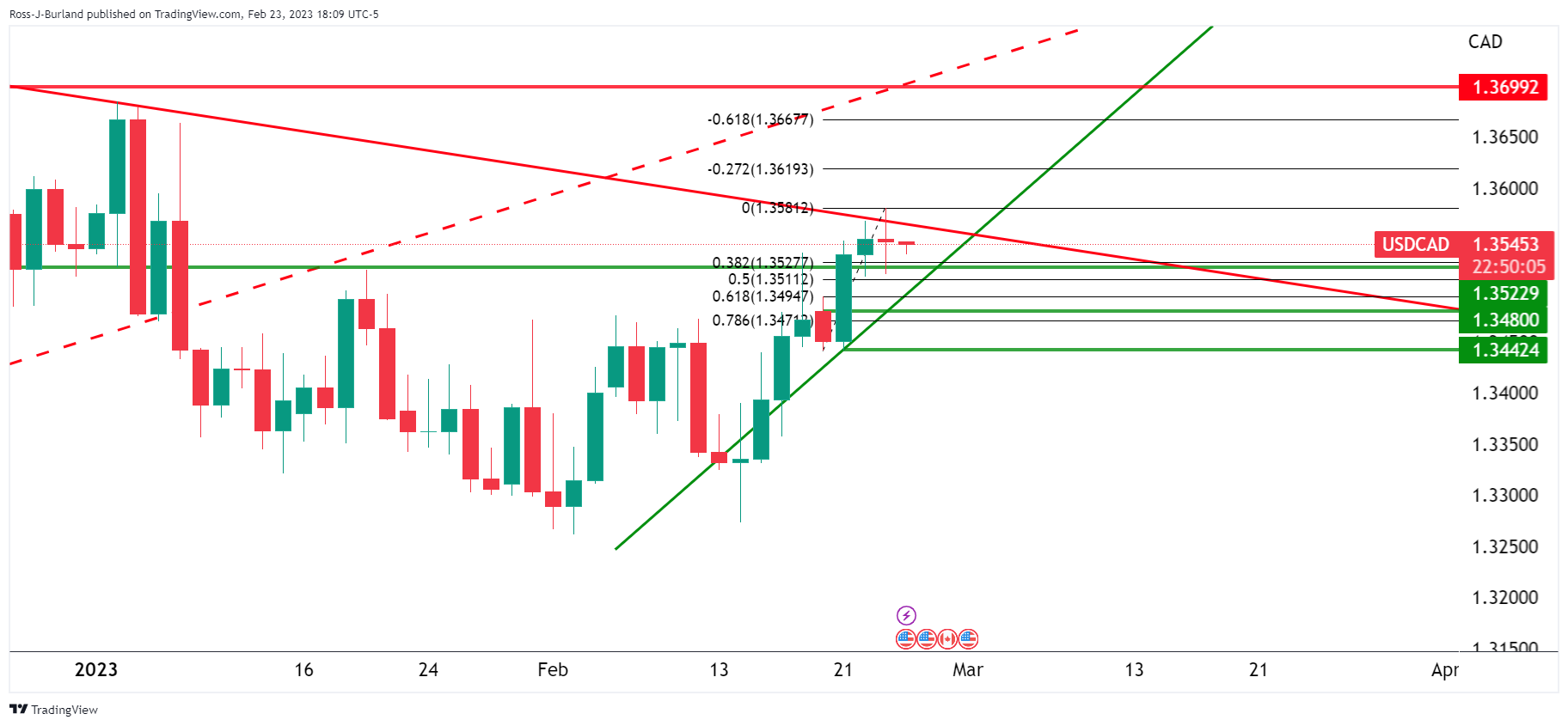

- USD/CAD is meeting resistance leaving the 38.2% Fibonacci retracement level towards 1.3500 exposed.

- US data will yet again be front and centre to end the week.

The US Dollar was bolstered by yet further evidence of an inflationary theme in the US economy with the strong economic data that continues to suggest the US Federal Reserve's monetary policy tightening could be extended if it is to bring down the highest inflation in decades. The number of Americans filing new claims for unemployment benefits unexpectedly fell last week, showing a still-tight labor market and a resilient US economy.

Meanwhile, the second estimate of US Q4 Gross Domestic Product being revised down 0.2% to 2.7% saar. The downward revision was driven by weakness in private consumption which was reported at 1.4% vs 2.1% in the preliminary estimate. The GDP deflator rose 4.3%, up from 3.9% in the previous estimate. The personal savings rate was revised to 3.9%, up 0.5pts.

Speaking of deflators, Friday's PCE deflator will be a key red news event. Ahead of the event, the Fed funds futures traders are now pricing for the federal funds rate to reach 5.34% in July, and staying above 5% all year. That rate is currently between 4.50%-4.75% range.

''The market is expecting the January headline data to remain at 5.0% YoY, in line with the previous month,'' analysts at Rabobank said. ''This would strengthen concerns that the downtrend in inflationary indicators may have stalled. Data in line with market expectations would thus add further weight to the view that the Fed will have to work harder to push inflation back to its target level. Currently implied market rates are pointing to a peak in Fed funds close to 5.33%.''

USD/CAD technical analysis

The above charts outline the boundaries for the price in USD/CAD that arrives with a meanwhile bearish bias as the bulls meet resistance following a burst to the upside on US Dollar strength. The bears eye a 38.2% Fibonacci retracement level towards 1.35 the figure for the day ahead.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.