- Analytics

- News and Tools

- Market News

- EUR/JPY Price Analysis: Trips down around 143.00 with bears targeting 142.00

EUR/JPY Price Analysis: Trips down around 143.00 with bears targeting 142.00

- EUR/JPY printed losses of 0.27% on Wednesday, but as the Asian session starts, it’s up 0.02%.

- Short term, the EUR/JPY peaked at around 144.00; hence further downside is expected before resuming the uptrend.

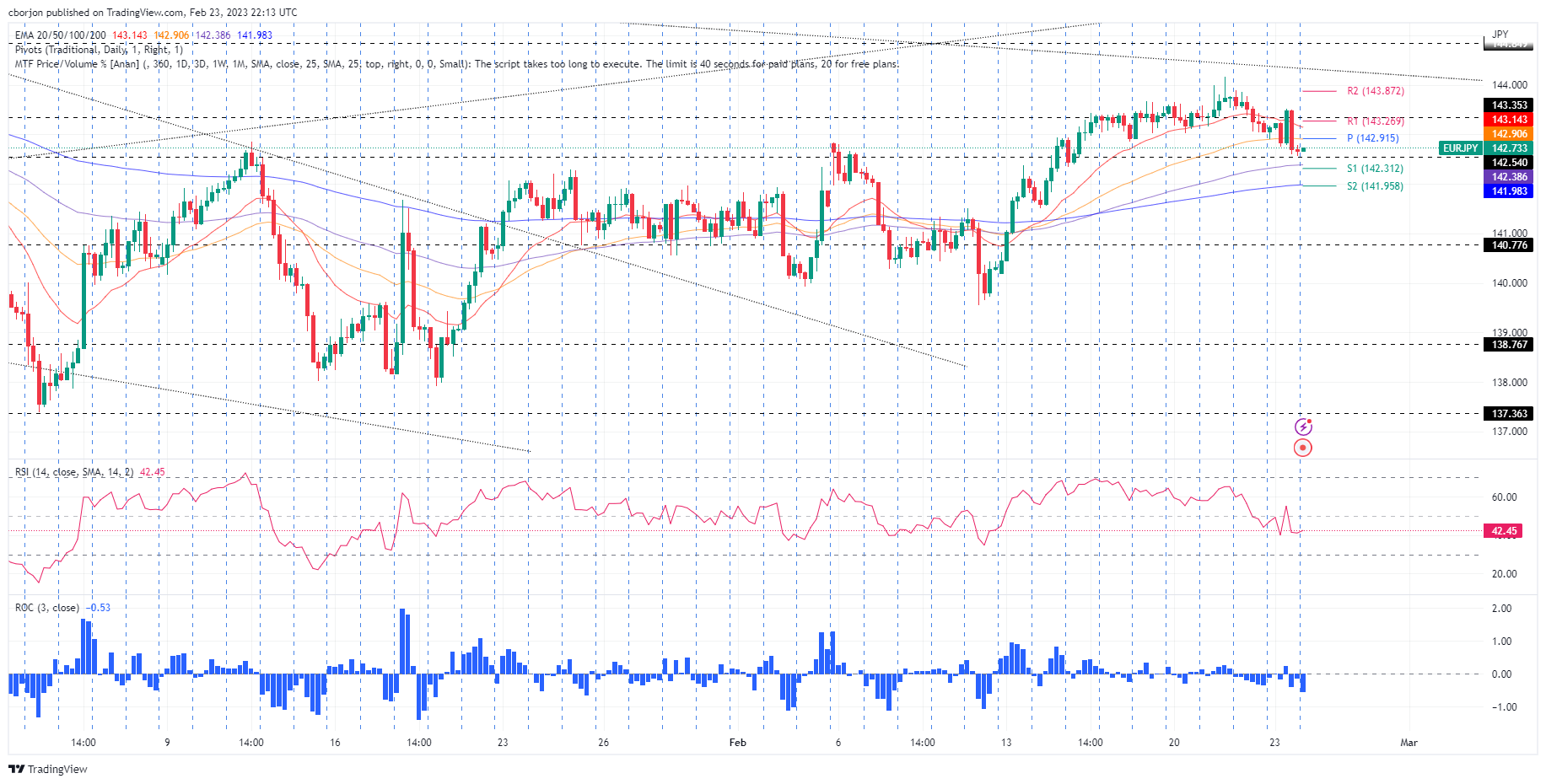

The EUR/JPY retraces after hitting a new weekly high at 144.16 on Tuesday but failed to hold to its earlier gains and dropped below 143.00, aiming toward the 20-day Exponential Moving Average (EMA) at 142.24. At the time of writing, the EUR/JPY exchange rate sits at 142.73, below its opening price by 0.22%, ahead of the Asian session beginning.

From a daily chart perspective, the EUR/JPY is still upward biased, even though the EUR/JPY has dived during the last couple of sessions and reached a weekly low of 142.56. Albeit the Relative Strength Index (RSI) aims downward, it still in bullish territory, suggesting that the shared currency could resume its uptrend. However, fundamental news could impact the overall uptrend of the EUR/JPY, and the pair might retreat on safe-haven flows.

From an intraday perspective, the EUR/JPY is neutral-upward biased, though it appears to have peaked around the 144.00 area. Since then, the EUR/JPY nosedived 150 pips, and at the time of typing, the spot price sits trapped within the daily pivot and the S1 pivot point. Therefore, the EUR/JPY could aim downwards before resuming its uptrend.

The EUR/JPY first support would be the 100-EMA at 142.38, followed by the S1 daily pivot point at 142.31. A breach of the latter and the EUR/JPY next stop would be the intersection of the 200-EMA and the S2 pivot point at around 141.95/98.

EUR/JPY 4-Hour chart

EUR/JPY Key technical levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.