- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bears eye a downside continuation, US PCE eyed

Gold Price Forecast: XAU/USD bears eye a downside continuation, US PCE eyed

- Gold price is in a bearish trend and the FOMC minutes have fuelled a sell-off.

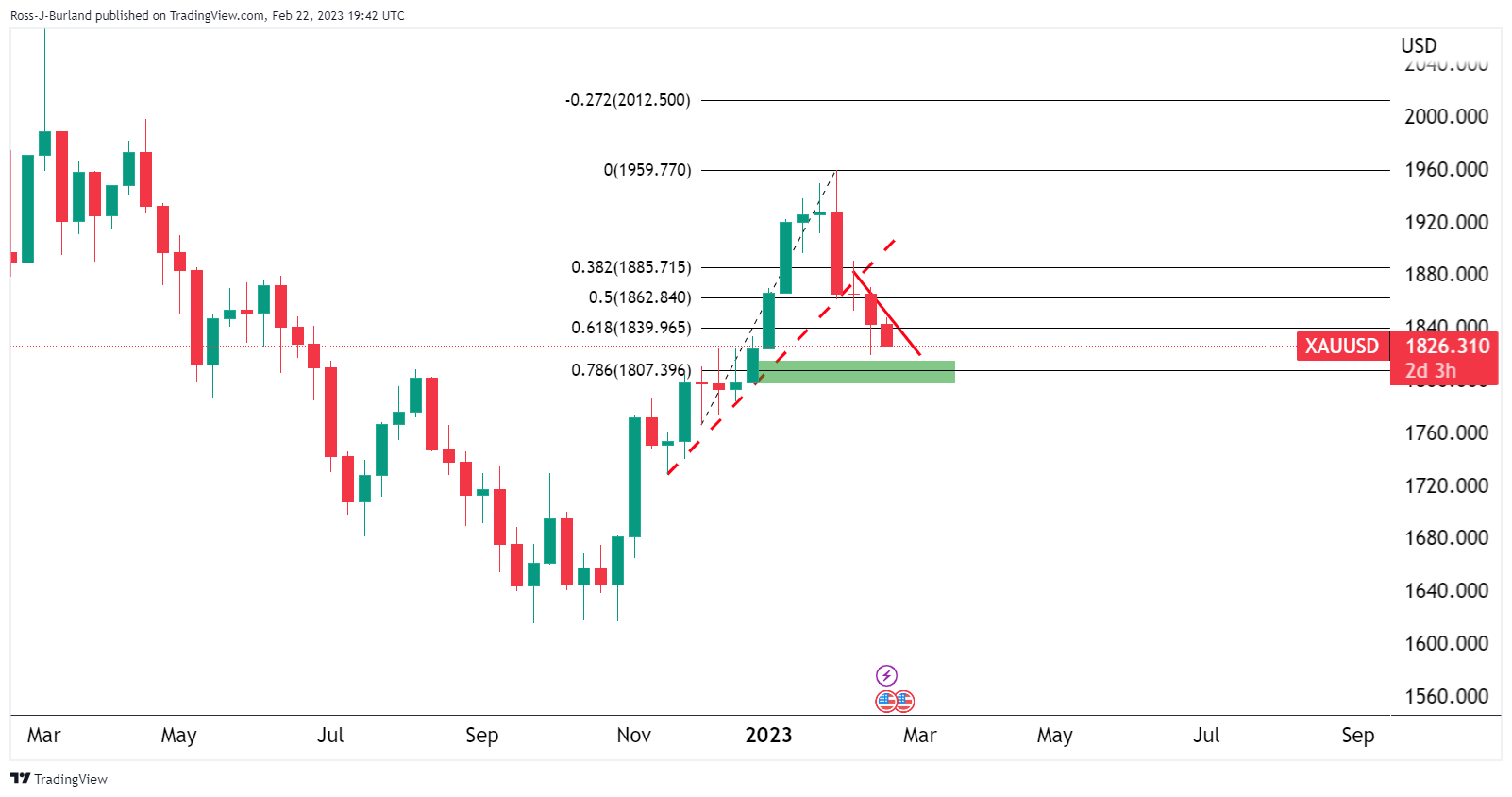

- Gold price's weekly chart shows support near the 78.6% Fibonacci retracement level at $1,807.

Gold price is under pressure by some 0.3% on the day and remains in the hands o the bears following the first Federal Open Market Committee Minutes of 2023.

The minutes were released whereby investors have been searching for further insights into the near-term path for policy and any comments regarding the possibility of the Federal Reserve going back to 50 bps hikes. The minutes showed that a few participants had favoured raising rates by 50 basis points which has put a bid in the US Dollar but left the US Treasury Yield relatively stable. This has left the Gold price somewhat pressured around the low of the day near $1,825.54 after the yellow metal fell from a high of 41,846.05 earlier in the day.

FOMC minutes key notes

- A few participants favoured raising rates by 50 basis points.

- All participants agreed more rate hikes needed to achieve Federal Open Market Committee's job, inflation objectives.

- Participants said restrictive monetary policy needed until Fed confident inflation falling to 2%; added that process likely to take 'some time'.

- All participants favored further fed balance sheet reductions under current plan.

- Participants said uncertainty associated with outlooks for economy, job market and inflation was 'high'.

- Participants saw upside risks for inflation, including china's economic reopening and Russia's war in Ukraine.

- Participants said risks to economic outlook weighted to downside.

- A number of participants said drawn-out US debt limit process could pose 'significant risks' to the financial system, economy.

- Participants said job market 'very tight,' labor demand outstripping available supply.

- Participants said continued tight job market would contribute upward pressure to inflation.

- Participants said inflation in last three months has eased, but they need to see more progress.

- Some participants saw elevated prospect of recession in 2023.

Meanwhile, analysts at Rabobank noting the recent strength of recent economic data, explained that current remarks of Fed officials may be more forthcoming in terms of providing clues for the next FOMC meeting on March 23, than the February 1 minutes.

In this regard, St. Louis Fed President James Bullard reinforced the hawkish sentiment ahead of the Fed minutes on Wednesday. Bullard said that the Fed has to get inflation on to a sustainable path down toward its 2% goal this year or risk a repeat of the 1970s, when interest rates had to be repeatedly ratcheted up. '

Looking ahead for the rest of the week, in terms of forthcoming data releases, the market consensus is pointing to strength in the personal consumption and spending data signalling robust domestic demand. ''The Fed’s favoured inflation measure, the PCE deflator, is also due for release this week,'' analysts at Rabobank explained.

''The market is expecting the January headline data to remain at 5.0% y/y, in line with the previous month. This would strengthen concerns that the downtrend in inflationary indicators may have stalled. Data in line with market expectations would thus add further weight to the view that the Fed will have to work harder to push inflation back to its target level. Currently implied market rates are pointing to a peak in Fed funds close to 5.33%.''

Gold technical analysis

Gold price's weekly chart shows support near the 78.6% Fibonacci retracement level at $1,807. The market is on the backside of the prior bullish trend and on the front side of the bear trend as illustrated above, thus offering a bearish bias to the said and shown support structure.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.