- Analytics

- News and Tools

- Market News

- US Dollar gives up some ground ahead of FOMC minutes, but bulls remain in play

US Dollar gives up some ground ahead of FOMC minutes, but bulls remain in play

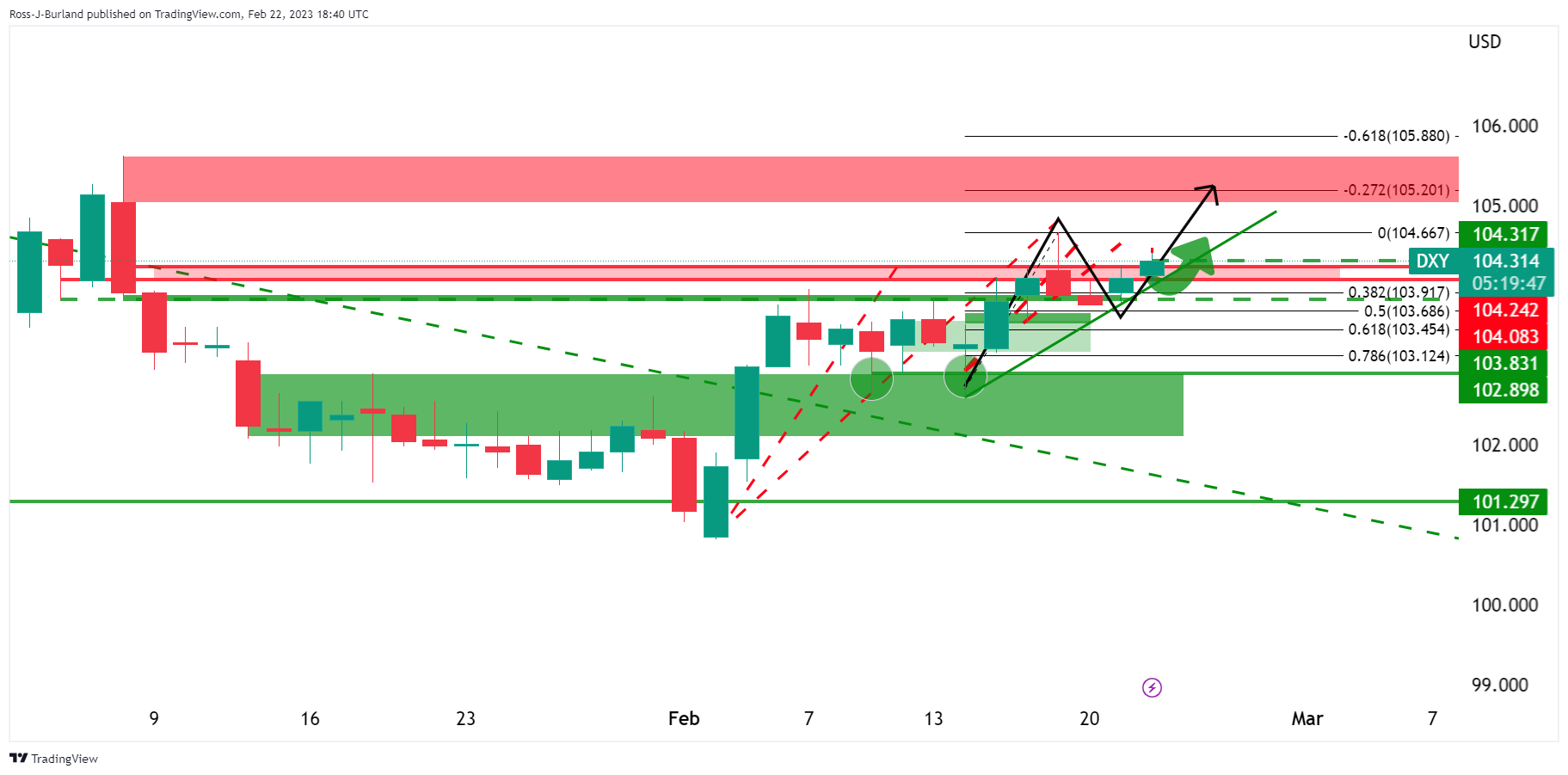

- DXY is on the move to the upside ahead of the FOMC minutes.

- Supported by a 38.2% Fibonacci on the daily chart, the 105.20s territories are eyed.

The US Dollar moved up on Wednesday as measured by the DXY index vs. a basket of currencies as traders get set for the Federal Open Market Committee minutes following a slew of strong economic data of late. At the time of writing, DXY is trading at 104.30 and it has ranged between a low of 104.006 and a high of 104.415 so far.

The FOMC February meeting minutes will provide further insights into the near-term path for policy but the Fed funds futures traders are now pricing the fed funds rate to reach 5.35% in July, and remain above 5% all year. The Fed's target range stands at 4.5% to 4.75%, having climbed strongly from 0% to 0.25% in March 2022.

The US data of late has eased recession fears but it has also reinforced worries that the Fed needs to stay higher for longer in terms of its interest rate hiking path. On top of a slew of past data, the latest survey data released on Tuesday showed US business activity unexpectedly rebounded in February to reach its highest in eight months and St. Louis Fed President James Bullard reinforced the hawkish sentiment ahead of the Fed minutes on Wednesday.

Bullard said that the Fed has to get inflation on to a sustainable path down toward its 2% goal this year or risk a repeat of the 1970s, when interest rates had to be repeatedly ratcheted up. ''Given the strength of recent economic data, current remarks of Fed officials may be more forthcoming in terms of providing clues for the next FOMC meeting on March 23, than the February 1 minutes,'' analysts at Rabobank said.

''In terms of forthcoming data releases, the market consensus is pointing to strength in the personal consumption and spending data later in the week signalling robust domestic demand. The Fed’s favoured inflation measure, the PCE deflator, is also due for release this week,'' the analysts explained further.

''The market is expecting the January headline data to remain at 5.0% YoY, in line with the previous month. This would strengthen concerns that the downtrend in inflationary indicators may have stalled. Data in line with market expectations would thus add further weight to the view that the Fed will have to work harder to push inflation back to its target level.''

US Dollar index technical analysis

The index has been climbing along trendline support and has moved up from the correction into the 38.2% Fibonacci on the daily chart. A continuation through current resistance opens risk to test the 105.20s territories.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.