- Analytics

- News and Tools

- Market News

- USD/CAD is subdued around 1.3530s as traders are in wait-and-see mode

USD/CAD is subdued around 1.3530s as traders are in wait-and-see mode

- USD/CAD collides with solid resistance and retreats to its 1.3520s lows.

- Traders are bracing for additional forward guidance from the US Federal Reserve.

- If the BoC pauses, the USD/CAD will extend its gains.

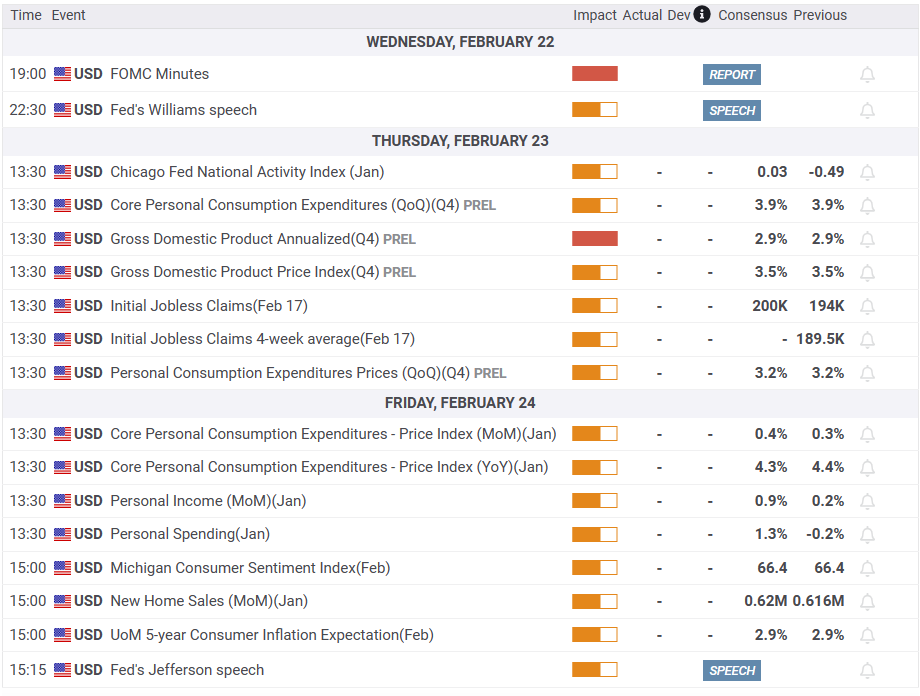

The USD/CAD is barely unchanged ahead of the FOMC’s minutes release, though slightly tilted to the downside, with losses of 0.05%. Traders worried that the Fed would raise rates further than expected, dampening the market mood during the last couple of weeks. At the time of typing, the USD/CAD is trading at around 1.3530s.

USD/CAD turns negative, drops 0.06%, before FOMC’s minutes release

Wall Street’s bulls are taking a respite before the Fed releases its minutes. US economic data throughout the last two weeks justified the need for further tightening, meaning a higher USD/CAD exchange rate. Inflation data in the US slowed down, except for the monthly readings of the Producer Price Index (PPI), which came above estimates and the prior’s month data. In addition, a Fed regional manufacturing index reported on its survey that prices jumped the most in 10 months, exacerbating a reassessment of how high the Fed will go. Therefore, worried investors turned to safety and bought the US Dollar (USD).

Consequently, the US 10-year Treasury bond yield spiked 40 basis points (bps) and underpinned the greenback.

Aside from this, the Canadian side revealed that inflation cooled down, a sign for the Bank of Canada (BoC) to pause its hiking cycle. Meanwhile, New Home Prices in Canada dived 0.2% in January from December data from Statistics Canada showed on Wednesday, but the annual rate slowed to 2.7%.

Hence, the USD/CAD broke above 1.3500 after trading sideways for almost two months. Nevertheless, the major faced a four-month-old resistance trendline and was rejected after hitting multi-week highs at 1.3560 and dropping toward 1.3520s.

What to watch?

USD/CAD Key technical levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.