- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD stills firm at around the high $1,830s ahead of the FOMC minutes

Gold Price Forecast: XAU/USD stills firm at around the high $1,830s ahead of the FOMC minutes

- Gold remains firm at around $1,835, with traders awaiting Fed minutes.

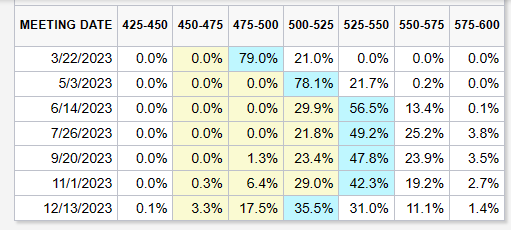

- Money market futures began to price in interest rates in the US in the 5.25%-5.50%.

- Gold Price Analysis: Range-bound, trapped within the 50/100-DMA.

Gold price recovers some ground, though it remains almost flat compared to its opening price. However, it clings to minimal gains before the release of the US Federal Reserve’s (Fed) last monetary policy meeting minutes. At the time of writing, the XAU/USD is trading at $1,835.10 a troy ounce.

Financial markets await the FOMC’s last meeting minutes

US equities bounced at the Wall Street open, but traders remained cautious amidst growing speculations that the Fed would turn more hawkish than expected. Money market futures are projecting 75 bps of additional tightening, as seen in the CME Fed Watch Tool. Nevertheless, US Dollar (USD) bulls are taking a respite, with the US Dollar Index (DXY) edging lower by 0.07% at 104.088, undermined by US bond yields, mainly the 10-year benchmark note rate down five basis points (bps), at 3.900%.

Source: CME FedWatch Tool

The economy in the United States is solid, justifying Fed official’s hawkish rhetoric

Tuesday’s data release, particularly S&P Global PMI for February, showed that business conditions in the United States (US) are improving, with both the Services and Composite PMIs exceeding estimates and expanding territory. The outlier was the Manufacturing Index, which improved but stood in a contractionary area.

US PMIs data summed up to last week’s inflation and justifies the need for additional rate hikes from the Fed, whose officials led by the Cleveland and St. Louis Fed Presidents Loretta Mester and James Bullard, stated that there was compelling evidence to raise rates by 50 bps on February’s one meeting.

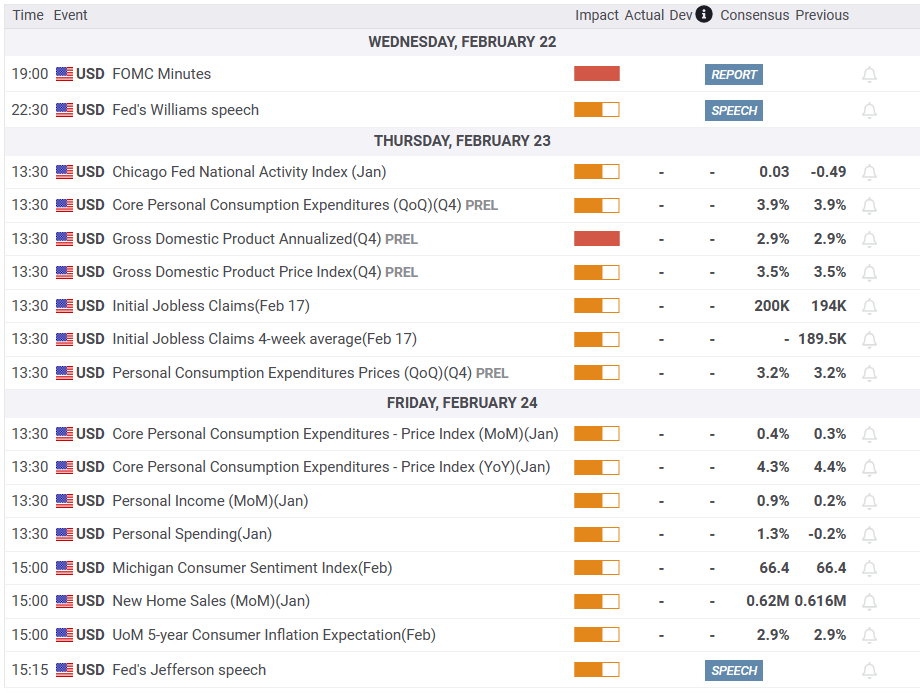

What to watch?

Gold technical analysis

XAU/USD’s daily chart suggests the yellow metal consolidated after hitting a daily high of $1,846.09. Nevertheless, failure to pierce the weekly high at $1,847.45 could pave the way for further downside, but the release of the Fed’s minutes could rock the boat and trigger upward/downward movements in the yellow metal. Oscillators aim downward, namely the Relative Strength Index (RSI) and the Rate of Change (RoC).

Therefore, the XAU/USD first support would be the 100-day Exponential Moving Average (EMA) at $1,820.59, followed the last week’s low of $1,818.97. A breach of the latter will expose the 200-day EMA at the $1,803.04 mark.

As an alternate scenario, a break above $1,847.45 and the XAU/USD’s next target would be $1,850, immediately followed by the 50-day Exponential Moving Average (EMA) at $1,852.50 and the 20-day EMA at $1,862.52.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.