- Analytics

- News and Tools

- Market News

- NZD/USD Price Analysis: Brace for volatility contraction ahead of RBNZ policy

NZD/USD Price Analysis: Brace for volatility contraction ahead of RBNZ policy

- NZD/USD is juggling ahead of the interest rate decision by the RBNZ.

- The Kiwi asset has sensed a decent buying interest after testing the horizontal support plotted from 0.6200.

- RBNZ's Shadow Board recommended a 50bps OCR increase citing strong inflationary pressures.

The NZD/USD pair is juggling below the immediate resistance of 0.6260 as investors are awaiting the interest rate decision from the Reserve Bank OF New Zealand (RBNZ) for further impetus. The New Zealand Consumer Price Index (CPI) has not delivered any sign, which could convey that inflationary pressures are peaked now. Therefore, a continuation of an interest rate hike is expected from RBNZ Governor Adrian Orr.

Meanwhile, a promise of a cyclone relief package of NZ$300 million ($187.08 million) by NZ Prime Minister (PM) Chris Hipkins has triggered fresh concerns about an increment in inflation projections. The release of the helicopter money might propel overall consumer spending and eventually the price pressures. On Monday, RBNZ's Shadow Board recommended a 50bps OCR increase citing strong inflationary pressures.

The US Dollar Index (DXY) is auctioning above 103.50, however, higher volatility cannot be ruled out as United States markets will open after a holiday-truncated weekend.

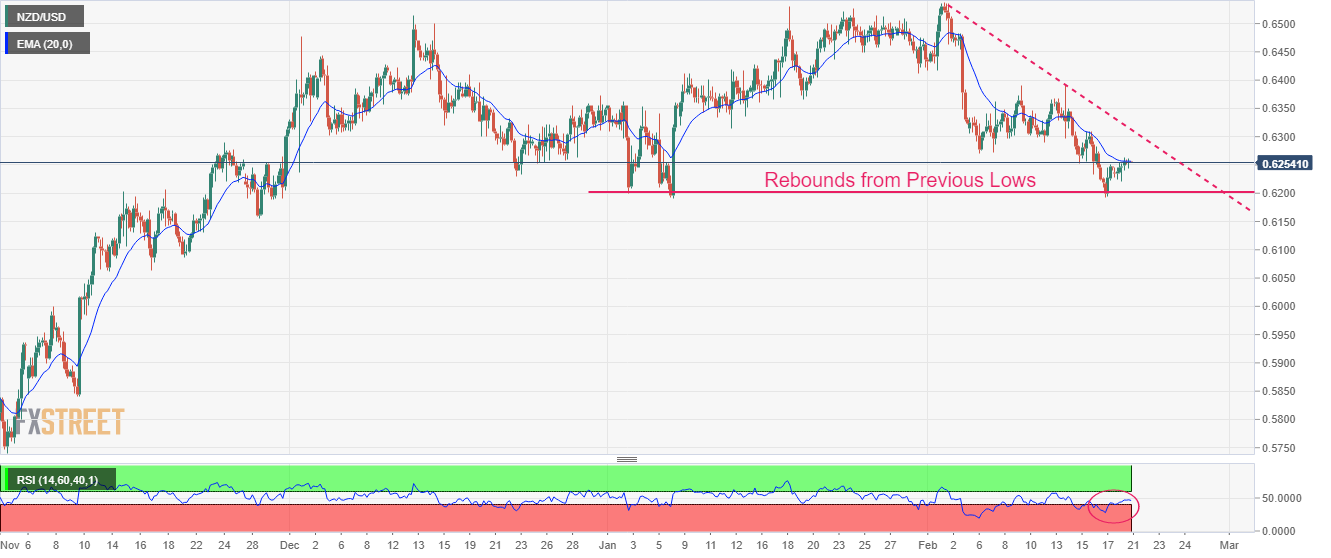

NZD/USD has sensed a decent buying interest after testing the horizontal support plotted from January 3 low around 0.6200 on a four-hour scale. This indicates a Double Bottom chart formation that results in a bullish reversal. The Kiwi asset is deploying efforts in surpassing the 20-period Exponential Moving Average (EMA) at 0.6258.

Meanwhile, the Relative Strength Index (RSI) (14) has managed to avoid the bearish range of 20.00-40.00. The RSI (14) has climbed back inside the 40.00-60.00 range and is awaiting a fresh trigger for a decisive move.

For further upside, the Kiwi asset needs to surpass January 8 low at 0.6272, which will drive the asset towards January 9 low at 0.6320, followed by February 7 high at 0.6363.

Alternatively, a breakdown of January 6 low at 0.6193 will drag the asset toward November 28 low at 0.6155. A slippage below the latter will expose the asset for more downside toward the round-level support at 0.6100.

NZD/USD four-hour chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.