- Analytics

- News and Tools

- Market News

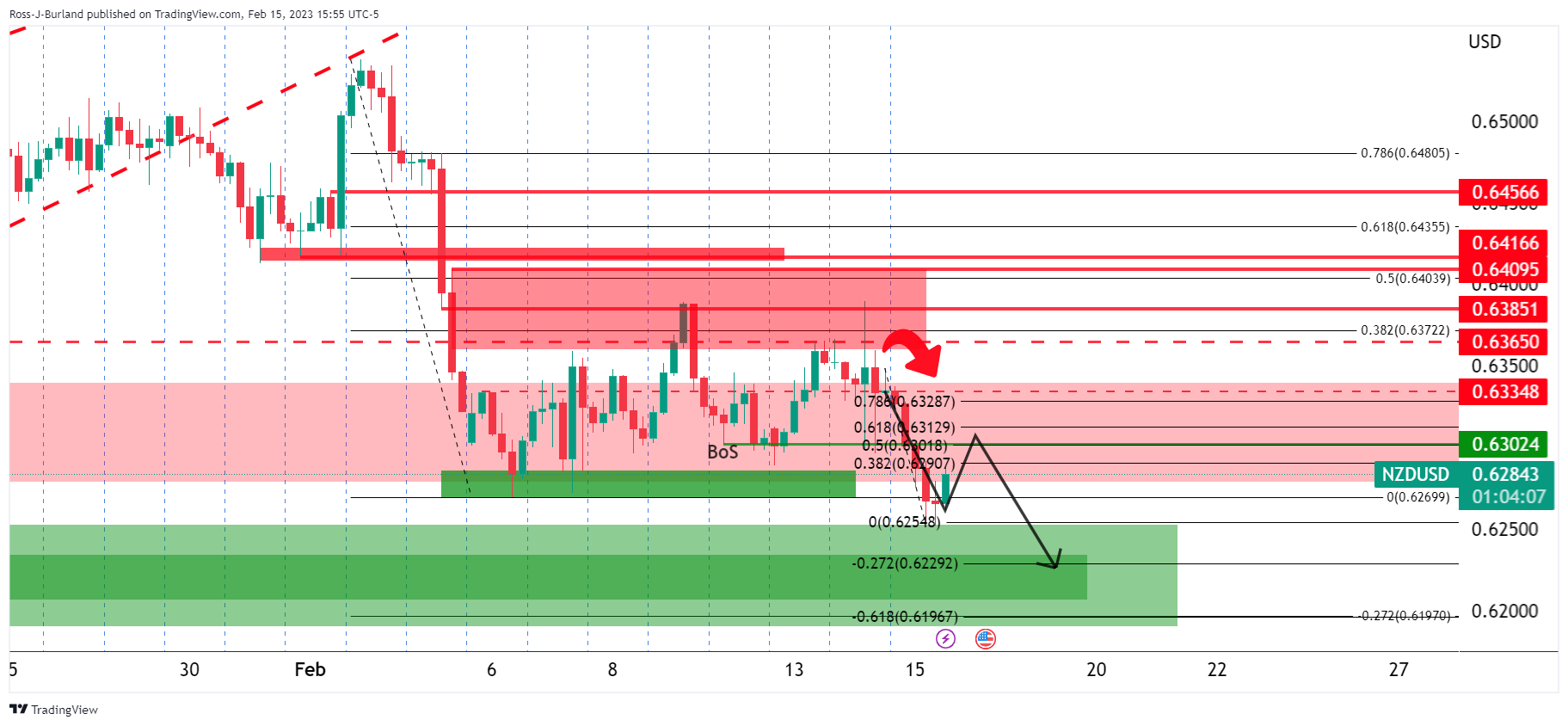

- NZD/USD bears are waiting to move in to keep pressures on below 0.6300

NZD/USD bears are waiting to move in to keep pressures on below 0.6300

- NZD/USD bears target the low 0.62s following the break of structure.

- A bullish correction is in process currently, but if bears commit below 0.6300, then this correlates with near a 61.8% ratio.

NZD/USD is down on the day as we enter the end of the North American session as the markets tussle with the prospects of higher for longer inflation in the United States and watch the Fed pivot disappear over the horizon.

At the time of writing, NZD/USD is trading at 0.6280 and is down some 0.8% on the day after falling from a high of 0.6337 to a low of 0.6252. The US Dollar, as measured in the DXY index, broke to the topside in the wake of strong US Retail Sales on the back of the prior day's Consumer Price index. Both reports saw bond yields there ratchet up another notch which has played into the hands of risk-off assets and the greenback.

Analysts at ANZ Bank said, ''regular readers will be aware that we have for some time been worried that the USD might re-firm if interest rate expectations there started rising and expectations for late-2023 rate cuts were to fade, and that’s what seem to be playing out.''

''But at the same time, unlike last year’s USD surge, this time we don’t have other central banks going slow – with the European Central Bank and Reserve Bank of New Zealand both on track to hike by 50bp at their next meetings,'' the analyst explained further. ''That, and valuations, may cap (but perhaps not stop) USD upside, but counting on that could be risky.''

NZD/USD technical analysis

Meanwhile, there are seeing prospects of a move lower.

While below resistance, the odds are for a move into the low 0.62s following the break of structure. a correction is in process currently, but if bears commit, say below 0.6300, then a sell-off from the region of a 50%, 61.8% ratio could be on the cards for the day ahead.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.