- Analytics

- News and Tools

- Market News

- Gold Price Analysis: XAU/USD reluctant to go down on the US data big beat

Gold Price Analysis: XAU/USD reluctant to go down on the US data big beat

- Gold price was initially reluctant to move lower on big surprise in US retail Sales.

- Gold price bears are slowly emerging again as the dust settles.

The United States Retail sales jump 3% in January, smashing expectations despite an inflation increase that might have otherwise kept consumers' hands in their pockets. Gold price has so far held in familiar pre-data ranges around $1,835.

The data arrived as follows:

- US Retail Sales Advance (MoM) Jan: 3.0% (est 2.0%; prev -1.1%).

- US Retail Sales Ex Auto (MoM) Jan: 2.3% (est 0.9%; prev -1.1%).

- US Retail Sales Ex Auto And Gas Jan: 2.6% (est 0.9%; prev -0.7%).

- US Retail Sales Control Group Jan: 1.7% (est 1.0%; prev -0.7%).

The US Dollar index strengthened to almost 104 on Wednesday, the highest in nearly five weeks after a stronger-than-expected US CPI report bolstered expectations the Federal Reserve will need to keep pushing interest rates higher to bring down inflation. It moved to below 104 into the New York session as traders got set for the Retail Sales data which kept Gold bulls in the game ahead of the data.

On Tuesday, the annual inflation rate in the US slowed slightly to 6.4% in January from 6.5% in December, the lowest since October 2021 but above market expectations of 6.2%. The latest Fed commentary also showed that policymakers largely backed more rate increases, fueling a bid in the greenback after what was an indecisive show from markets around the inflation data initially.

With the latest data showing that retail sales rebounded more than expected in January, and rose the most since March 2021, highlighting the strength of the economy, the US Dollar has still not been able to take off which is giving the Gold bulls a lifeline currently:

Gold technical analysis

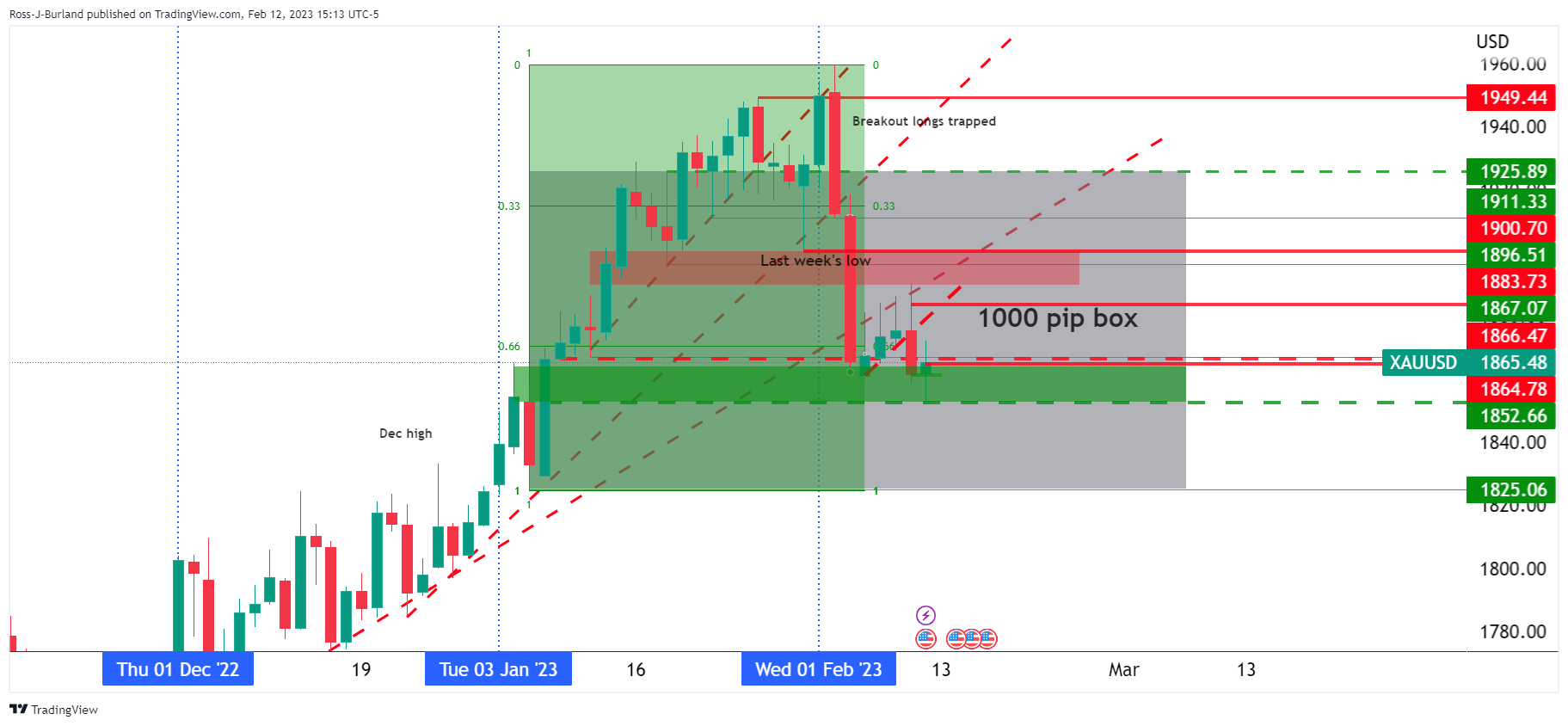

From a daily perspective, the price would be expected to fulfil a 1000 pip move to $1,825 whereby traders were trapped long at the start of the month. In prior analysis, it was stated that we were in the upper third of the 2023 range and on the backside of the first trendline that is broken and acting as a counter-trendline. A break of $ $1,925 was expected to open the risk of a move to test $1,896 and then $1,867 as the top of the lower third of the range that guarded a 1000 pip box low of $1,825:

The above chart was analysis drawn at the end of January and below is where we are up to date ahead of the week commencing 12 February open:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.