- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD rebound appears elusive below $1,880 – Confluence Detector

Gold Price Forecast: XAU/USD rebound appears elusive below $1,880 – Confluence Detector

- Gold price picks up bids to extend the bounce off six-week low.

- XAU/USD grinds higher as hawkish Fed bets fail to gain acceptance amid softer US inflation.

- Multiple hurdles stand tall to challenge XAU/USD run-up, bears need validation from $1,850.

- Second-tier US data, central bank comments eyed for more directions.

Gold price (XAU/USD) renews its intraday high near $1,860, following a bounce off a 1.5-month low, as market players react to the softer US inflation data during early Wednesday. That said, the yellow metal witnessed a volatile Tuesday but ended up with 0.04% intraday gains as the Federal Reserve (Fed) officials reiterated their hawkish bias despite the lowest US Consumer Price Index (CPI) increase since 2021. Also likely to have probed the Gold buyers previously were the upbeat US Treasury bond yields and the rebound in the US Dollar.

However, a retreat in the benchmark US bond coupons from the monthly highs joins fresh doubts on the hawkish Fed bets to underpin the latest Gold price recovery. Moving on, US Retail Sales and Industrial Production details for January, as well as NY Empire State Manufacturing Index for February and Fed talks, should be watched closely for clear directions.

Also read: Gold Price Forecast: XAU/USD eyes further downside on hawkish Federal Reserve talks

Gold Price: Key levels to watch

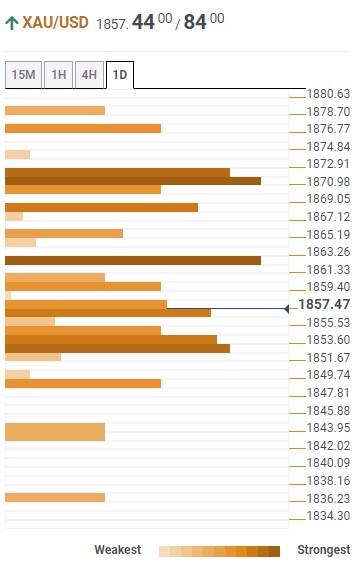

The Technical Confluence Detector shows that the Gold price appears stuck inside a jungle of technical levels on both sides, despite the latest recovery moves from the immediate key support surrounding $1,851, which includes Pivot Point one month S1, previously weekly low and four-hour bottom.

That said, Fibonacci 23.6% on one-week joins the 5-DMA to guard the XAU/USD’s immediate upside near $1,863.

Following that, Fibonacci 61.8% on one month joins Pivot Point one-day R1 and 50-Hour Moving Average (HMA) to highlight $1,872 as the key upside hurdle.

It’s worth observing that the Fibonacci 61.8% on weekly, close to $1,877, acts as the last defense of the Gold bears.

On the flip side, a break below the $1,851 support will need validation from the $1,848 mark comprising the Pivot Point one-week S1 to validate the Gold price south-run.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.