- Analytics

- News and Tools

- Market News

- EUR/USD climbs to fresh tops past 1.0800 on US CPI

EUR/USD climbs to fresh tops past 1.0800 on US CPI

- EUR/USD advances further north of the 1.0800 mark.

- Flash EMU Q4 GDP came in at 1.9% YoY, 0.1% QoQ.

- US inflation figures surprised to the upside in January.

EUR/USD picks up extra pace and trespasses the key barrier at 1.0800 the figure on Tuesday, or multi-session highs.

EUR/USD firmer post-US data

EUR/USD extends the uptick just beyond the 1.0800 mark in the wake of the release of US inflation figures for the month of January.

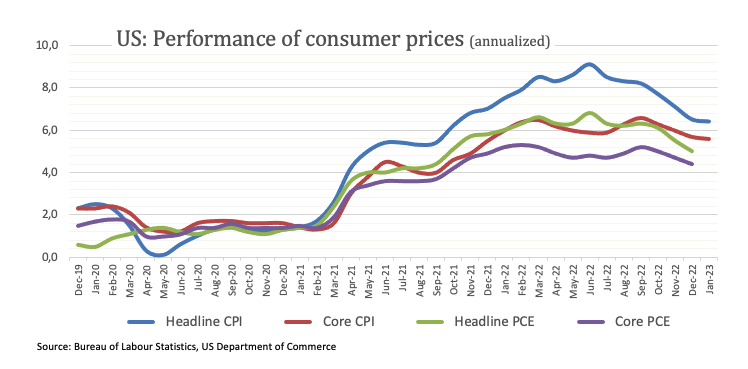

Indeed, the pair saw its ongoing weekly rebound gather extra impulse after US headline CPI rose at an annualized 6.4% in January and 5.6% when it comes to the Core CPI. The prints, albeit higher than previously estimated, keep showing a loss of momentum in consumer prices.

Earlier on Tuesday, flash EMU Q4 GDP saw the economy still expected to expand 1.9% YoY in the October-December period and 0.1% inter-quarter.

What to look for around EUR

EUR/USD seems to have embarked in a decent bounce following Monday’s drop to the 1.0650 region, although the resistance line above 1.0800 continues to cap occasional bullish attempts for the time being.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the central bank delivered a 50 bps at its meeting last week.

Back to the euro area, recession concerns now appear to have dwindled, which at the same time remain an important driver sustaining the ongoing recovery in the single currency as well as the hawkish narrative from the ECB.

Key events in the euro area this week: ECOFIN Meeting, EMU Flash Q4 GDP (Tuesday) – EMU Balance of Trade, Industrial Production, ECB Lagarde (Wednesday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is gaining 0.46% at 1.0767 and is expected to meet the next up barrier at 1.0804 (weekly high February 14) seconded by 1.1032 (2023 high February 2) and finally 1.1100 (round level). On the flip side, a drop below 1.0655 (weekly low February 13) would target 1.0481 (2023 low January 6) en route to 1.0323 (200-day SMA).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.