- Analytics

- News and Tools

- Market News

- GBP/USD Price Analysis: A Round 1 knockout victory for the bulls ahead of US CPI

GBP/USD Price Analysis: A Round 1 knockout victory for the bulls ahead of US CPI

- GBP/USD short squeeze takes out the weaker hands start of the week.

- GBP/USD downside thesis on the daily chart is still valid around the US CPI event.

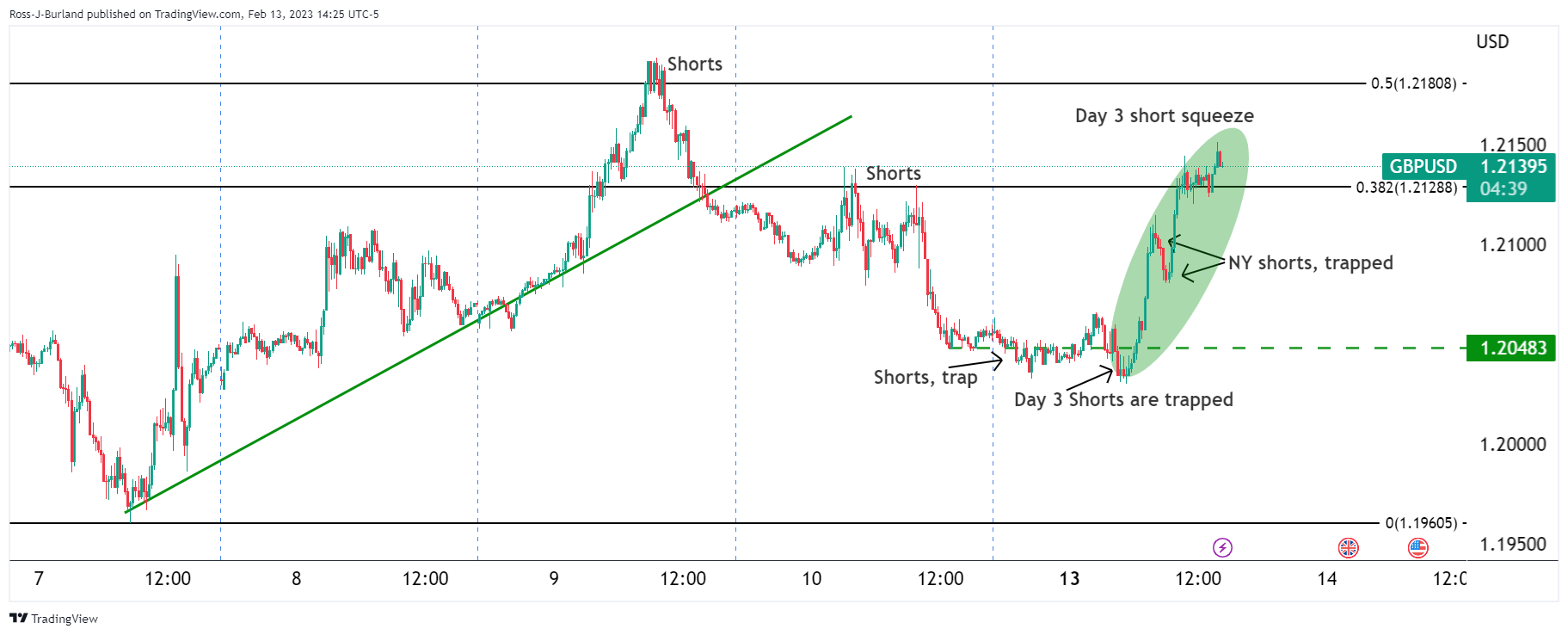

GBP/USD has been on a tear as it pulls away from the start of the day's trapped shorts that were seeking a break below 1.2050 for the initial balance for the week. At the time of writing, GBP/USD is trading at 1.2140 and up 0.8% on the day.

The following is an illustration of the price action and thesis for a long in the New York session ahead of this week's critical US Consumer Price Index and Retail Sales data the following day.

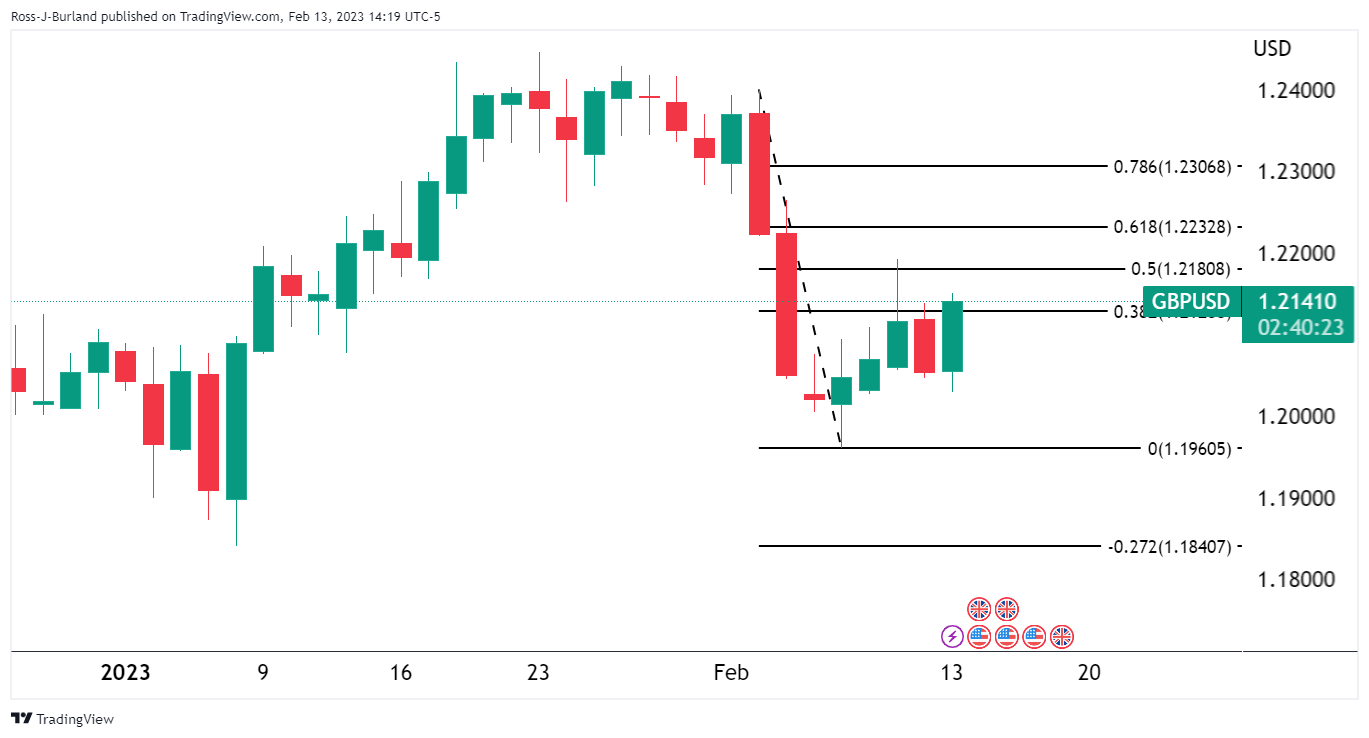

GBP/USD daily chart

at first glance prior to the day, the market was appearing to be set up for a downside continuation given the correction to the 50% mean reversion and strong rejection from the bears. However...

The bulls put on a short squeeze as illustrated above.

GBP/USD M15 chart

As illustrated, the market was overwhelmed with sellers and the bulls took advantage of this to start the week. On Thursday, an influx of supply came on and Friday had more shorts coming into the market. On Monday, the bears attempted to get on board with what appeared to be a downside extension and breakout opportunity below 1.2050. However, there was a break of structure to the long side as follows:

GBP/USD bears still in play

Nevertheless, the downside thesis on the daily chart is still valid around the US CPI event with the price still below the 1.2200 psychological level and a 50% mean reversion resistance that has a confluence with prior support looking left:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.