- Analytics

- News and Tools

- Market News

- EUR/USD stares 1.0700 as German Inflation softens and Fed’s higher rates fears soar

EUR/USD stares 1.0700 as German Inflation softens and Fed’s higher rates fears soar

- EUR/USD is expected to deliver more downside to near 1.0700 amid the risk-aversion theme.

- The USD Index has got strength as investors are worried about higher interest rates by the Federal Reserve.

- European Central Bank is still favoring a continuation of a bumper policy tightening spell despite softened German Inflation.

- EUR/USD is struggling to find direction beyond the 50% and 61.8% Fibo retracements gamut.

EUR/USD has dropped firmly to near 1.0720 in the early European session. The major currency pair is expected to deliver more downside to near the round-level support of 1.0700 as Germany’s Harmonized Index of Consumer Prices (HICP) has shown a surprise decline amid falling energy prices and rising worries about ‘higher and longer’ interest rates by the Federal Reserve (Fed).

The Euro is facing immense pressure as the risk-off mood has trimmed the appeal for risk-perceived assets. The risk-aversion theme is supporting the US Dollar Index (DXY), which has pushed it above the 103.00 resistance. The USD Index is aiming to shift its business above 103.00. The alpha provided on the 10-year US Treasury yields is still holding above 3.66%.

Meanwhile, S&P500 futures are facing immense pressure as the street is expecting that the United States recession imminent amid rising interest rates.

Brace for a surprise rise in US Inflation

The spotlight has entirely shifted to the United States Consumer Price Index (CPI) data, which will release on Tuesday. As per the consensus, the headline inflation could soften to 5.8% on an annual basis vs. the prior release of 6.5%. And, the core inflation that excludes the impact of oil and food prices is seen lower at 5.3% against the former release of 5.8%.

Observing the commentary from Richmond Fed President Thomas Barkin on inflation and the stronger-than-projected employment report released in January, it is likely that the price index could surprise the street ahead.

Federal Reserve Barkin argued that it would make sense for the Federal Reserve to steer "more deliberately" from here due to lagged effects of policy, as reported by Reuters. He further added that "While average inflation has peaked, the decline has been distorted by a few goods, the median has stayed high."

A strong labor market in the United States is expected to propel the employment cost index as the shortage of labor will be augmented by higher employment proposals from firms. This could trigger a rebound in the inflation projections as households with higher earnings in possession can lead to higher consumer spending.

Higher US Inflation could fade downside bias for US Dollar

On a broader note, the US Dollar Index has remained in a downtrend in the past three months after the Federal Reserve signaled a deceleration in the policy tightening pace. Inflationary pressures have slowed down consecutively in the past three months and the USD Index has followed the footprints effectively. And, now a halt in inflation’s downside trend could vanish downside bias for the mighty US Dollar.

Economists at MUFG expect the greenback to be underpinned by a strong inflation report. The rationale behind an improvement in the appeal for the US Dollar is the rise in used car prices at the start of this year. Bloomberg reported that average used-vehicle prices rose 2.5% in January according to data from Manheim.

ECB bets still solid despite German inflation softens

Lately, the Eurozone inflation rate has shown a meaningful decline after easing energy prices and higher interest rates by the European Central Bank (ECB). The nation, Germany, that carries out the largest magnitude of activities in the Eurozone revealed a decline in the Harmonized Index of Consumer Prices (HICP) to 9.2% vs. the consensus of 10.0% and the former release of 9.6%. The inflationary pressures have surprisingly slowed, however, the odds of a continuation of bumper interest rate hikes by the European Central Bank are still solid. The inflation rate is still hovering at extremely elevated levels, which needs a monetary policy sufficiently restrictive to tame inflation. Therefore, the room for a continuation of interest rate hikes by European Central Bank President Christine Lagarde is open.

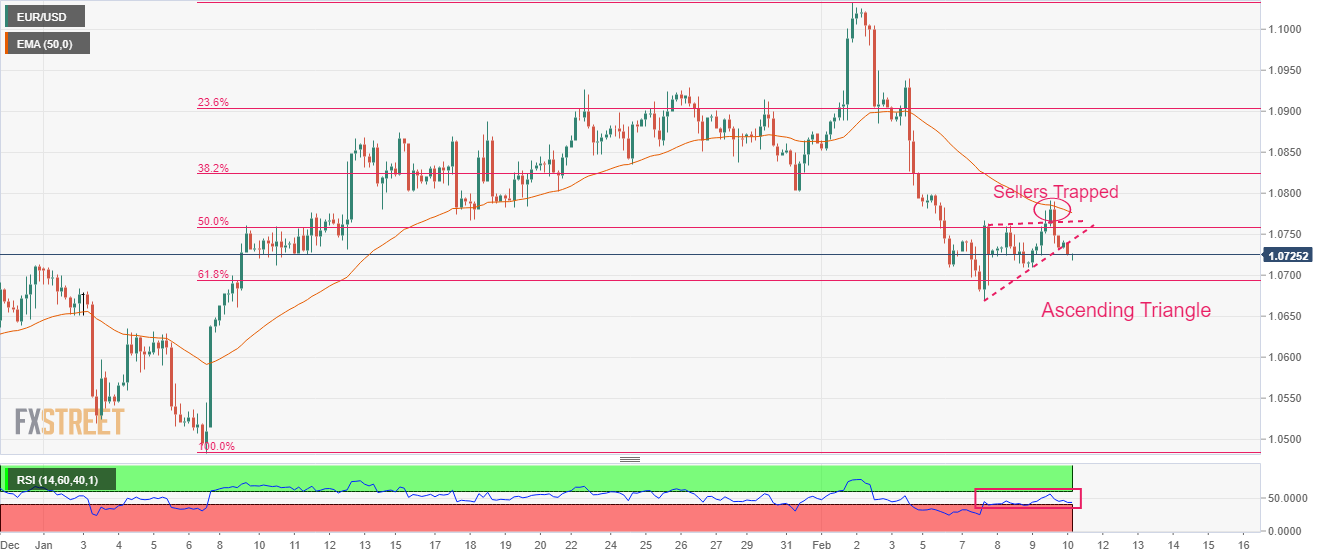

EUR/USD technical outlook

EUR/USD is still auctioning between the 50% and 61.8% Fibonacci retracements (placed from January 6 low at 1.0483 to February 1 high at 1.1033) at 1.0760 and 1.0694 respectively. The shared currency pair attempted to deliver a breakout of an Ascending triangle chart pattern on Thursday, however, investors were trapped as the breakout move failed to find follow-up buying and drifted back inside the woods.

The 50-period Exponential Moving Average (EMA) at 1.0778 has acted as major barricade for the Euro.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the 40.00-60.00. A breakdown into the bearish range of 20.00-40.00 will activate the downside momentum.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.