- Analytics

- News and Tools

- Market News

- USD/JPY grinds sideways with a bearish bias if below 131.80

USD/JPY grinds sideways with a bearish bias if below 131.80

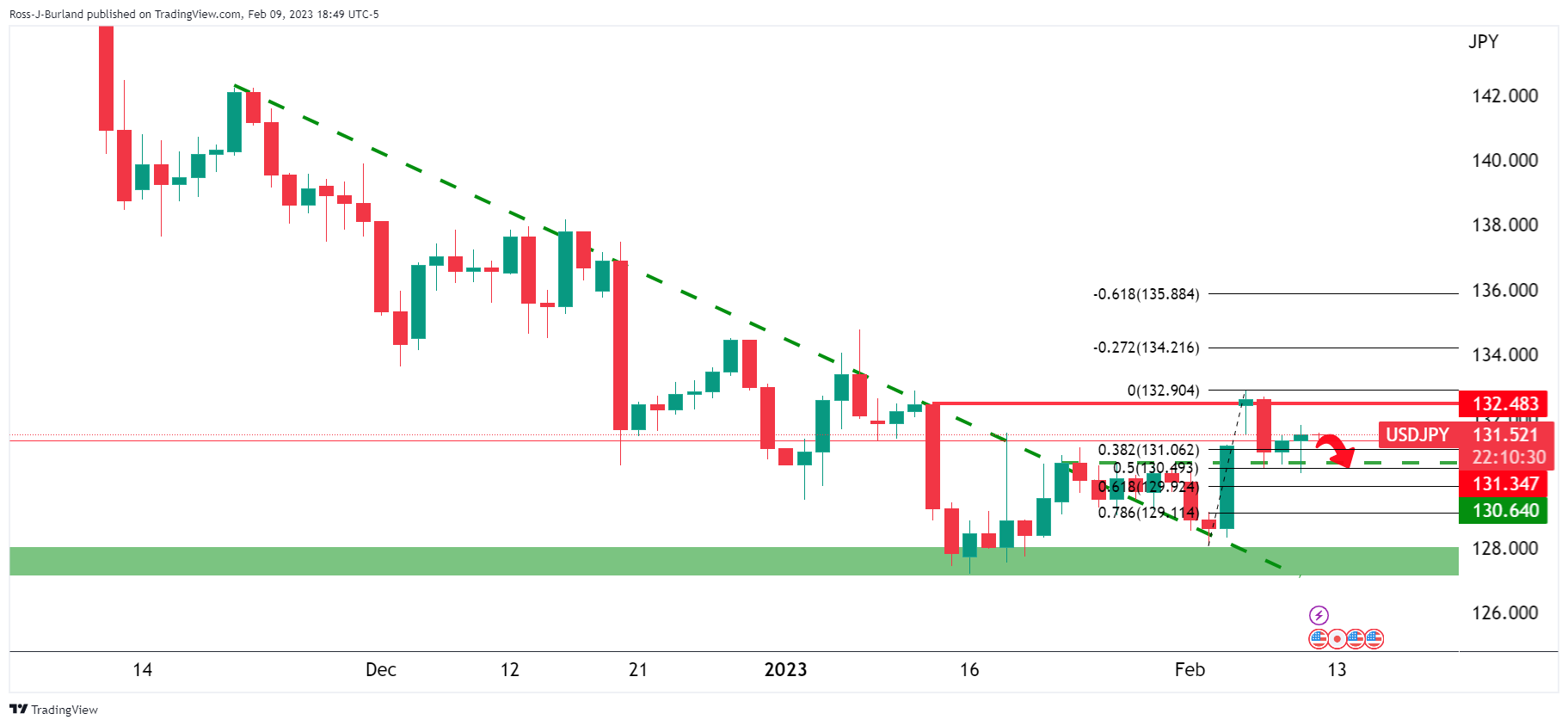

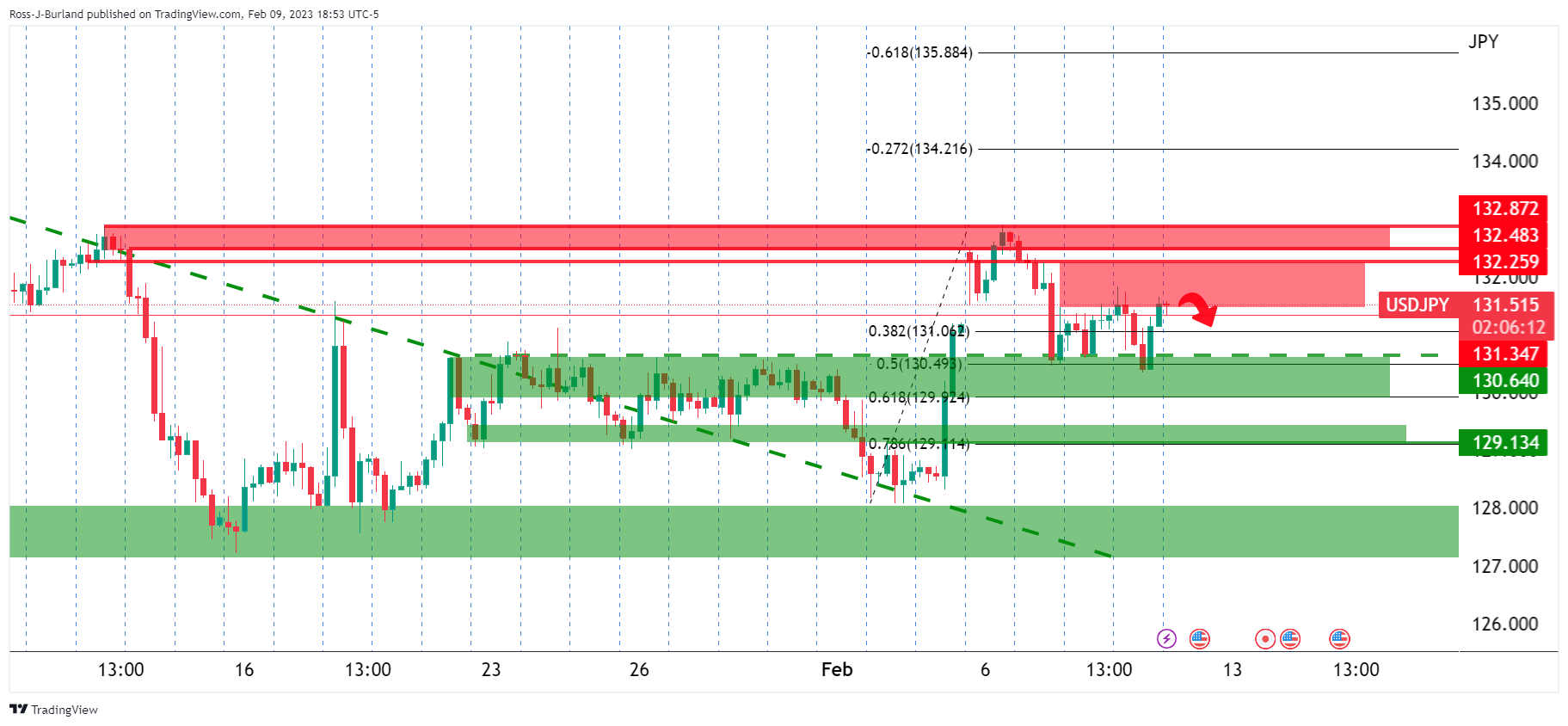

- USD/JPY has prospects of a move 131.00 while below 131.80.

- On the other hand, if above 132.00, there could be further strength in London with 132.20/50 eyed.

USD/JPY is travelling in a sideways fashion between 131.34 and 131.57 but is leaning bearish in a chop below the highs of February as markets look ahead to the next catalyst for the US Dollar.

The greenback came to life in the US cash open on Wall Street and US equities tanked. This was despite the gap between two- and 10-year yields staying inverted at -82.3 bps, after steepening to -87.5 bps earlier in the session. The two-year rose 3.4 basis points to 4.488% after hitting an almost 10-week high of 4.514%.

However, markets are coming to some sense that the show is not over getting inflation down to the Fed's 2% target could easily take more than a year, something that Federal Reserve officials have continued to warn in various speeches since Fed's chairman Jerrome Powell mentioned that disinflation was started to be a theme in economic data.

A higher-than-expected US Jobless claims number did not keep the greenback down for long as the prospects of a tight labour market keep nervous investors on the sidelines waiting for next week's Consumer Price Index.

State unemployment benefits rose 13,000 to a seasonally adjusted 196,000 for the week ended Feb. 4, data showed. However, this is still well below the 250k a year prior. Economists polled by Reuters had forecast 190,000 claims for the latest week.

Before next week's data, we will get Friday's slew of numbers including the University of Michigan Consumer Sentiment Survey that could move the needle in markets that are more than ever data-dependent right now.

Meanwhile, next week's CPI is looming and is expected to show headline inflation for January at 0.5% MoM and core inflation running at 0.3% MoM. ''If these numbers are achieved this would result in an easing of core inflation from 5.7% to 5.4% YoY and headline inflation from 6.6% to 6.2%,'' the analysts at ANZ Bank explained, noting also Retail Sales and manufacturing data er due.

''If we continue to see strength in these data, then it will be very difficult for Federal Reserve policymakers to signal anything other than a further tightening of monetary policy.''

USD/JPY technical analysis

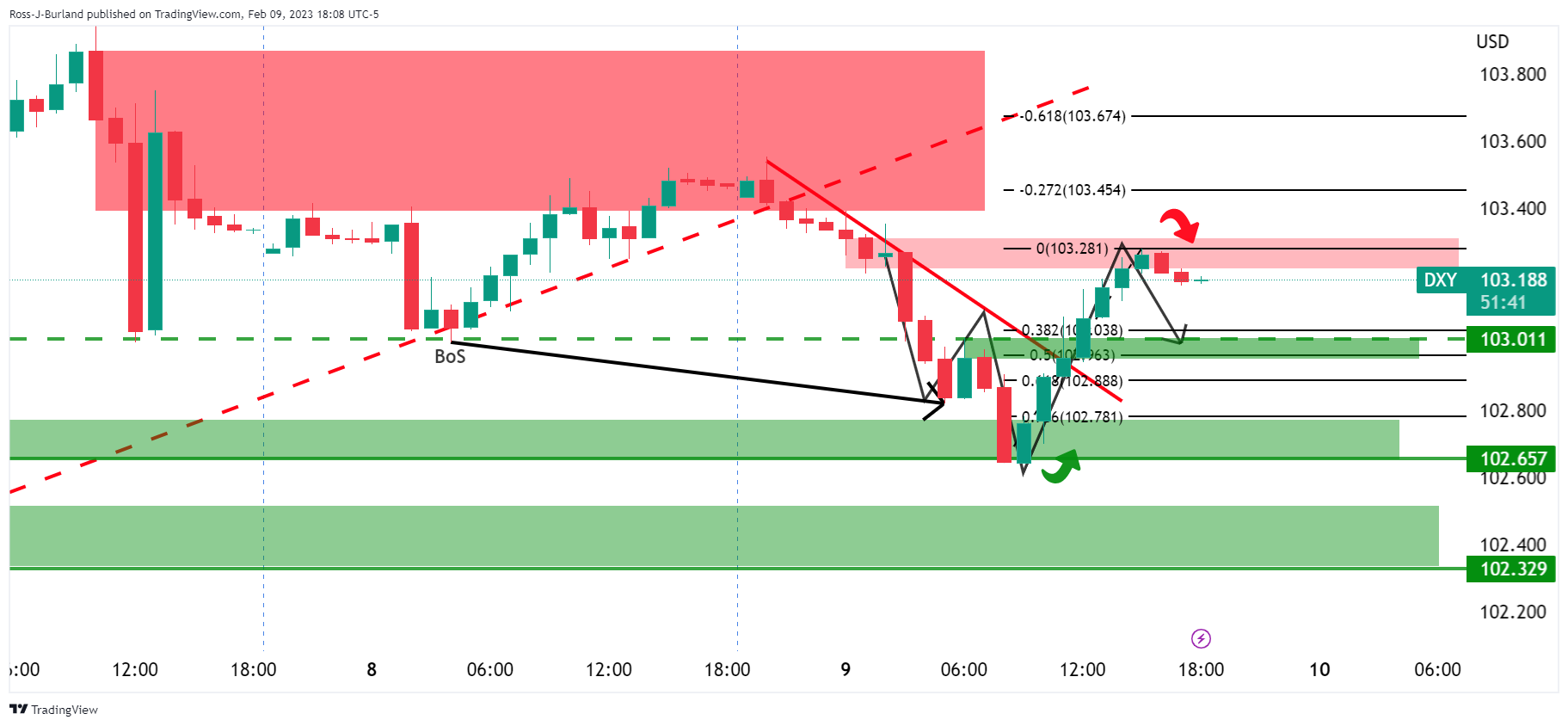

The DXY is a W-formation on the charts which is a reversion pattern that would be expected to pull in the price for the near term. this leaves the outlook temporarily, at least, for USD/JPY as follows:

The price has bust through a structure but there is a lack of conviction while below prior resistance for the week, so far. Nevertheless, there are prospects of a move 131.00 while below 131.80. On the other hand, a break there and a follow-through above 132.00 could see the starting balance for the day favourable for further strength in London with 132.20/50 eyed:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.