- Analytics

- News and Tools

- Market News

- EUR/USD recaptures 1.0740 as market mood soars, investors digest Fed’s hawkish guidance

EUR/USD recaptures 1.0740 as market mood soars, investors digest Fed’s hawkish guidance

- EUR/USD is aiming to stretch upside to near 1.0740 ahead of German Inflation data.

- Federal Reserve is expected to hike interest rates further as the upbeat labor market might propel consumer spending.

- Higher German Inflation data will bolster the case of bumper interest rate hikes by the European Central Bank ahead.

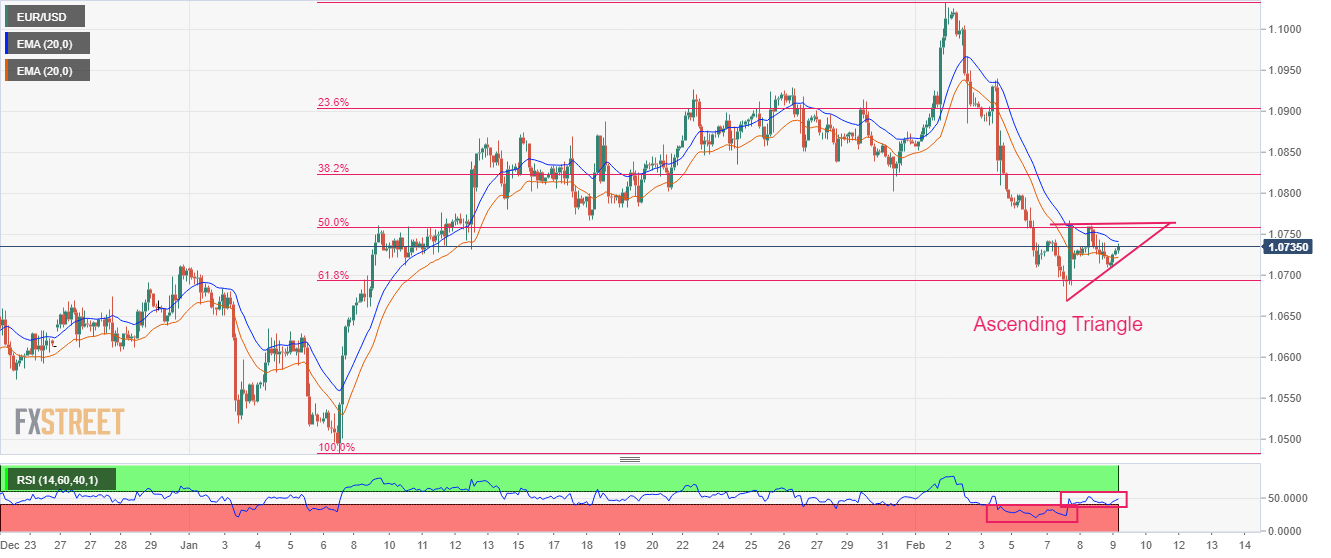

- EUR/USD is auctioning in an Ascending Triangle that indicates a volatility contraction.

EUR/USD has delivered a range extension above 1.0730 in the early European session after a recovery move from around 1.0710. The major currency pair has picked strength as the risk aversion theme has faded after investors digest the hawkish guidance from Federal Reserve (Fed) policymakers.

The US Dollar Index (DXY) has faced immense pressure as US Treasury yields have softened after investors rushed for buying US government bonds despite soaring expectations of a higher interest rate peak by the Federal Reserve. The USD Index is attempting to recapture the 103.00 resistance, however, the downside seems favored. Meanwhile, the 10-year US Treasury yields have dropped below 3.62%.

S&P500 futures have recovered firmly in the Asian session after a sell-off on Wednesday as tech stocks melted. Alphabet Inc. was heavily dumped by the market participants after Google Chatbot Brad Artificial Intelligence (AI) delivered an incorrect answer to an online advertisement.

Strong US Labor market to propel consumer spending

The street started expecting a pause in the policy tightening spell by Fed chair Jerome Powell earlier after scrutiny of December’s inflation-associated indicators. Consumer spending was contracted, Producer Price Index (PPI) was trimmed, and the scale of manufacturing economies confirmed a third consecutive contraction. However, fresh Nonfarm Payrolls (NFP) report faded the policy tightening pause expectations after reporting an almost three-fold jump in the number of job additions.

A strong labor market in the United States is expected to propel the employment cost index as the shortage of labor will be augmented by higher employment proposals from firms. This could trigger a rebound in the inflation projections as households with higher earnings in possession can lead to higher consumer spending.

Federal Reserve interest rate to climb above 5%

The latest US job market report has faded the expectations of 'wait and watch' approach for the interest rate policy and cues from analysts and Federal Reserve policymakers. There is no denying the fact that higher consumer spending by individuals due to higher earnings will fuel inflation projections and Fed chair Jerome Powell will be having no other option than to stretch interest rates further.

Jamie Dimon, CEO of JPMorgan Chase & Co., cautioned against declaring victory against inflation too early, warning the Fed could raise interest rates above the 5% mark if higher prices ended up "sticky," reported Reuters. He further added that Federal Reserve must go beyond 5% if inflation doesn’t come down to 3.5-4.00%.

German Inflation data to trigger action ahead

EUR/USD is expected to deliver a power-pack action after the release of the German Harmonized Index of Consumer Prices (HICP) data. The economic calendar has remained light this week, therefore, the impact of the German HICP will be relatively higher. The annual HICP (Jan) is expected to strengthen further to 10.0% from the prior release of 9.6%. The monthly price index is expected to accelerate by 1.4% vs. the contraction by 1.2%.

The double-digit inflation figure might add to troubles for the European Central Bank (ECB), which has already pushed interest rates to 2.50%, and more interest rate hikes are in pipeline.

European Central Bank policymaker Klaas Knot in an interview with MNI Market cited “Headline inflation has peaked now and the ECB will shift its focus to underlying inflation,” as reported by Reuters. European Central Bank policymaker further stated that the sharp decline in energy prices might continue to weigh pressure on headline inflation. The contraction in economic activities in Eurozone will be shallow and after that, a recovery in activities would again provide a cushion to the Consumer Price Index (CPI).

EUR/USD technical outlook

EUR/USD is oscillating between the 50% and 61.8% Fibonacci retracements (placed from January 6 low at 1.0483 to February 1 high at 1.1033) at 1.0760 and 1.0694 respectively. The shared currency pair is auctioning in an Ascending triangle chart pattern, which indicates a squeeze in volatility. The upward-sloping trendline of the chart pattern is placed from February 7 low at 1.0069 while the horizontal resistance is plotted from February 7 high at 1.0766.

The Euro is attempting to surpass the 20-Exponential Moving Average (EMA) (High-Low) band. A break above the same might trigger volatility for the US Dollar bulls.

The Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range from the bearish range of 20.00-40.00, which indicates an attempt for a bullish reversal by the shared currency bulls.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.