- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD eyes $1,880 as investors digest Powell’s guidance and Biden’s SOTU

Gold Price Forecast: XAU/USD eyes $1,880 as investors digest Powell’s guidance and Biden’s SOTU

- Gold price is aiming to recapture $1,880.00 as the risk appetite is improving.

- Investors have shrugged-off uncertainty from Powell’s speech and US Biden’s SOTU meeting.

- The Fed might continue keeping rates higher for a longer period as the entire disinflationary process seems complicated.

Gold price (XAU/USD) is aiming to capture the immediate resistance of $1,880.00 in the Asian session. The precious metal rebounded after dropping to near $1870.00 and is expected to add gains ahead as the risk appetite of the market participants is improving.

Investors have digested the hawkish guidance on interest rates delivered by Federal Reserve (Fed) chair Jerome Powell and US President Joe Biden’s commentary at State of the Union (SOTU).

Fed chair Jerome Powell cleared that the central bank will hike interest rates further if the labor market report continues to surprise the market on the upside. The Fed is committed to bringing the inflation rate to 2% and therefore, higher interest rates will continue to stay for a longer horizon.

Meanwhile, US President Joe Biden sounded tough on China citing that “The United States is in strongest position from decades to compete with China or anyone else.”

Risk-perceived assets like S&P500 futures have ignored Powell’s hawkish commentary and US Biden’s tough statement on China and have recovered losses displayed in the Asian session, portraying a risk-on market mood. The US Dollar Index (DXY) is struggling to firm its feet and is expected to resume its downside journey. Also, the 10-year US Treasury yields have slipped to near 3.65%.

Gold technical analysis

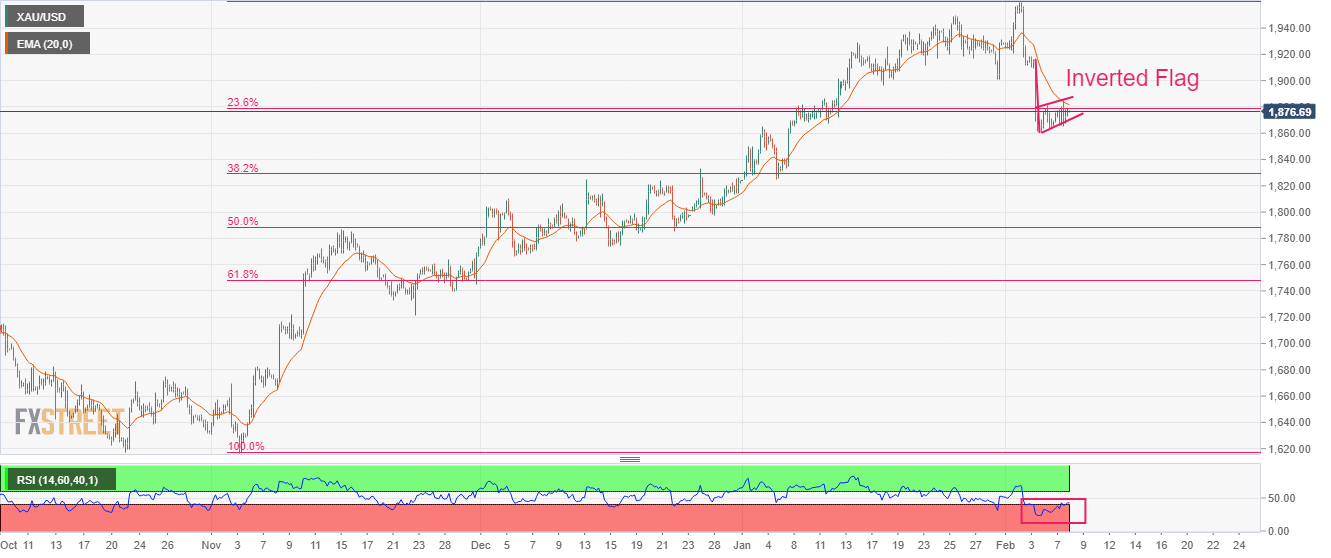

Gold price is forming an Inverted Flag chart pattern on a four-hour scale that indicates a sheer consolidation, which is followed by a breakdown in the same. Usually, the consolidation phase of the chart pattern serves as an inventory adjustment in which those participants initiate shorts, which prefer to enter an auction after the establishment of a bearish bias.

The Gold price is also struggling to sustain above the 23.6% Fibonacci retracement (placed from November 11 low at $1,617.32 to February 2 high at $1,959.20) at $1,878.00.

The 20-period Exponential Moving Average (EMA) at $1,882.20 is acting as a major barricade for the Gold price.

Meanwhile, the Relative Strength Index (RSI) (14) is struggling to cross 40.00, which indicates an absence of strength in the Gold bulls.

Gold four-hour chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.