- Analytics

- News and Tools

- Market News

- GBP/USD breaks to the upside, eyes 1.2050s

GBP/USD breaks to the upside, eyes 1.2050s

- GBP/USD rallies in the New York session ahead of Fed Powell.

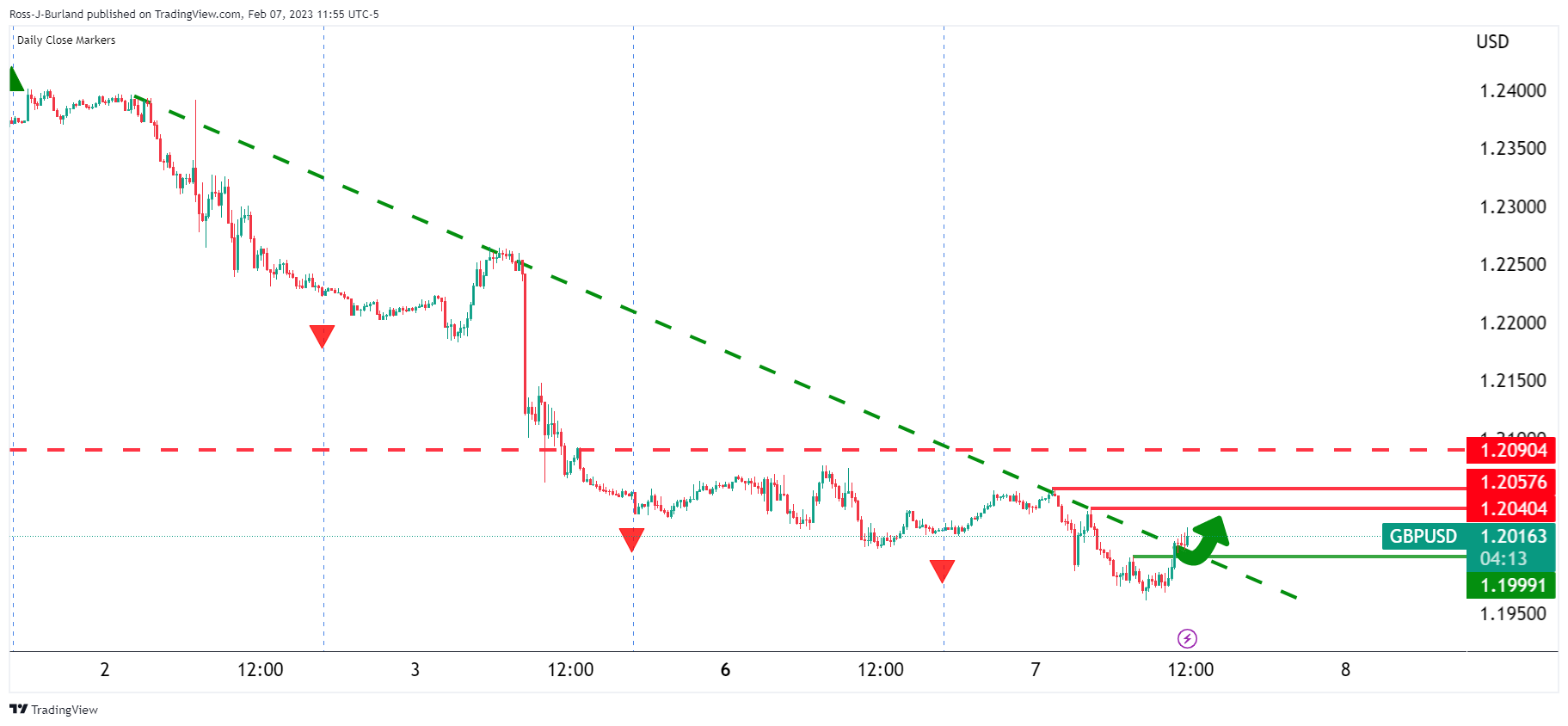

- GBP/USD is the back side of the trendline resistance which is now expected to act as a counter-trendline with a focus on the upside.

- There are prospects of a move towards the 1.2050s with the 1.1990s eyed as support.

GBP/USD is breaking 1.20 the figure and the bulls eye 1.2050 for the sessions ahead. Cable has done 80% of the daily ATR of 122 so far and has travelled between a low of 1.1960 and 1.2057 on Tuesday.

The US Dollar lost some ground in the London fix which boosted the Pound to fresh session highs in New york, delving into 50% of the London session sell-off in a move that precedes a key speech from Federal Reserve's chairman, Jerome Powell. There will be other Fed speakers as well as the start of the refunding auctions with the 3-year auction today.

Fed Chairman Powell will be interviewed at a live transmitted event at the Economic Club of Washington, D.C., beginning at 18.00 CET. ''This could give Powell an opportunity to mitigate the markets' very dovish reaction to his press conference last week if he wants to, especially in light of the strong jobs report and ISM data we have seen since then,'' analysts at Danske Bank explained.

Meanwhile, the UK's Monetary Policy Committee recently raised its policy rate by 50bp to 4.00%, which was in line with consensus but above our forecast for a 25bp hike. The vote was split 7-2, with the two members voting against preferring no change at all in Bank Rate. However, the Bank of England is now moving into data-dependent mode and given that inflation is expected to be significantly lower by year-end and prospects of a rising unemployment rate, there are downside risks for the Pound should the BoE flip the script.

Nevertheless, we have heard from a hawkish BoE MPC member Catherine Mann this week who said ''the consequences of under-tightening far outweigh, in my opinion, the alternative. We need to stay the course, and in my view the next step in bank rate is still more likely to be another hike than a cut or hold.” In fact, BoE speakers are plentiful this week and we heard from Chief Economist Huw Pill as well who said, ''if you ask me where we are at the moment, I think we are still more concerned about the potential persistence of inflation.''

''Concerned about inflationary pressure in the labour market ‘probably tilts us to saying we haven't quite got to the point where we're confident to engage in a discussion of a turning point in rates.''

GBP/USD technical analysis

As per the start of the week's analysis, where it was registered that GBP/USD had closed in the red for three day's in a row, a move up into the in-the-money shorts was anticipated:

However, as the illustration above suggested, the bears could be lurking in a move-up to test the break of structure area (BoS) near 1.2090.

Meanwhile, we are starting to see the bulls move in as anticipated:

We are on the back side of the trendline resistance which is now expected to act as a counter-trendline with a focus on the upside. There are prospects of a move towards the 1.2050s with the 1.1990s eyed as support.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.