- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD pokes $1,880 hurdle as US Dollar retreats ahead of Fed Chair Powell’s speech

Gold Price Forecast: XAU/USD pokes $1,880 hurdle as US Dollar retreats ahead of Fed Chair Powell’s speech

- Gold price clings to mild gains while extending the week-start rebound from one-month low.

- US Dollar bears the burden of market’s cautious optimism to propel XAU/USD rebound.

- Fed Chair Powell needs to praise recently strong US data to challenge Gold buyers.

- US President Biden’s SOTU, Sino-American headlines also eyed for immediate directions.

Gold price (XAU/USD) picks up bids to refresh intraday high near $1,876 while printing a two-day uptrend during early Tuesday.

In doing so, the bright metal extends the week-start rebound from a monthly low as the US Dollar weakness joins cautious optimism in the market to favor the XAU/USD bulls. However, anxiety ahead of the Federal Reserve Chairman Jerome Powell and US President Joe Biden’s State of the Union (SOTU) comments seem to challenge the metal buyers of late.

The mildly positive sentiment could be linked to the comments from US Treasury Secretary Janet Yellen and President Joe Biden which pushed back the US recession concerns. On the same line were the comments from US President Joe Bide which appear to placate the Sino-American fears by saying, “The balloon incident does not weaken US-China relations.”

Alternatively, hawkish Fed talks seem to put a floor under the US Treasury bond yields, as well as the US Dollar. “The strong labor market probably means ‘we have to do a little more work,’” said Federal Reserve Bank of Atlanta President Raphel Bostic in an interview with Bloomberg. It’s worth noting that the firmer US jobs report and activity data for January renewed hawkish Fed bias the last Friday but a lack of directives seem to probe the greenback bulls afterward.

Against this backdrop, S&P 500 Futures print mild gains but the US Treasury bond yields struggle to extend the two-day rebound from the monthly low. It should be observed that the US Dollar Index (DXY) also retreats from the one-month high, marked the previous day, amid sluggish markets.

Looking ahead, Gold traders should concentrate on Fed Chair Powell’s capacity praises the latest upbeat US data, as well as US President Biden’s SOTU.

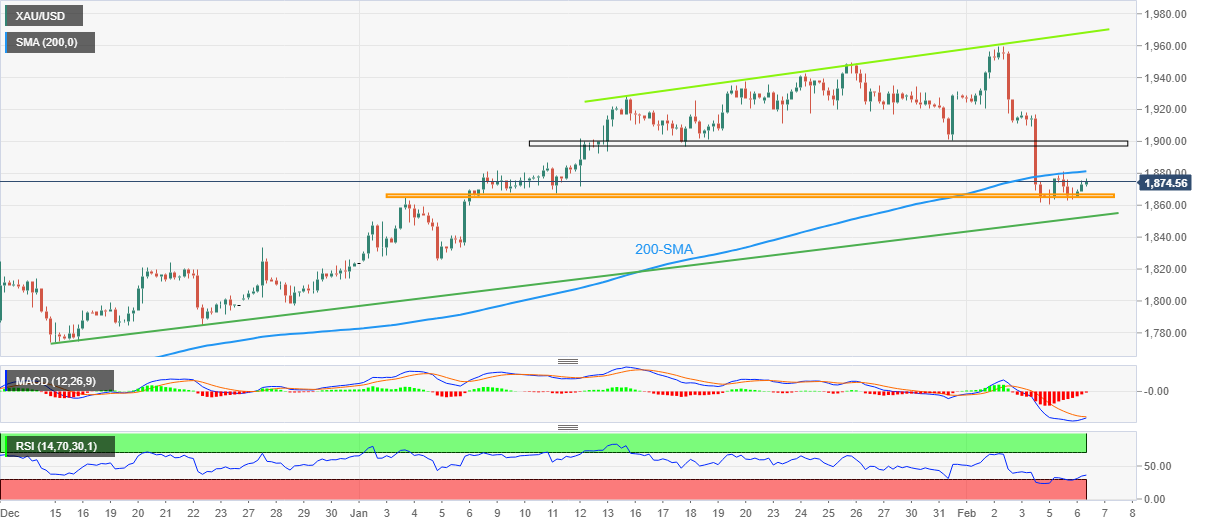

Gold price technical analysis

Gold price rebounds from one-month-old horizontal support surrounding $1,865 backed by an improvement in the oversold RSI (14), as well as the looming bull cross on the MACD.

However, 200-Simple Moving Average (SMA) surrounding $1,880 guards the XAU/USD’s immediate upside.

Even if the Gold price stays firmer past $1,880, a three-week-long resistance area around the $1,900 round figure could act as the last defense of the sellers before directing the prices towards the resistance line from mid-January, close to $1,968 at the latest.

Meanwhile, a clear downside break of $1,865 isn’t an open welcome to the Gold bears as an upward-sloping support line from December 15, 2022, around $1,850, could challenge the metal’s further downside.

Gold price: Four-hour chart

Trend: Limited recovery expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.