- Analytics

- News and Tools

- Market News

- USD/JPY bulls capped on the opening gap, bulls remain in control

USD/JPY bulls capped on the opening gap, bulls remain in control

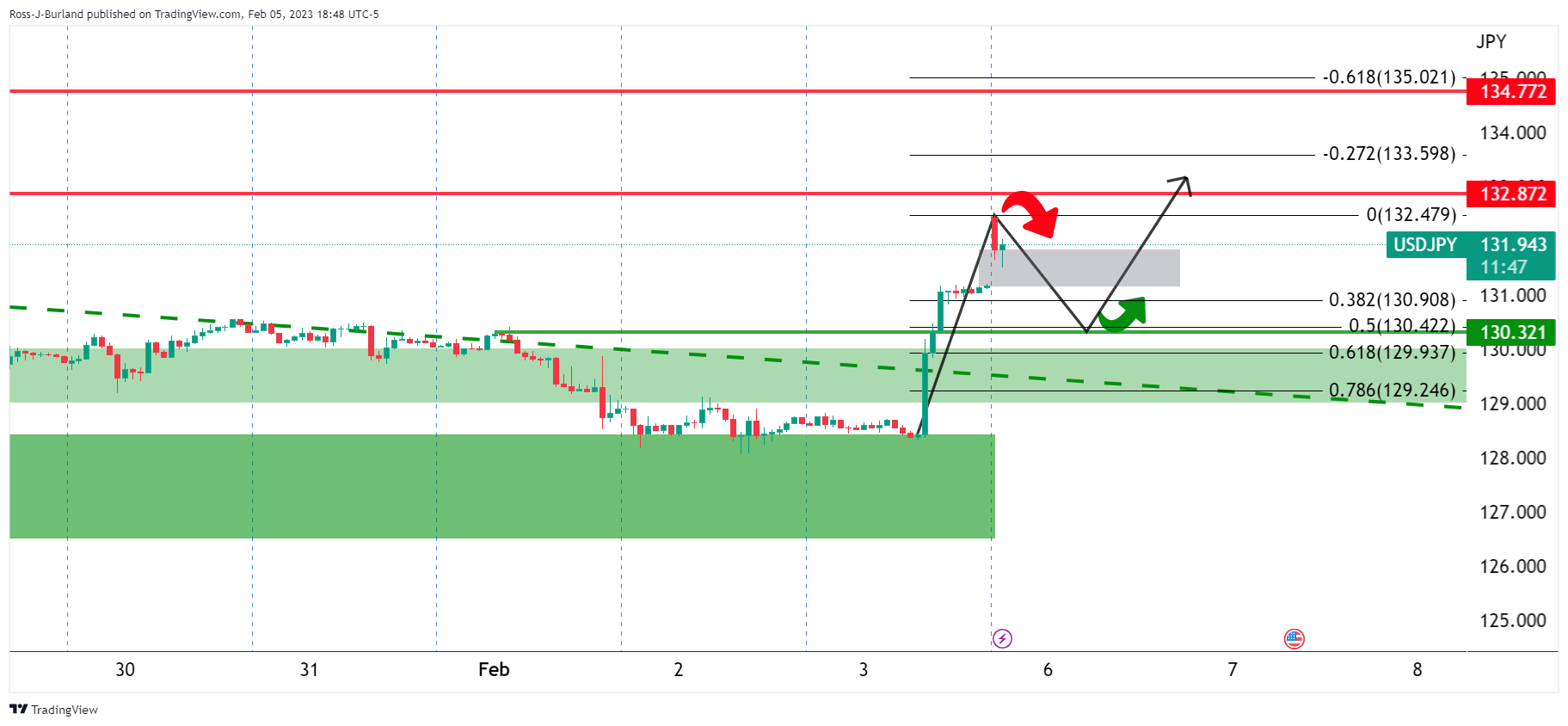

- USD/JPY is on the way to closing the bullish opening gap.

- The bulls eye 132.80s for the sessions ahead.

USD/JPY is correcting the opening gap rally that hit a high of 132.47 and is now back to 131.70 at the time of writing. Outstanding results in the US jobs market are still being digested by investors and we could be in for some volatility ahead as the week unfolds.

The United States added 517,000 jobs in January, well more than the average analyst estimate for a 187,000-job rise. The robust increase showed the US economy continues to surge despite rising interest rates. the key here is that the data arrived at a time when markets were positioning for a Fed pivot. A more hawkish stance could now come back into play in terms of sentiment even after it raised interest rates by just 25 basis points on Wednesday. The hike was the smallest hike since it began tightening rates to slow inflation and the dovish rhetoric from the Fed's chairman, Jerome Powell, sealed the deal, at least until the jobs numbers.

''Chair Powell is pleased with the recent softer inflation prints, but says the Fed needs substantially more evidence to be confident that inflation is on a sustained downward path,'' analysts at ANZ Bank explained. ''For the Fed, the biggest uncertainty surrounding the inflation outlook is what happens with core services ex-shelter prices. Wages growth is the main driver of this component of inflation.''

''Labour market data out last week point to still-hot demand for labour, but at the same time provide further evidence of cooling wage growth. Although wage growth is easing, it needs to slow further. With the labour market remaining tight, the Fed is likely to remain hawkish with its guidance,'' the analysts added.

Meanwhile, it will be a very light week in terms of US data, especially in comparison to last week. With that being said, Federal Reserve speakers will be out in force, including Powell. Also, at the end of the week, the highlight may be Consumer Price Index revisions. Of note, January CPI data won’t be released until February 14.

From the Bureau of Labor Statistics website: “Each year with the release of the January CPI, seasonal adjustment factors are recalculated to reflect price movements from the just-completed calendar year. This routine annual recalculation may result in revisions to seasonally adjusted indexes for the previous 5 years.”

Final stages of nominations for BoJ governor

Domestically, reports suggest BOJ Deputy Governor Amamiya has been approached about the post of Governor and this suggests the government is in the final stages of its nominations for replacing the outgoing Governor Kuroda.

''Amamiya has been instrumental in helping Kuroda formulate and implement the BOJ’s massive monetary stimulus program,'' analysts at Brown Brothers Harriman argued.

''Former Deputy Governor Nakaso has emerged as the other frontrunner and is viewed as slightly more hawkish than Amamiya. That said, we believe the next Governor will have no choice but to begin removing accommodation this year. Of note, Kuroda’s term ends April 8 and Prime Minister Kishida has said that the replacement will be named in February''

USD/JPY technical analysis

USD/JPY is moving towards the gap but remains on the backside of the prior bearish trend so the bias is to the upside with the 132.80s eyed.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.