- Analytics

- News and Tools

- Market News

- GBP/USD Price Analysis: Sees continuation of its downside journey below 1.1850

GBP/USD Price Analysis: Sees continuation of its downside journey below 1.1850

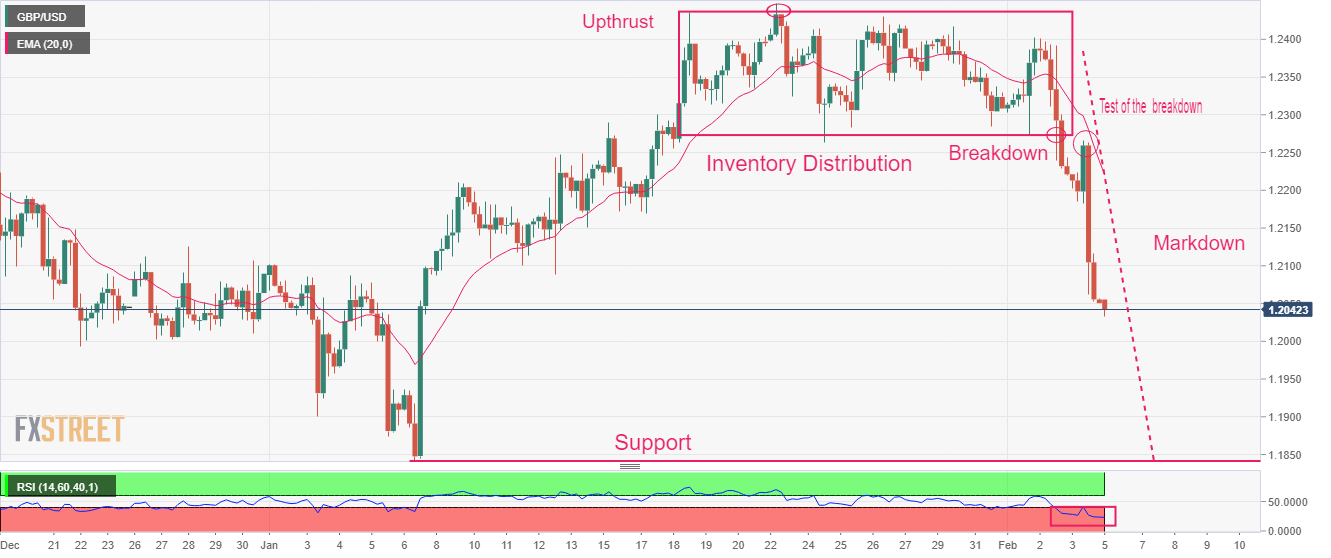

- GBP/USD witnessed significant selling pressure after testing the inventory distribution breakdown around 1.2268.

- The Cable is in a Wyckoff’s markdown phase and may find support near 1.1850.

- A 20.00-40.00 range oscillation by the RSI (14) indicates more weakness ahead.

The GBP/USD pair has dropped below the critical support of 1.2050 in the early Tokyo session on expectations that the Federal Reserve (Fed) will continue hiking interest rates due to upbeat United States official employment data. The market mood has turned risk-averse as further interest rate hiking by Fed chair Jerome Powell will deepen recession fears.

S&P 500 futures tumbled after a three-day winning streak, portraying a sheer decline in the risk appetite of the market participants. The 10-US Treasury yields have recovered above 3.51% as the inflation projections are set to rebound further.

GBP/USD witnessed a massive sell-off after delivering a downside break of the Inventory Distribution formed on a two-hour scale. The formation of Upthrust around January 23 high at 1.228 indicates the presence of significant selling interest. The Cable has shifted into a markdown phase after testing the downside break of Wyckoff’s inventory distribution.

The 20-period Exponential Moving Average (EMA) at 1.2224 will act as a major barricade for the Pound Sterling bulls.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the bearish range of 20.00-40.00, which indicates that the downside momentum is active.

A further decline in the Cable below the intraday low at 1.2033 will drag the asset toward January 3 low at 1.1900 followed by horizontal support placed from January 6 low around 1.1841.

On the contrary, a break above January 24 low at 1.2263 will support a bullish reversal and will drive the Cable towards February 2 high around 1.2400. A breach of the latter will send the major toward January 23 high at 1.2448.

GBP/USD two-hour chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.