- Analytics

- News and Tools

- Market News

- AUD/USD Price Analysis: Bears under a 78.6% target area ahead of RBA

AUD/USD Price Analysis: Bears under a 78.6% target area ahead of RBA

- AUD/USD bears eye support structure for the open.

- Bulls look to 100 pips higher for a corrective opportunity.

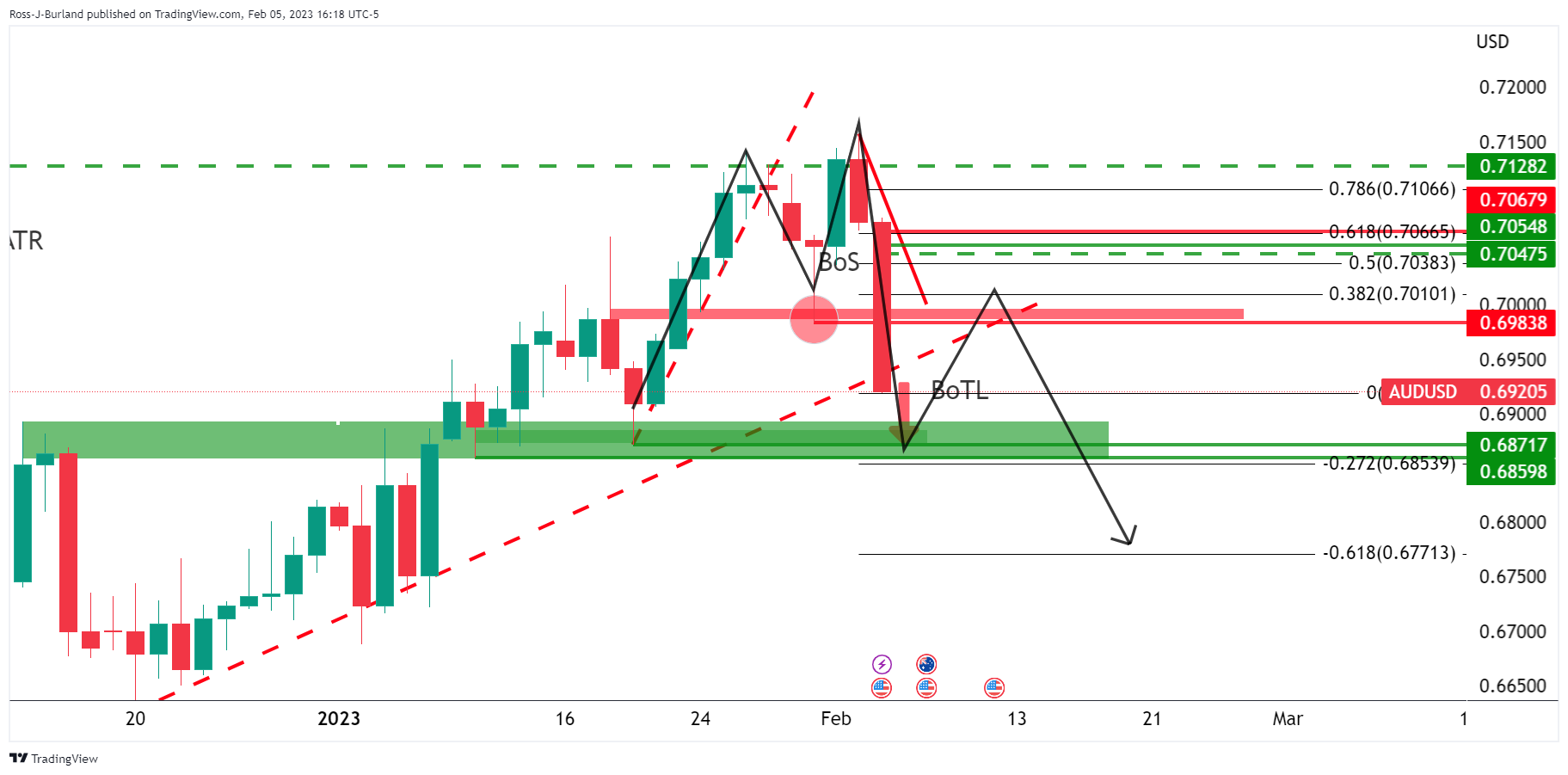

AUD/USD sold off in a huge way at the end of last week and has broken critical breakout structures along the way as the following will illustrates. The price dropped to close below a 78.6% target area:

The culprit was outstanding results in the US jobs sector that took the market off guard that was backed up by some pretty impressive Services data as well.

The United States added 517,000 jobs in January, well more than the average analyst estimate for a 187,000-job rise. The robust increase showed the US economy continues to surge despite rising interest rates. the key here is that the data arrived at a time when markets were positioning for a Fed pivot. A more hawkish stance could now come back into play in terms of sentiment even after it raised interest rates by just 25 basis points on Wednesday, the smallest hike since it began tightening rates to slow inflation.

Meanwhile, the Aussie had been boosted by the re-opening of the Chinese economy as well as the surprising strength of Australia’s December inflation release that landed recently and had firmly put the risk of another 25 bp rate hike from the RBA on the table for February 7. ''Accelerating services inflation locks in a 25bps hike,'' analysts at TD Securities said. ''We forecast a follow-up 25bps hike in March taking the terminal to 3.6%.''

However, markets will be looking for the statement to open the door to pausing here. And this is a sangue into the charts below because we might have seen a high for the year so far if this were to be the case:

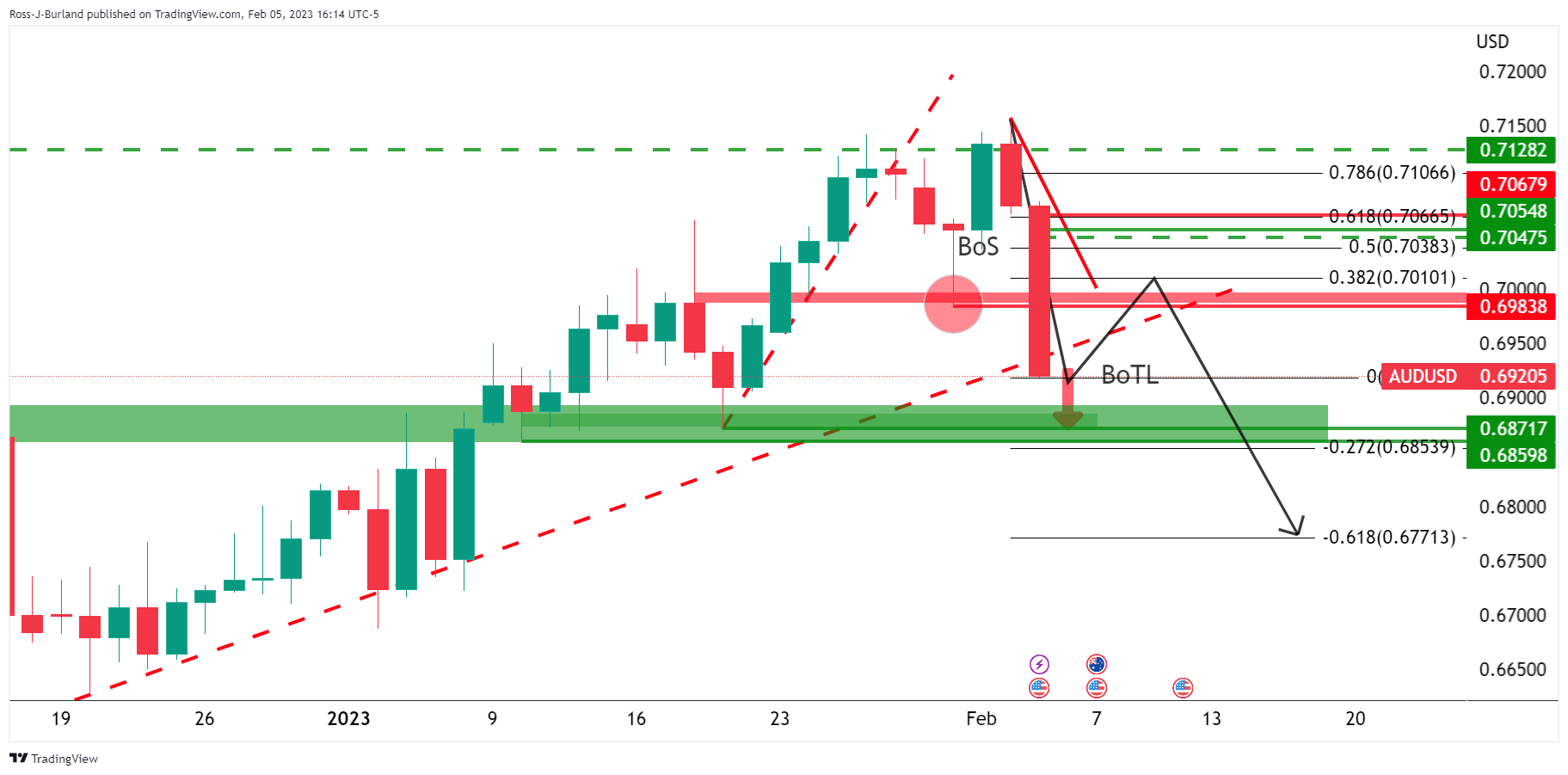

AUD/USD daily chart

The price is breaking the trendline.

However, we have an M=formation on the charts as illustrated above.

This could therefore lead to a bullish correction to test the neckline of the M-pattern with 0.70 eyed.

However, it can't be taken away from the bears that the momentum is to the downside and we could just see a continuation of the initial balance for the week and open as early prices suggest, downs some 50 pips to 0.6880 from Friday's 0.6929 close.

If this plays out in the official open in Syden, then taking 0.6870 as a floor, the 38.2% Fibo retracement on the daily comes in at around 0.6980:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.