- Analytics

- News and Tools

- Market News

- RBA's KIohler: We believe peak of inflation was in Q4

RBA's KIohler: We believe peak of inflation was in Q4

Reserve Bank of Australia's head of economic analysis Marion Kohler said they believe that the peak of inflation was in the fourth quarter.

Opening statement to the Senate Select Committee on the cost of living:

Good morning chair and members of the Committee.

Thank you for holding this hearing. The Reserve Bank welcomes the opportunity to contribute to these discussions about the cost-of-living pressures that households in Australia are currently facing. Cost of living is an important issue for all Australians. A rising cost of living puts pressure on household budgets across the country. Many people are understandably concerned about how they and others will manage through a period when the cost of living has increased considerably.

The cost-of-living pressures currently being faced by all Australians are a result of a substantial rise in the rate of inflation over the past year or so. Annual inflation as measured by the Consumer Price Index (CPI) has increased from a little below 2 per cent in the years immediately prior to the pandemic to around 8 per cent at the end of 2022. Prices have risen significantly for many of the goods and services that people buy. Today, the higher cost of living is front of mind for many more people than was the case in the years leading up to the pandemic.

Most advanced countries have experienced a large increase in inflation over the past year or so. A big driver of higher prices was unpredictable shocks to supply that affected many countries. Most notable are the pandemic disruptions to global supply chains and Russia's invasion of Ukraine. In Australia, we also had flooding on the east coast that affected supply here. But strong growth in domestic demand has also played a role in many countries.

Different groups in society have different patterns of spending, so their experience of cost of living can vary from the national average. Lower income households typically have the most constrained budgets. These households, including those on the age pension and other welfare payments, tend to spend more of their income on essential items such as food, utilities and rent. Higher income households tend to spend more on items like owner-occupied housing and so-called discretionary items such as recreation and consumer durables.

Despite these differences, in Australia most groups in society have seen their cost of living increase by roughly the same extent over the most recent period. This is because the increase in inflation so far has been quite broadly based. This has not been the case in some other countries, particularly in Europe. There, lower income households have been hit relatively harder by higher energy prices than higher income households have been.

It is clear that the cost of living in Australia has increased significantly. But that is not the full picture. What matters also is whether people's means to pay these costs - their incomes - have kept pace. Over the past year or so, consumer prices have grown faster than households' disposable incomes, meaning that real incomes have declined overall.

The experience of individual households varies widely. Hourly wages have picked up, but not by as much as inflation, and so some workers who have remained in the same job and with the same hours will have seen their real incomes decline significantly. Still, many households have been able to benefit from the strong labour market. Some now have a job who previously didn't, while others have been able to pick up more hours or move to a better paying job. The large increase in the minimum and award wages in the middle of last year has also helped many households. And most welfare payments are indexed to inflation, which should help support the incomes of many lower-income households.

While those relying on interest income - such as self-funded retirees - have seen their incomes boosted by higher interest rates over the past year, those with mortgages will be feeling the effects of the rise in interest rates. We understand that some people are finding the rise in interest rates difficult to manage and others will have to cut back on discretionary spending. However, higher interest rates are necessary to ensure that the current period of higher inflation and cost of living pressures does not persist too long. As the Governor has emphasised, the Reserve Bank Board is focused on returning inflation to target and establishing a more sustainable balance of demand and supply in the Australian economy.

We are currently revising our forecasts and will publish these at the end of next week, so we are not in a position to preview them yet. What we can say is that we think the peak in inflation was at the end of 2022 - at around 8 per cent - and that inflation will begin to ease over the course of this year.

Thank you. My colleague and I are here to answer your questions.

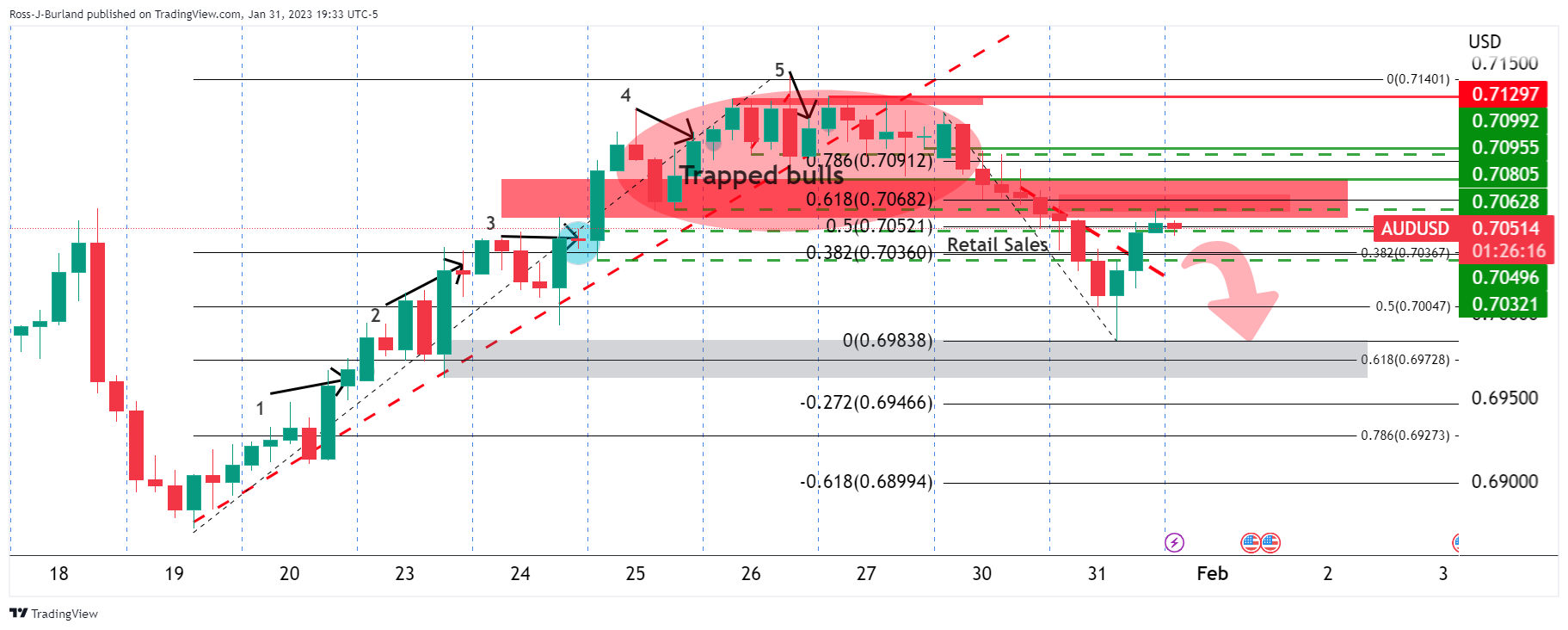

AUD/USD update

The price is breaking down below an area where bulls were rapped up high chasing the breakout of 0.7050 and 0.7100 following five days of rise. The Retail Sales miss sent the pair lower and back below 0.7050. The correction is firm but has decelerated at 0.7050 in a 50% mean reversion of the bearish leg and could now be starting to move lower again for a downside extension towards the prior lows near 0.6980. A Break there opens risk to 0.6950 in the first instance.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.