- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD's time has come in a pivotal chorus of events

Gold Price Forecast: XAU/USD's time has come in a pivotal chorus of events

- Gold price is testing the bull's commitments into highly important events for the rest of this week.

- Gold bears are waiting to pounce, chipping away at critical support structures.

- Federal Reserve and European Central Bank meetings will start off the chorus of expected volatility before the showdown, Nonfarm Payrolls.

Gold price had given two-way business on Tuesday as markets get set for the Federal Reserve, Fed, at month-end making for a particularly choppy day. However, the Gol price is headed for a third straight monthly gain, with the US Dollar and bond yields weakening despite higher interest rates expected from this week's meetings of the Federal Reserve's policy committee.

Federal Reserve and central bank meetings to impact Gold price

The US Dollar index was last seen down 0.2% at 102.03 after falling from a high of 102.607 and 102.013 while the US Treasury 10-year note is paying 3.523%, down 0.54% on the day as we move into the Federal Reserve interest rate decision and accompanying announcements. We also have the European Central Bank, ECB, which is also expected to increase rates on Thursday as both central banks look to slow their economies to combat high inflation. As a result, the Gold prices during the events are likely to be volatile.

First up, we have the US central bank policy decision that is due at 1900 GMT on Wednesday, followed by a news conference from Federal Reserve Chair Jerome Powell and while markets have priced in a 25 basis point Fed rate hike to a range of 4.5-4.75% and expect rates to peak at 4.9% in June, some analysts are sceptical. For instance, analysts at Brown Brothers Harriman said the hard part for the Fed will be convincing the markets that they are wrong about its perceived pivot.

''The Federal Reserve will leave the door wide open for further rate hikes and Federal Reserve Chair Powell will stress that the Fed is prepared to continue hiking rates beyond 5% and keep them there until 2024, as the December Dot Plots showed,'' the analysts argued. ''As things stand, the Fed is seen starting an easing cycle in H2 and we view that as highly unlikely,'' they said.

New Federal Reserve Dot Plots and macro forecasts won’t come until the March 21-22 meeting, so the Fed official's rhetoric between this meeting and the next will be important, starting with the Federal Reserve's Chairman, Jerome Powell, when he speaks to the press. For instance, while we have been in a blackout period ahead of the Fed, where Fed speakers go quiet, prior to this, Federal Reserve's James Bullard said he expects inflation to recede this year but not as fast as the market sees. He said the Fed policy is almost restrictive but not quite there yet, adding that his 2023 rate projection last month was for 5.25-5.50%. He stressed that rates need to remain above 5% in order to push inflation down. He would prefer that the Fed policy were to err on the tighter side as insurance. This is bearish for the Gold price and bullish for the US Dollar.

Additionally, the European Central Bank and Bank of England are expected to hike rates by 50 basis points on Thursday. These too could be a spanner in the works for the Gold price as lower rates tend to be beneficial for bullion, decreasing the opportunity cost of holding the non-yielding asset. If the outcomes of both meetings a determined by hawkish rhetoric, then this in turn could be bad news for the Gold price bugs among us.

United States of America Nonfarm Payrolls and data in general are key

Markets also await Friday's US Nonfarm Payrolls report for January, with weakening in the labour market translating to decreasing inflation. Job creation likely remained solid, with payrolls gains staying above the 200k mark in Jan, analysts at TD Securities expect. ''We look for the Unemployment Rate rate to stay put at 3.5%.''

In this regard, analysts at ANZ Bank said that the weaker economic data recently released in the United States of America does raise the question as to when the Federal Reserve will start to ease rates, or pause their hikes. However, they added that they '' think that the Federal Open Market Committee, FOMC, will acknowledge there has been some progress in weakening demand but we do not think that trends are yet sufficiently established in the labour market or service prices for the Federal Reserve to be able to step back from its hawkish disposition just yet.''

Depending on the outcome of these events this week, the technical outlook for Gold price will be just as key as the yellow metal tinkers on the edge of falling below $1,900. Analysts at TD Securities said that a move below $,1890 would likely spark a notable selling program totalling -6% of the trend following cohort's maximum historical position size. ''Upside trend signals continue to deteriorate across the complex, pulling the thresholds for trend reversals closer.''

Gold price technical analysis

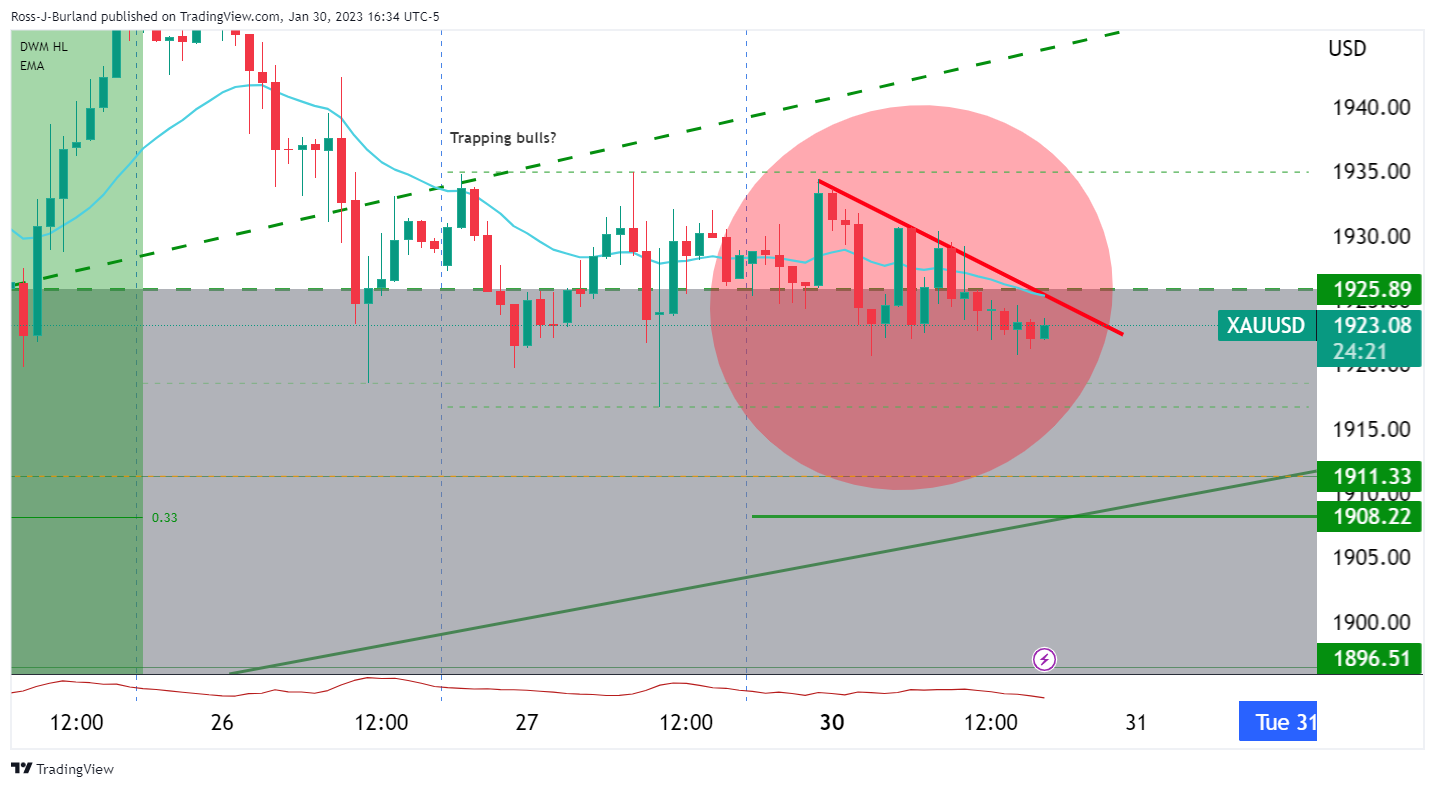

As per the prior analysis, Gold Price Forecast: XAU/USD bulls could emerge ahead of Federal Reserve, the Gold price has been forced out of a geometrical pattern and dropped to test $1,900 on what could have been clear out of stale sell-stops:

Prior Gold price analysis

We can see that we had a 3-line strike in play for the Gold price:

This was a Gold price trend continuation candlestick pattern consisting of four candles. In this particular scenario, we did not have the close below the first of the four candles, but this was a bearish scenario nonetheless for Monday and bears capitalized on it as follows:

The Gold price hourly chart showed that the Gold price is being jammed into the lows and a subsequent sell-off occurred as follows:

At this juncture, we are likely to see consolidation as we head into the Federal Reserve. however, for a full analysis of the Gold price that was made at the start of the week and remains valid for the events, see here: Gold, Chart of the Week: XAU/USD trapped bulls into the Fed and NFP, and here: Gold, Chart of the Week: XAU/USD trapping longs for a significant squeeze ahead of key red-hot events.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.