- Analytics

- News and Tools

- Market News

- BoJ January policy meeting Summary of Opinions: Price rises accelerating

BoJ January policy meeting Summary of Opinions: Price rises accelerating

The Bank of Japan's Summary of Opinions is coming out in stages.

Key points

It will take time for Japan to achieve sustained wage growth, must support the economy with macro policy.

Focusing on service prices as demand-pull inflation must be achieved for Bank of Jaopan's price target to be met.

Price rises accelerating not just for goods but for services.

Public's norm on prices may be changing due to big, external shock.

Appropriate to maintain current monetary easing, including YCC.

Crucial to generate positive economic, price cycle in order to achieve BoJ's price target

BoJ must keep yields from rising across curve while being mindful of bond market function.

Must spend more time to gauge impact of December decision on bond market function.

Must communicate to markets achievement of price target will take some time.

Expansion of BoJ's market operation tool will help create stable shape of yield curve.

When time for exiting ultra-loose policy comes, boj must check whether market players are prepared for the move.

BoJ must conduct a review of its policy at some point, but appropriate to maintain easy monetary policy for now.

Japan's consumer inflation is likely to slow pace of increase toward latter half of next fiscal year.

Cost-push pressure on prices are starting to ease.

Still see some distance in achieving the BoJs price target.

USD/JPY update

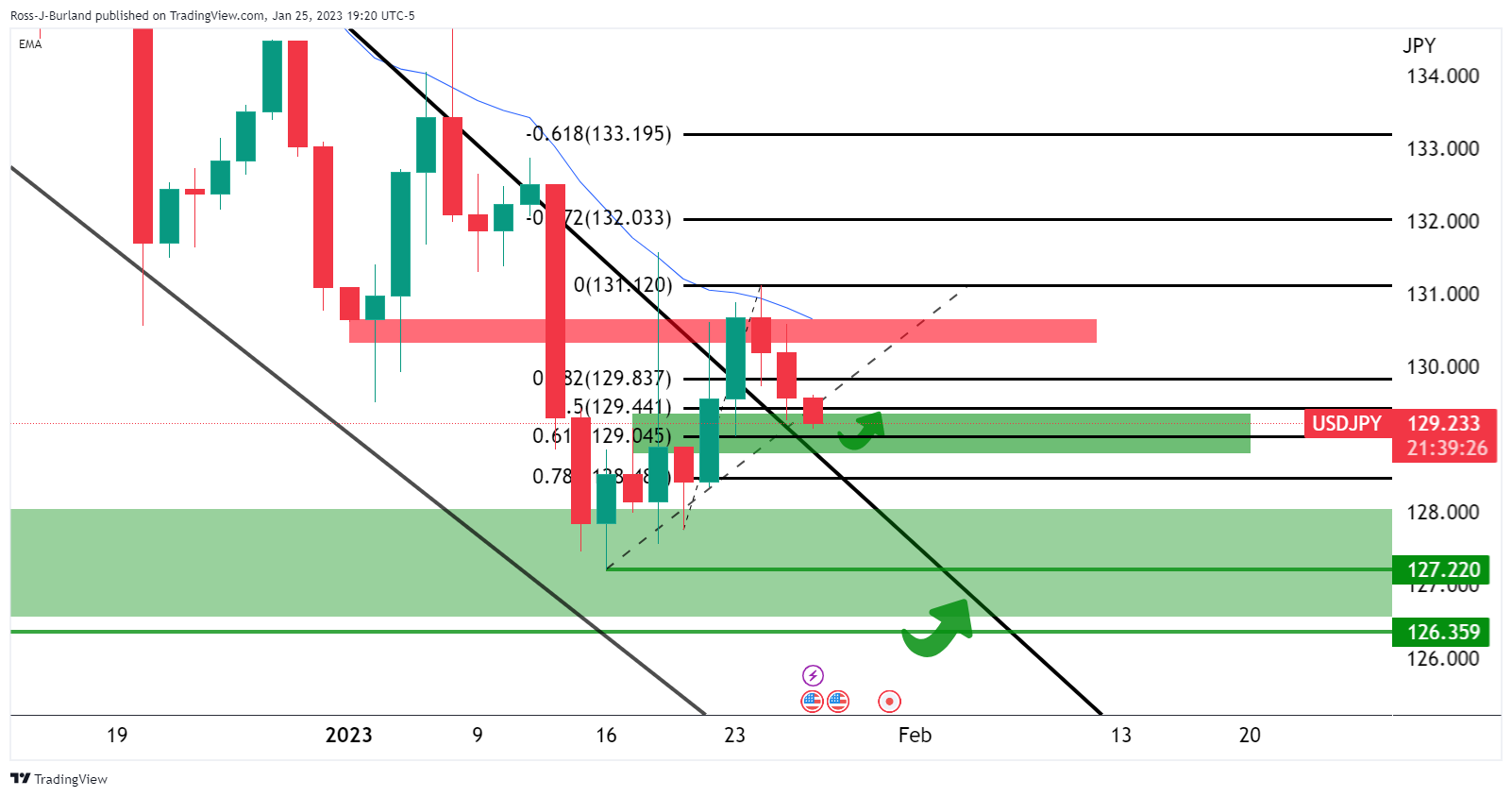

There has been no effect on the Yen but the price action was volatile on Wednesday with the bulls now back under pressure again towards 129.00:

If the bulls commit near 129.00, the has a confluence with the 129.00 figure, then there could be prosp3ects of a move back to test 130.00 before the week is out.

About the Bank of Japan's Summary of Opinions

This report includes the BOJ's projection for inflation and economic growth. It is scheduled 8 times per year, about 10 days after the Monetary Policy Statement is released.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.