- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls move into a trap after Consumer Price Index rally?

Gold Price Forecast: XAU/USD bulls move into a trap after Consumer Price Index rally?

- Gold price moves into fresh bull cycle highs on the Consumer Price Index.

- Federal Reserve speakers have come out with mixed comments.

- Some analysts argue that the market is underestimating the risks of a higher for longer Federal Reserve interest rate path.

Gold price rallied on Thursday following the Consumer Price Index, CPI, data that came in as expected on th2e whole. The US Dollar fell heavily and is licking its wounds into Friday's early Asian trade down at weekly lows. At the time of writing, Gold price is trading at $1,897.00 and higher by some 1.15%. Gold price rallied from a low of $,1873.91 to a high of $1,901.67.

Gold price rallies on United States Consumer Price Index

The year-over-year Consumer Price Index, CPI, print landed at 6.5% or 0.6 of a percentage point cooler than the November number. The one exception was a positive surprise. On a monthly basis, the headline number actually decreased by a nominal 0.1% instead of remaining unchanged, as analysts expected. The data has raised the bar for a higher pace of rate hikes by the Federal Reserve (Fed) and this was bolstered by less aggressive Federal Reserve speakers such as Philly-Fed’s Patrick Harker who said he favours hikes of 25bp going forward. A weaker US Dollar as a result of a less hawkish Fed saw investor appetite for the precious metal rise.

Federal Reserve speaker comments after Consumer Price Index

However, St. Louis Federal Reserve leader James Bullard, following today's Consumer Price Index, stated that the most likely scenario is inflation remaining above 2%, so the policy rate will need to be higher for longer. Richmond Federal Reserve President Thomas Barkin said the last three months' inflation prints have been a "step in the right direction," but cautioned that while the average has dropped the median has stayed high.

Moreover, analysts at Brown Brothers Harriman argued that ''core Personal Consumption Expenditures, PCE, has largely been in a 4.5-5.5% range since November 2021 and we think the Fed needs to see further improvement before even contemplating any sort of pivot.''

''WIRP suggests a 25 bp hike February 1 is fully priced in, with nearly 30% odds of a larger 50 bp move. Another 25 bp hike March 22 is fully priced in, while one last 25 bp hike in the second quarter is nearly 45% priced in that would take the Fed Funds rate ceiling up to 5.25%. However, the swaps market continues to price in an easing cycle by year-end and we just don’t see that happening.''

Gold price technical analysis

The immediate bearish outlook for Gold price as illustrated in the prior day's analysis was invalidated leading into the Consumer Price Index event:

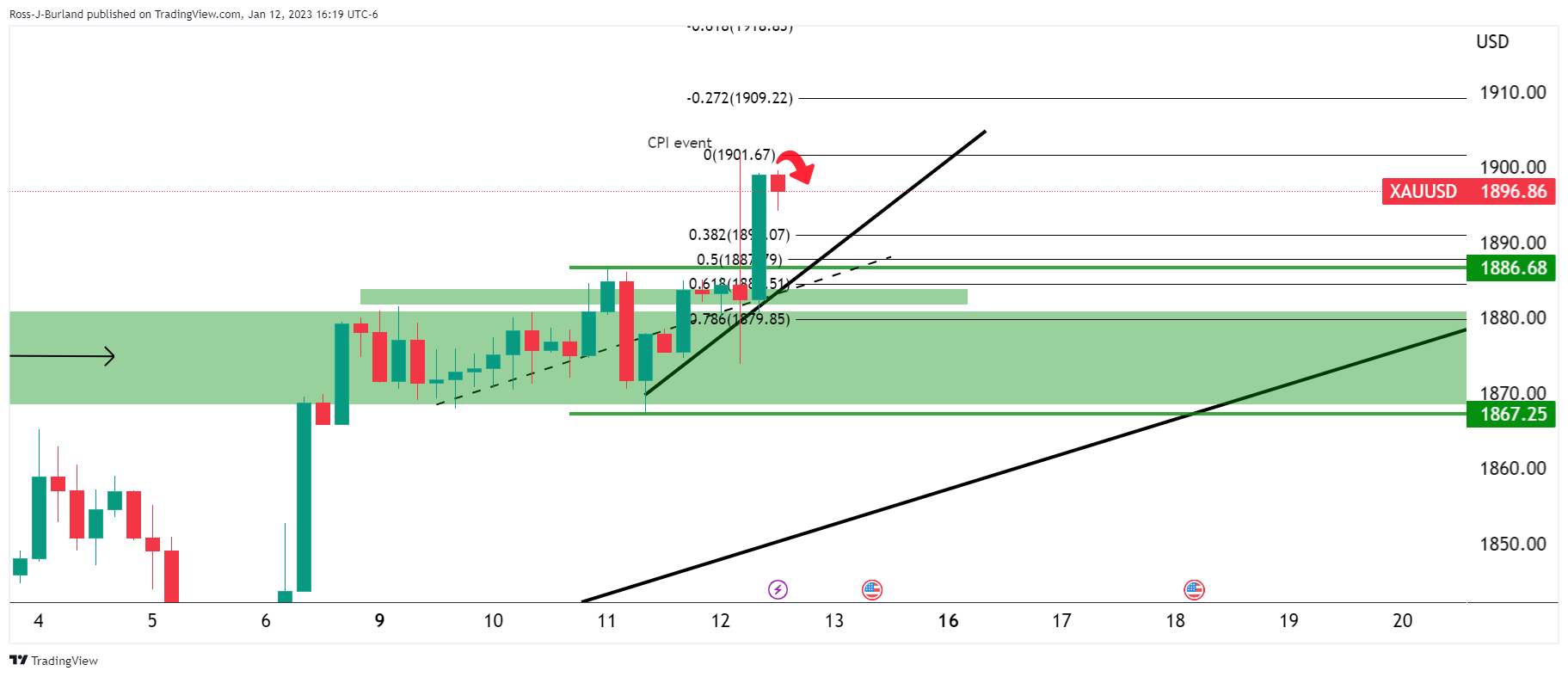

Instead, we got a burst through the head of the head and shoulders as follows:

However, what is important to note is that Gold price breakout traders are triggered as follows:

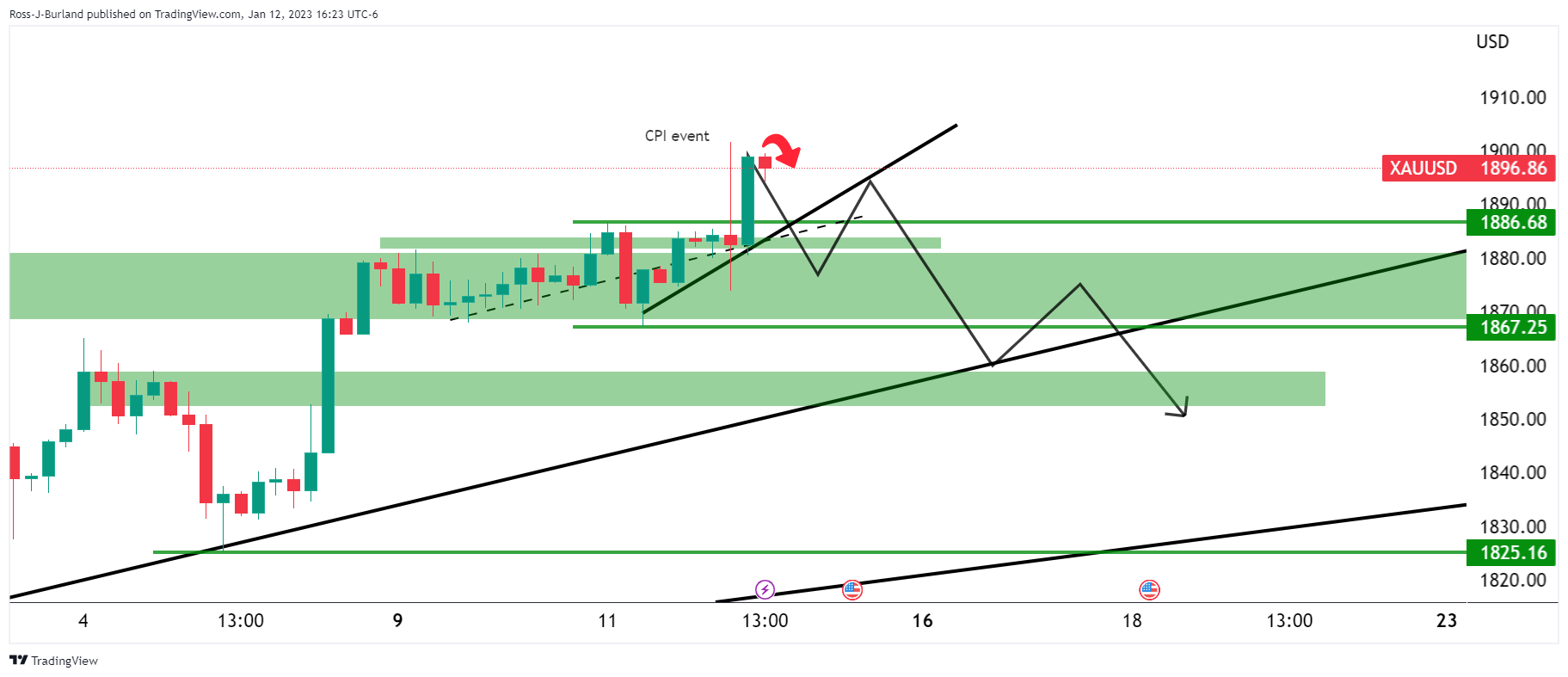

Gold price is now treading water above the summer 2022 highs of near $1,880. This will have added to net longs in the market and therefore, a rebalancing of shorts would be expected to emerge over the coming days. This leaves scope for a significant correction, trapping longs on the wrong side of the market:

On the 4-hour chart, Gold price is already decelerating on the bid and a 50% mean reversion could be on the cards for the coming sessions to test back below $1,890. This will pressure the Gold price micro-supporting trendline. A break of the trendline will open significant downside risks towards a test of $1,870 and the more dominant trendline:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.