- Analytics

- News and Tools

- Market News

- NZD/USD bulls take on 0.64 territories after US CPI event

NZD/USD bulls take on 0.64 territories after US CPI event

- NZD/USD bulls move in on the countrterndline and 0.64 the figiure.

- US CPI sends the US Dollar lower, supporting risk appetite and NZD.

NZD/USD is ending the day some 0.5% higher after rallying from a low of 0.6304 to a high of 0.6417 on the day where sellers came in and faded the move back to test below 0.64 the figure. The US Dollar fell on the back of the Consumer Price Index data that came in as expected on the whole.

The data have helped cement expectations for a 25bp Fed hike next month, and the resulting drop in US bond yields has weighed on the greenback. The year-over-year CPI print landed at 6.5% or 0.6 of a percentage point cooler than the November number. The one exception was a positive surprise. On a monthly basis, the headline number actually decreased by a nominal 0.1% instead of remaining unchanged, as analysts expected.

''While this latest Kiwi rally is logical in that context, NZ policy expectations are fading too as markets ask can the Reserve Bank of New Zealand deliver another 75bp in February if the Fed only delivers 25bp, which may create NZD headwinds,'' analysts at ANZ Bank explained. ''It’s all part and parcel of what could be a messy year of non-synchronised global cycle turning points.''

NZD/USD technical analysis

The price pulled in breakout traders on the move below last month;'s lows that are now being squeezed and moving out of their shorts. This leaves scope for a continuation to the upside with the trendline and horizontal resistances eyed. However, the bears could be encouraged to move in data discount and 0.6190 guards against a bearish breakout.

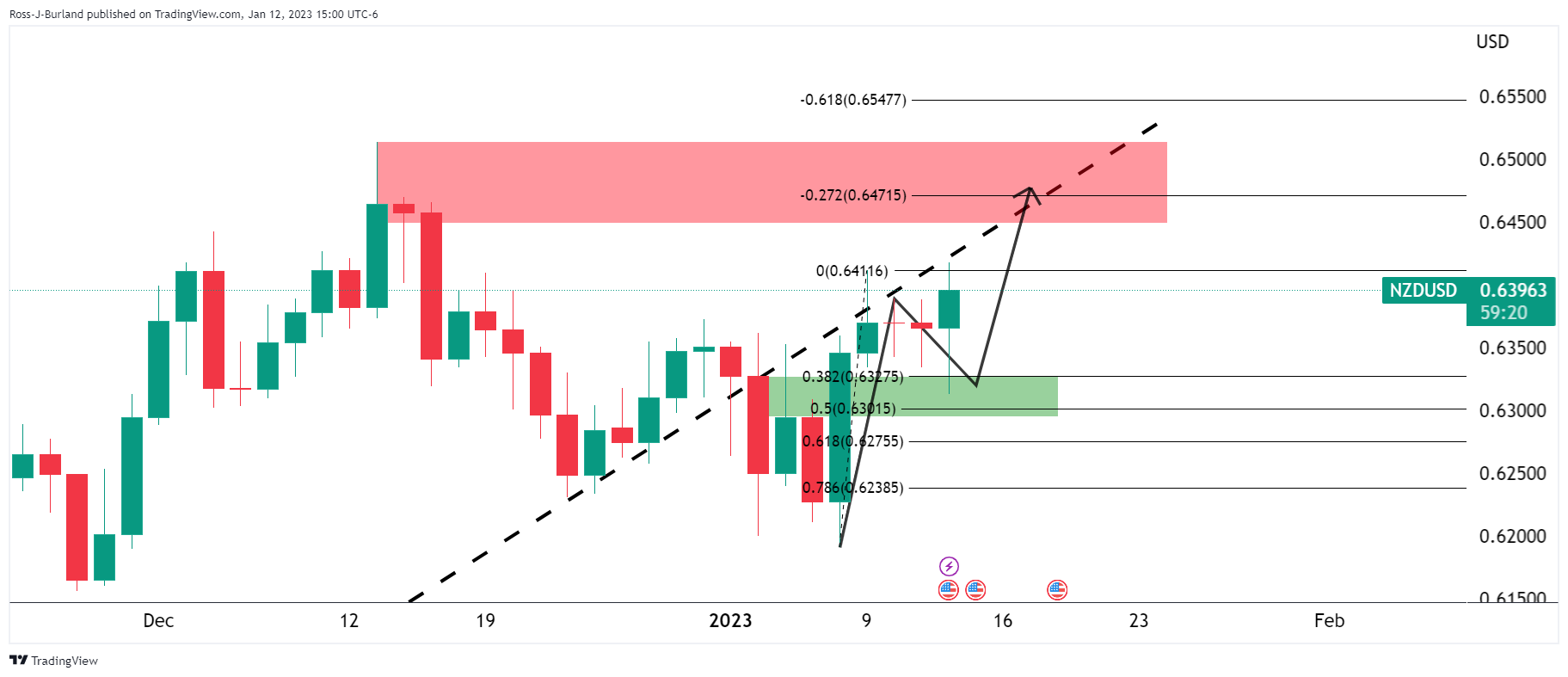

Nearer term, the price is supported by a 38.2% ratio and the neckline of the W-formation and the bulls eye the prior highs near 0.6470 and 0.6500 targets:

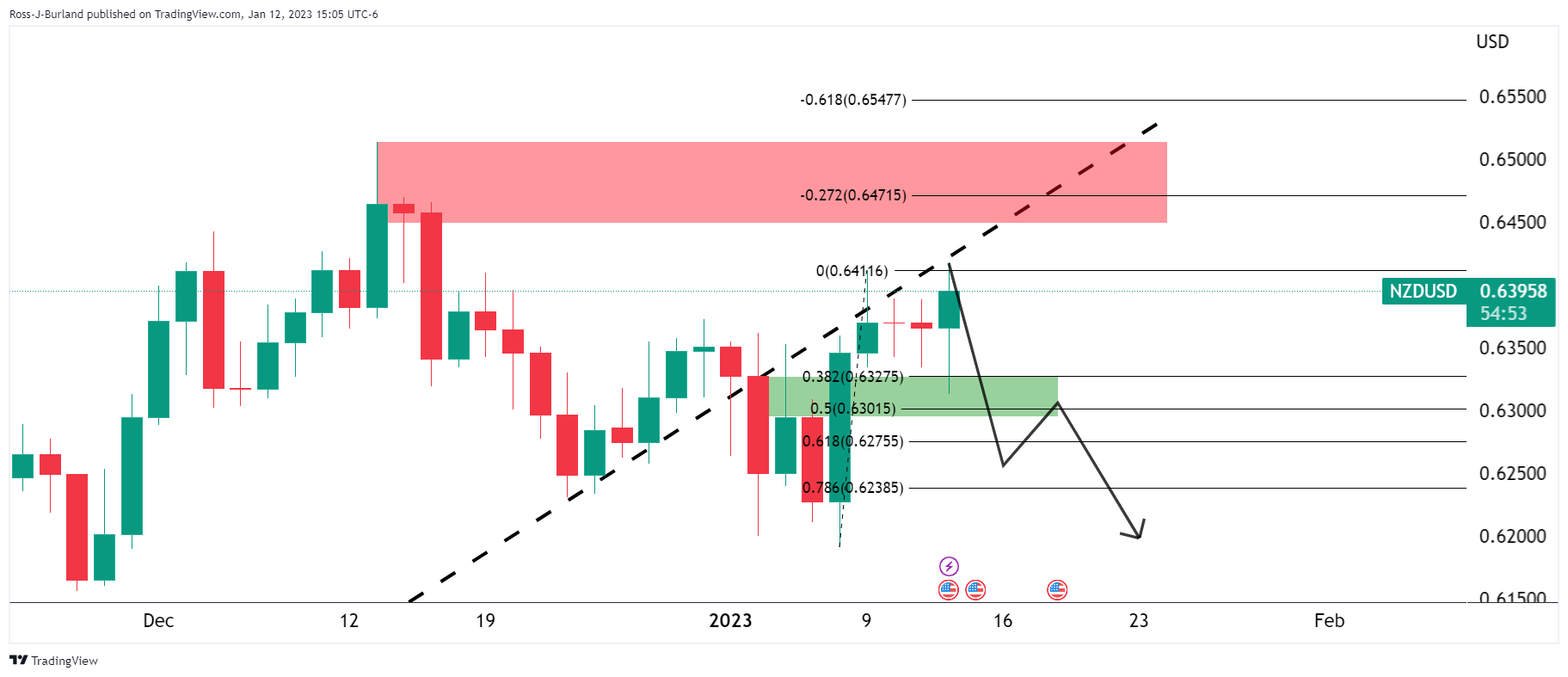

However, should the countertrend line resist and the CPI data prove to be only a temporary distraction from what some analysts argue a far more hawkish reality at the Fed, then a break of 0.6300 could be a significant bearish development for the weeks ahead:

Analysts at Brown Brothers Harriman argued that ''core PCE has largely been in a 4.5-5.5% range since November 2021 and we think the Fed needs to see further improvement before even contemplating any sort of pivot.''

''WIRP suggests a 25 bp hike February 1 is fully priced in, with nearly 30% odds of a larger 50 bp move. Another 25 bp hike March 22 is fully priced in, while one last 25 bp hike in Q2 is nearly 45% priced in that would take the Fed Funds rate ceiling up to 5.25%. However, the swaps market continues to price in an easing cycle by year-end and we just don’t see that happening.''

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.