- Analytics

- News and Tools

- Market News

- EUR/USD advances through 1.0800 post US CPI

EUR/USD advances through 1.0800 post US CPI

- EUR/USD picks up extra pace and leaves behind 1.0800.

- The dollar drops to multi-month lows when tracked by the DXY.

- US inflation figures extended the decline in December.

EUR/USD sees its upside accelerated to levels last seen back in late April 2022 north of 1.0800 the figure on Thursday.

EUR/USD rose to 9-month peaks above 1.0800

EUR/USD advances for the fifth consecutive session to trade in levels past the 1.0800 barrier on the back of the increasing selling pressure in the dollar, particularly exacerbated following the release of US inflation figures during December.

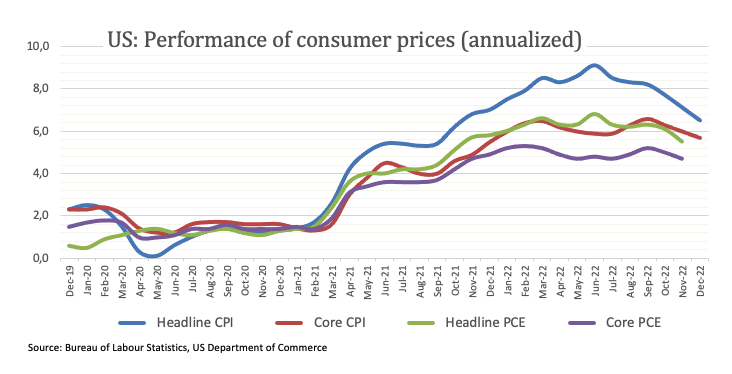

On the latter, the headline CPI rose at an annualized 6.5% in December and 5.7% YoY when it comes to the Core CPI, which excludes food and energy costs. Headline consumer prices therefore retreat for the sixth consecutive month so far and add to the rising perception of Fed’s pivot in the not-so-distant future.

Additional releases in the US calendar saw Initial Jobless Claims rise 205K in the week to January 7, surpassing consensus.

In the wake of the publication of the US CPI, the probability of a 25 bps rate hike at the next Fed event climbed to 82% according to CME Group’s FedWatch Tool.

What to look for around EUR

EUR/USD finally breaks above the key 1.0800 barrier to print new 9-month peaks on Thursday.

Price action around the European currency continues to closely follow dollar dynamics, as well as the impact of the energy crisis on the region and the Fed-ECB divergence.

Back to the euro area, the increasing speculation of a potential recession in the bloc emerges as an important domestic headwind facing the euro in the short-term horizon.

Key events in the euro area this week: France final Inflation Rate, Germany Full Year GDP Growth, MEU Balance of Trade/Industrial Production (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the protracted energy crisis on the region’s growth prospects and inflation outlook. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is advancing 0.43% at 1.0803 and faces the next up barrier at 1.0815 (monthly high January 12) followed by 1.0900 (round level) and finally 1.0936 (weekly high April 21 2022). On the other hand, the breach of 1.0481 (monthly low January 6) would target 1.0443 (weekly low December 7) en route to 1.0424 (55-day SMA).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.