- Analytics

- News and Tools

- Market News

- AUD/USD Price Analysis: Distribution could be playing out into US CPI critical event

AUD/USD Price Analysis: Distribution could be playing out into US CPI critical event

- While below 0.6950, the bias for AUD/USD is to the downside for the near term.

- A break of 0.6870 will open the risk of a move into the 0.6800 figure and the targetted area between 0.6791 and 0.6748.

- US Dollar is also poised for a move higher as per the daily M-formation.

Despite hot domestic economic data that reinforced the case for further increases in interest rates from the Reserve Bank of Australia, AUD/USD has failed to hold onto the knee-jerk gains. At the time of writing, AUD/USD is treading water at 0.69 the figure. The pair has moved between a range of 0.6872 and 0.6925 (highs reached ahead of Frankfurt open, fuelled by data).

As per the prior analysis, AUD/USD Price Analysis: Bears move in on key 0.6905 support structure, higher time frame traders were triggered into the market on the break of the prior week's and month's highs near 0.6890. While some temporary gains were made on a run to 0.6950 (offered) highs, in-the-money longs have been squeezed back to 0.6859 over the course of the week as the US Dollar perked up and recovered from the lowest levels since the summer of 2022 as per the DXY index.

Both the DXY and AUD/USD are coiled markets, treading water into the US Consumer Price Index on Thursday. Therefore, a breakout could be imminent. We have some red news on the calendar for the Aussie ahead of the event, but so long as the US Dollar remains firm, this might do little to steer the bears away from targeting the stubborn longs towards 0.6850 that guards volumes between 0.6790 and 0.6750.

DXY technical analysis

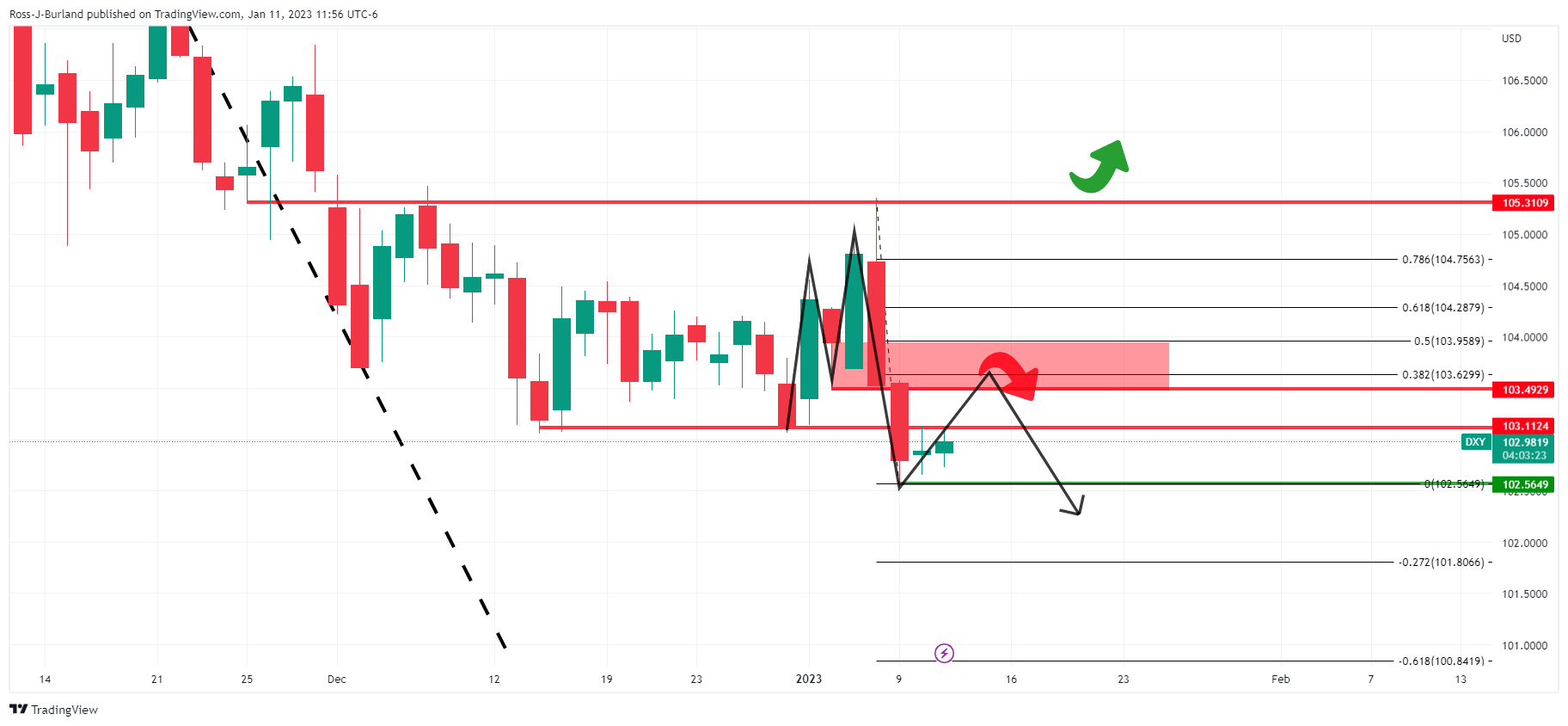

Looking at the DXY index chart, we have a compelling bullish technical outlook that has taken shape as follows:

The hourly chart shows the price in a coil and in the absence of bearish commitments below the initial balance lows, then the bias is to the upside on a strong close above last month's lows. Liquidity above the equal highs opens prospects of mitigation of the price imbalance between 104.05 and 104.90s.

Looking at the daily chart, an upside bias, for the meanwhile, could also be argued, at least for a test of the 103.50s:

The US Dollar's decline is decelerating after moving to the backside of the bearish trendline and stalling at recent lows of 102.56. However, while below 105.31, the dominant bias is bearish. With that being said, and in accordance with the short-term bearish bias for the Aussie, zooming in on the DXY daily chart, an M-formation is in play:

The M-formation is a reversion pattern and the price would be expected to move in for the restest of the resistance structures and neckline of the pattern between 103.50 and 104.00. Such a move would align with a 38.2% Fibonacci retracement and a 50% mean reversion at the extreme. Beyond there, then the mitigation of the price imbalance opens the risk of a test of 105 the figure.

AUD/USD technical analysis

Coming back to the Aussie, a move higher in the greenback would cement the bearish themes for a run towards 0.6750:

While below 0.6950, the bias is to the downside for the near term. That is not to say that the price will automatically fall, and again, there is plenty of red news on tap that could go either way. However, a break of 0.6870 will open the risk of a move into the 0.6800 figure and the targetted area between 0.6791 and 0.6748.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.